Key Points

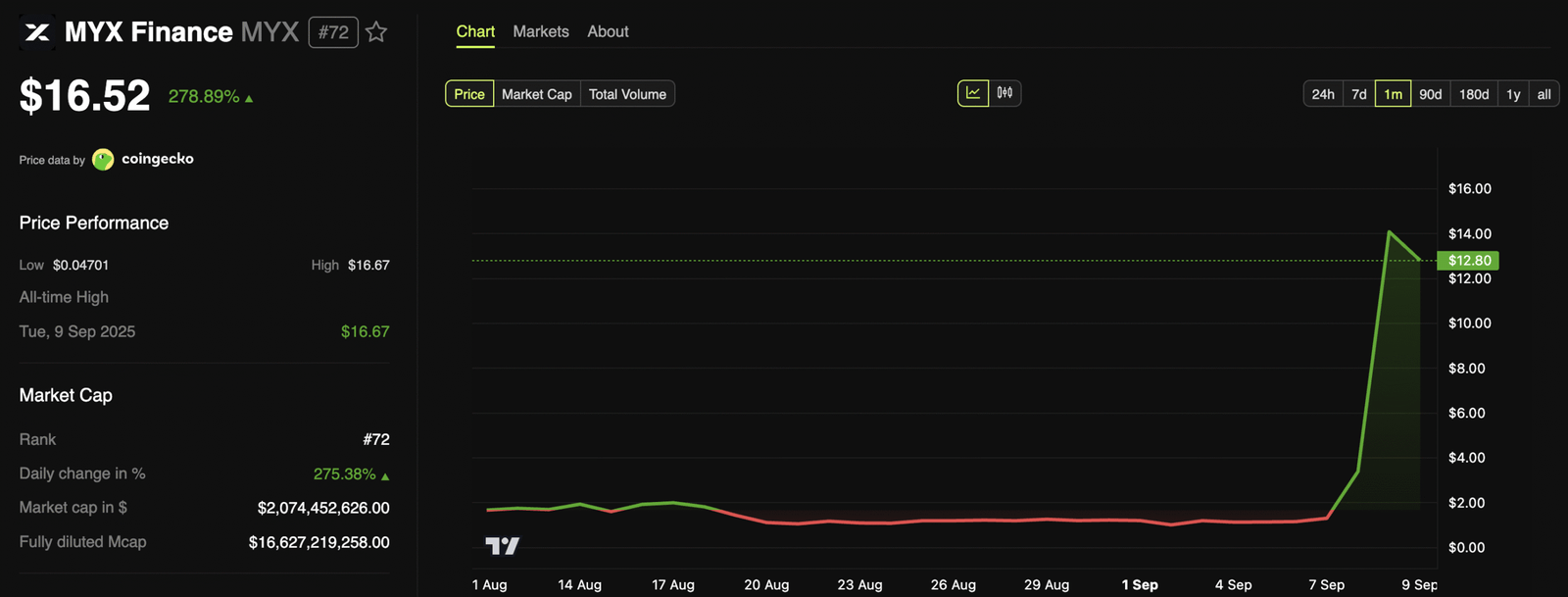

- MYX jumps 279% in 24 hours and 893% in a month

- Market cap crosses $2B despite just $32M in TVL

- Analysts compare MYX rally to MANTRA’s boom-and-bust

- Binance futures activity sparks systemic risk concerns

MYX Finance Price has shocked the crypto world with one of the strongest rallies of the year.

The token surged nearly 279% in the past 24 hours, bringing its monthly gain to a staggering 893%. With its market cap climbing past $2 billion, MYX is now among the top gainers in the industry.

MYX Finance (MYX) Price Performance. Source: Techtoken

But the fast rise of MYX Finance Price has triggered doubts. Analysts warn that this explosive growth may not be sustainable.

Instead, many see troubling signs that MYX could follow the same trajectory as MANTRA (OM), which experienced a boom-and-bust cycle earlier this year.

MYX Finance Price Action Raises Manipulation Fears

Data from BeInCrypto shows MYX initially pumped 1,957% in early August. After a brief pullback, the token surged again this week, gaining 167% yesterday and an additional 279% today. This rapid appreciation has made MYX the single biggest daily gainer in the market.

Despite these huge gains, MYX Finance Price looks disconnected from fundamentals. DeFiLlama data reveals that the project has just $32 million in total value locked (TVL). By comparison, the token’s valuation now exceeds $2 billion.

Who’s been tracking $MYX? @MYX_Finance has gone off the charts, over 200x from the bottom.

Looks like a clear case of manipulation when a project with little / no activity is sitting at a market cap of $2.5bn.

I’m taking a short on @binance here (small amount, be wary of the… pic.twitter.com/7dQqm4wFKN

— Jay.eth (@Jai0xCrypto) September 9, 2025

“MYX Finance has gone up more than 200x from its bottom. With such little activity, it makes no sense for this project to be valued at $2.5 billion. It’s a clear case of manipulation,” one analyst commented.

‘Crypto is moving towards the fundamentals!’

The Fundamentals: $MYX , a 9b fdv coin with 32m in TVL. pic.twitter.com/ZnxX0KmOOn

— Altcoin Sherpa (@AltcoinSherpa) September 8, 2025

Others argue that the MYX Finance Price surge mirrors the rise and fall of MANTRA (OM). Last year, OM rocketed from outside the top 150 tokens into the top 50, only to collapse quickly after insiders were accused of driving the pump. Analysts believe MYX is showing the same signs of insider-driven demand.

MYX 这只的操盘手法跟去年的$OM 几乎一致,都是无脑涨,连续好几天从市值150名开外一直疯涨到top50甚至Top30,然后趁着大家不注意,一泻千里。

你们可以看看OM,也是这样的套路,涨到9附近,然后狂跌。最开始OM说自己是还在团队,后来发现是国人操盘,深圳帮。不知道这个MYX会不会也是国人操盘的… pic.twitter.com/qMiWivjhTQ

— 财仔 (@SYG102030) September 9, 2025

This type of risky momentum trading is not new to the crypto market. Just recently, a Swiss crypto exchange was hit by a $41.5M Solana hack that reminded investors how fragile speculative projects and platforms can be.

最近 $myx 这波走势,真的值得细品。

短短时间直接拉了十几倍,表面看是散户狂欢,实际上几乎没人晒单盈利,反而满屏都是做空嗷嗷叫。为什么?

因为散户根本没吃到肉,喊空的还和项目方走得很近。🔹 项目方逻辑

1.先把空投筹码收回来,手里才有完整的控盘筹码。… pic.twitter.com/1TjBRwrekA— 青禾 (@HUADA999) September 9, 2025

One analyst went further, claiming that the rally does not represent retail interest at all. Instead, it may be orchestrated by the project team.

According to him, MYX is reclaiming airdropped tokens, pushing prices higher to liquidate shorts, and then dumping before accumulating again. The goal, he suggested, is to dominate supply and make futures trading their primary source of revenue.

最近 $myx 这波走势,真的值得细品。

短短时间直接拉了十几倍,表面看是散户狂欢,实际上几乎没人晒单盈利,反而满屏都是做空嗷嗷叫。为什么?

因为散户根本没吃到肉,喊空的还和项目方走得很近。🔹 项目方逻辑

1.先把空投筹码收回来,手里才有完整的控盘筹码。… pic.twitter.com/1TjBRwrekA— 青禾 (@HUADA999) September 9, 2025

MYX Finance Price and Futures Market Risks

The conversation around MYX Finance Price is not only about its spot performance but also its derivatives activity. MYX was recently awarded the “Volume Powerhouse” title at the BNB Chain Awards.

Reports show that the project generated more than $2 billion in weekly trading volume, cementing its reputation as one of the busiest exchanges in the sector.

$MXY rallied all the way from $0.1 to $14, a clean 140x in just 2 months and now sits at a 1.75 billion MC.

The perps exchange @MYX_Finance is gaining serious traction with over $2 billion in weekly trading volume, and just bagged the “Volume Powerhouse” crown at the… pic.twitter.com/9B3sVHgbTA

— Whale Coin Talk (@WhaleCoinTalk) September 8, 2025

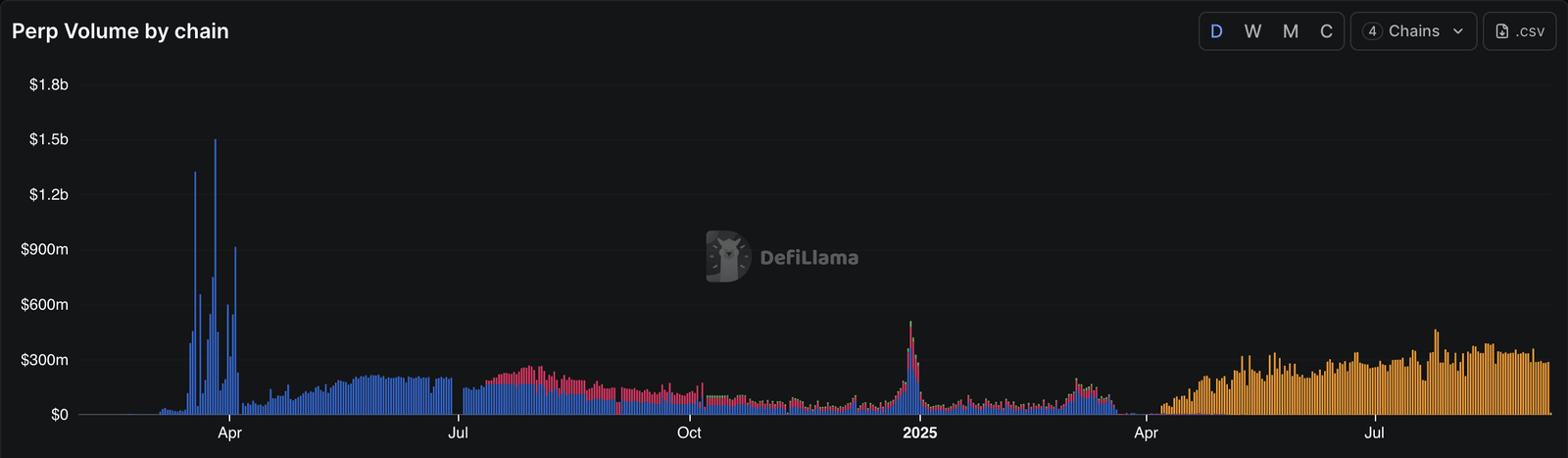

Data from DefiLlama highlights a major shift. Since April, most of MYX Finance Perpetual (Perp) trading has moved to the BNB Chain. The token now averages $200–$300 million in daily Perp volume, far above its earlier activity on Arbitrum.

MYX Finance Perp Volume. Source: DefiLlama – Techtoken

On Binance, MYX Finance Price has drawn $200 million in open interest despite not being listed on Tier 1 or Tier 2 exchanges. This rapid growth has raised alarms among market analysts.

Jordi Alexander, a well-known trader, pointed out that MYX reached a $10 billion fully diluted valuation while traders on Binance paid negative funding rates. Meanwhile, Binance collected tens of millions in fees from $9 billion worth of MYX trading volume. Retail traders, however, suffered steep losses.

Ok in an industry that has had the most crime season to tap all crime seasons, this MYX thing takes the cake.

$200M in Open Interest stuck on binance alone paying negative funding- A random token without Any Tier 1 or even Tier2 listings, trading at 10 Billion FDV.

Binance… pic.twitter.com/ZlXb3vmn1q

— Jordi Alexander (@gametheorizing) September 8, 2025

Alexander cautioned that perpetual contracts can become dangerous when spot liquidity is too low. “If internal market makers don’t get hit, it’s business as usual.

But eventually, Binance will delist this token and the same strategy will just be repeated with the next one,” he warned.

This echoes the same concerns raised when USDD stablecoin expanded to Ethereum, where questions about liquidity and long-term sustainability followed the launch.

Some of you might be wondering why this shit like $MYX pumped?

It’s quite simple.

– BNB chain was getting volume.

– Insiders got the alpha before anyone else.

– Binance listed it and futures volume surged to 6-7B+ with very little buying in spot.

And people like yourself… https://t.co/RieyAT404O pic.twitter.com/1YgofN5XS9

— Alex RT₿ (@rutradebtc) August 5, 2025

Why MYX Finance Price Has Sparked Wider Debate

The rise of MYX Finance Price has also sparked a bigger conversation about the state of the crypto market. Many argue that tokens like MYX reveal the fragile balance between hype-driven rallies and long-term sustainability.

While MYX is gaining recognition for high trading volumes and aggressive futures activity, its low TVL and uncertain fundamentals suggest risks for retail investors.

The strong comparison with MANTRA (OM) has only fueled skepticism, with analysts reminding traders that similar rallies have ended in painful crashes.

Meanwhile, other projects are building long-term strategies. For instance, Kazakhstan’s crypto reserve plan aims to launch by 2026, showing how governments are trying to bring more stability into the digital asset space.

Similarly, market sentiment often shifts quickly on token news. We saw this when Ripple CTO’s NFT move sent PHNIX soaring 40% within hours, a reminder that hype can drive short-term spikes, but not always lasting value.

Even Bitcoin projects like EasyBitcoin app are drawing attention by focusing on usability instead of speculation, offering a contrast to the high-risk strategies seen in MYX Finance Price.

For now, MYX remains one of the most-watched tokens in the market. Whether it can sustain its $2 billion valuation or ends up following the path of OM will depend on whether real adoption and liquidity eventually back up the hype.