Key Points

- 90% Drop in Solana DEX Traders Shocks the Market

- Solana DEX trader count plunged from 8M to under 1M in one year

- DEX volumes still strong at $3–$5B daily, hinting at bot-driven activity

- Some analysts view the drop as a retail exodus and a bearish sign

- Others argue it’s a bot purge, making way for long-term growth

The Solana ecosystem just experienced one of its most surprising shifts yet.

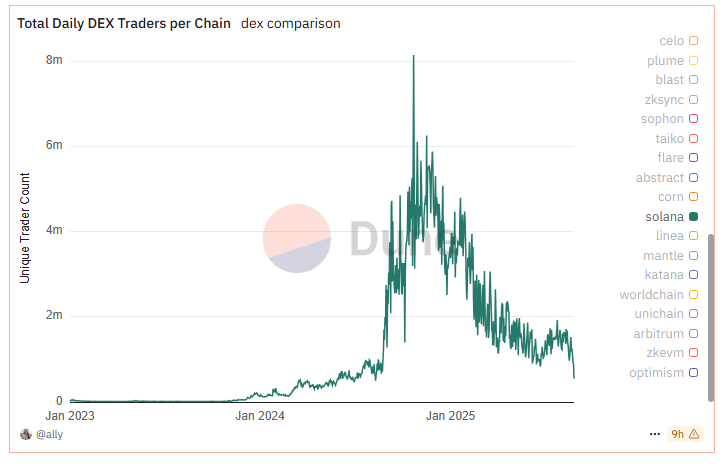

New data shows that the number of active daily traders on Solana’s decentralized exchanges (DEXs) has fallen by nearly 90% in less than 12 months. That’s a steep drop, from more than 8 million traders in October 2024 to under 1 million today.

Total Daily DEX Traders on Solana. Source: Dune

This staggering decline has raised serious questions among analysts and investors. Is Solana losing its appeal to retail users? Or is this a much-needed cleanup of fake activity driven by bots?

Despite the trader drop, DEX trading volume hasn’t dipped, it remains stable between $3 billion and $5 billion per day, according to DefiLlama.

Everyone left the casino or lost it all

Insane chart pic.twitter.com/i6UIPoeIpI

— Qwerty (@Quanterty) August 27, 2025

This disconnect between falling user numbers and steady volume is what’s keeping the community divided and confused.

Solana DEX Traders Disappear, But Bot Activity Suspected

Typically, if 7 million traders leave a network, you’d expect trading volume to fall off a cliff.

But in Solana’s case, that hasn’t happened.

Daily trading activity is still clocking in between $3B and $5B. This strange trend has led many to believe that bots are keeping the ecosystem alive, not real users.

“Everyone left the casino or lost it all. Insane chart,” said crypto investor Qwerty.

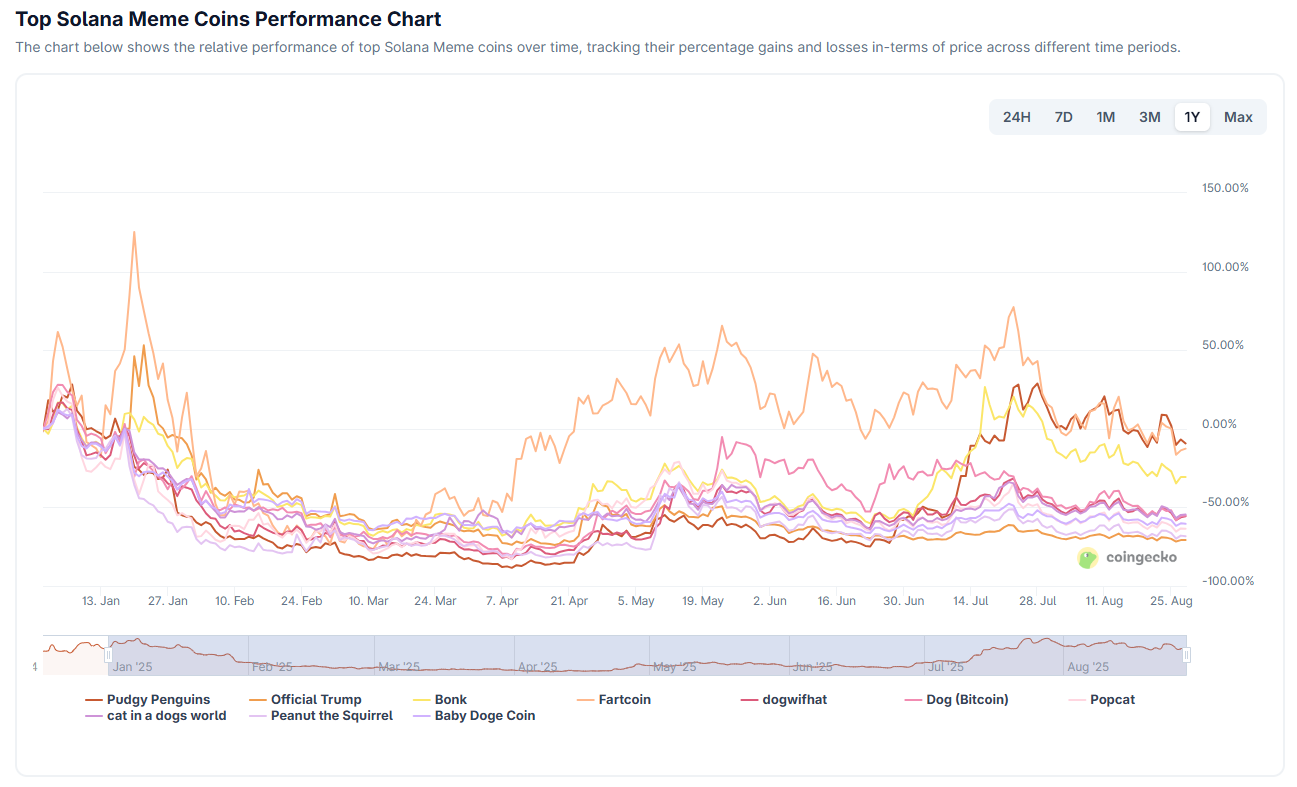

Further evidence comes from the underperformance of Solana meme coins. Tokens like $TRUMP, $MELANIA, $LIBRA, and $YZY, once hyped across social media, have turned out to be major disappointments. Most of them are down between 10% and 70% year-to-date, as per CoinGecko.

Top Solana Meme Coins Performance Chart. Source: Coingecko. – Techtoken –

Once a source of quick profits, these tokens are now associated with rug pulls, hype-driven launches, and broken trust. That has likely driven many retail users away from Solana or out of DeFi entirely.

In fact, we’re seeing a trend similar to the recent Dolo price crash and WLFI community fallout, where high volatility and poor tokenomics sparked an investor exodus.

“Looking at volume is way more misleading when we all know how many farms + volume bots are happening 24/7. The number of active traders falling off a cliff is horrible and can be felt even without a chart,” said @NoCapMat.eth.

wrong. looking at volume is way more misleading when we all know how many farms + volume bots are happening 24/7.

Number of active traders falling off a cliff is horrible and can be felt even without a chart if you’re here everyday.

— NoCapMat.eth🥕 (@MatRabbit) August 27, 2025

It’s clear that while volume appears strong, the quality and authenticity of that activity are now under heavy scrutiny.

A Bot Purge or a Retail Collapse?

Not everyone sees this as a bad thing.

Some analysts argue that this drop might be the beginning of a new chapter for Solana, one with cleaner, more accurate user metrics.

Their argument? The massive trader decline is likely a bot purge, not a true collapse in human users. For years, Solana’s fast and cheap transaction model made it ideal for farming bots, which artificially inflated activity stats.

Seems like not a lot of people talking about the fact that botting/sandwiching may not be as profitable as it once was which is probably contributing to this drop in active wallets on Solana

— . (@0xuberM) August 27, 2025

Now that botting isn’t profitable anymore, the DEX metrics are finally normalizing, giving the network a chance to build on a stronger foundation.

“The seven million-wallet drop may reflect the removal of bots rather than real users,” explained one blockchain analyst.

This theory gets support from Matthew Nay, an analyst at Messari, who believes the chart showing this drop is misleading.

“It’s just wrong, transactions, fee payers, and signers are all flat, not down as much as that chart says,” he said.

Especially since it’s just wrong – transactions, fee payers, and signers are all flat (not down as much as that chart says) pic.twitter.com/olqRnX18ov

— Matthew Nay (@NaytheForceBwU) August 27, 2025

The key takeaway? We might be seeing a healthy reset where real user activity can shine, without getting drowned out by automated trading.

Interestingly, despite all the noise, Solana’s price (SOL) has been rallying hard. In August 2025 alone, SOL is up over 35%, now trading above $210.

That performance suggests that, at least from a market sentiment perspective, confidence in Solana is still intact, and maybe even growing.

As the network continues to evolve, the question remains: Will Solana return to organic growth led by actual users? Or will trading bots continue to dominate their on-chain activity?

For now, both sides of the debate are watching closely.