Key Points

- Stripe and Paradigm launch Tempo Blockchain for stablecoin payments.

- Experts compare Tempo Blockchain to Meta’s failed Libra.

- It could challenge Ethereum, Solana, and Tron for transaction volume.

- Raises questions about decentralization and network neutrality.

Stripe and crypto venture firm Paradigm just unveiled Tempo Blockchain, a new Layer-1 network built from the ground up to prioritize stablecoin payments.

This “payments-first” blockchain is engineered for speed, simplicity, and low-cost transactions, especially targeting the use of stablecoins like USDC and USDT.

The launch has already stirred debate across the crypto community, some calling it a “Libra 2.0 done right,” while others question its long-term relevance.

Unlike Ethereum, which supports complex smart contracts and decentralized apps, Tempo Blockchain focuses on fast, low-friction value transfer. It’s not trying to replace Ethereum’s DeFi ecosystem. It’s trying to simplify payments for millions of users already on Stripe.

This has sparked comparisons with Meta’s failed Libra project, a digital currency that aimed to reshape the global payments system. But unlike Libra, Tempo Blockchain enters the market during a time when crypto adoption is booming, regulations are clearer, and fintech players like Stripe have earned user trust.

Tempo chain by Stripe is Libra v2 but with a political climate that won’t strangle it in the crib

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) September 4, 2025

“Tempo chain by Stripe is Libra v2 but with a political climate that won’t strangle it in the crib,” said Ryan Adams of Bankless.

If successful, Tempo Blockchain could onboard millions of new users into the crypto world, especially merchants already using Stripe to process payments.

Flashbacks to our Libra work ~6 years ago.

The technical motivation shared here made sense back then, but the world has changed quite a bit. Sui can do way more than than the TPS quoted, perform huge batch payments via PTBs, simulate stable-denominated fees via sponsored… https://t.co/WxL0mpLTyG pic.twitter.com/LwA8vIIPnq

— Sam Blackshear (@b1ackd0g) September 4, 2025

Tempo Blockchain Faces Doubts from Experts

While the potential sounds promising, not everyone is convinced.

Some in the crypto space argue that Tempo Blockchain’s technical value is underwhelming compared to established networks like Ethereum, Solana, or Sui. In fact, Sui is currently experiencing a momentum breakout, raising the question: Does the world need another L1 focused on payments?

The CEO of Mysten Labs, the team behind Sui, questioned the actual innovation behind Stripe’s blockchain move:

“There might be business reasons for a Stripe L1, but the cited technical motives are a bit sus in 2025.”

I question this notion of “neutrality” for a gas token in Tempo, and whether any stablecoin could be used in practice.

Paradigm & Stripe are respectable outfits, so surely they wouldn’t allow some fraudulent or partially backed stable to be used as a gas token.

But now we have… https://t.co/FqPOwRE2me

— Omid Malekan 🧙🏽♂️ (@malekanoms) September 4, 2025

Another concern is the “neutrality” claim. Stripe says that Tempo Blockchain will support multiple stablecoins and allow various assets to be used for gas fees.

However, this deviates from the typical model of most L1s, which typically require their native token for gas to reduce risk and keep incentives aligned.

“There’s a reason successful L1s only accept their own token for gas. The counterparty risk is high,” said one X user.

From a regulatory standpoint, this multi-token gas system could also backfire. With governments increasingly watching stablecoin flows, a payments-focused chain like Tempo Blockchain may walk a fine line between innovation and oversight.

In contrast, Ethereum continues to adapt with improvements like Layer-2 scaling and strategic moves such as selling 10,000 ETH from the Ethereum Foundation, a sign of financial reallocation amid changing market dynamics.

Tempo Blockchain’s Market Impact and Ethereum Rivalry

The launch of Tempo Blockchain could reshape how stablecoins move across networks, and even spark new infrastructure demand.

With every new Layer-1, interoperability becomes more important. Cross-chain bridges, data oracles, and liquidity aggregators will play a key role in connecting Tempo Blockchain to Ethereum, Solana, Tron, and others.

Players like Chainlink (LINK), LayerZero, and Wormhole may benefit significantly from this new chain’s presence.

While Tempo Blockchain could challenge Ethereum in payments, it may also boost Ethereum by attracting more stablecoin users into the crypto space, who could later explore DeFi and staking.

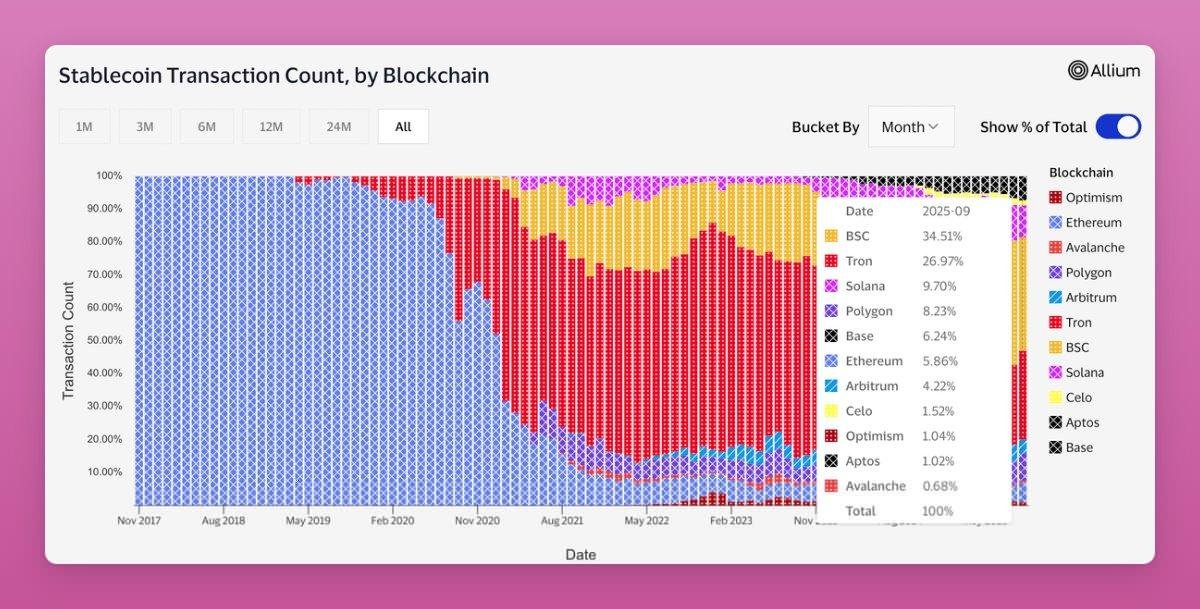

Still, some analysts are cautious. DeFi researcher Ignas noted that most stablecoin transactions still occur on Tron, Solana, and Ethereum Layer-2s—not Layer-1 newcomers.

Stablecoin transactions by blockchain. Source: Ignas on X – Techtoken

That said, Tempo Blockchain could redirect volumes if Stripe succeeds in bringing real merchant usage.

Blockworks CEO Jason Yanowitz explained:

“Tempo could become a serious competitor to Tether, Circle, Ethereum, and Solana in the payments niche.”

Tempo: Bullish or bearish $ETH is the key question.

ETH isn’t dominating stablecoin transfers, so early cannibalization is small. The biggest loser looks like Tron, then Solana, Polygon and L2s.

Ethereum stablecoin usage is mostly yield and DeFi based, plus long-term holding.… https://t.co/wDF50IEsBl pic.twitter.com/aOELehQSr3

— Ignas | DeFi (@DefiIgnas) September 4, 2025

Meanwhile, Bitcoin continues to dominate headlines. As it nears the $113,000 mark, institutional demand is rising, but so is sell pressure, as covered in this analysis on Bitcoin sell pressure. These macro factors will influence how much capital flows into projects like Tempo Blockchain.

At the same time, Michael Saylor’s MicroStrategy empire is facing $8.2 billion in debt risk, putting pressure on large corporate crypto players. In contrast, Stripe is entering the space cautiously but confidently, positioning Tempo Blockchain as a key part of the future payment rails.

With Stripe’s massive customer base and fintech muscle, Tempo Blockchain isn’t just another chain. It’s a direct challenge to the way crypto payments work today.