Key Points

- Meteora TGE confirmed for October, launching MET token

- Heavy concentration of points in launch pools raises flags

- Tokenomics transparency remains a critical missing piece

- Sell pressure could test Solana’s DeFi resilience

The Meteora TGE is set to become one of the most talked-about events in the Solana ecosystem this year. As Meteora prepares to launch its native MET token in October 2025, the excitement within the DeFi space is palpable.

But beyond the buzz, deeper questions are being asked about fairness, sustainability, and whether this TGE will drive long-term value or just short-term speculation.

Rapid Growth Sets the Stage for Meteora TGE

Over the past year, Meteora has grown into one of the most dominant liquidity protocols on Solana. Its innovative Dynamic Liquidity Market Maker (DLMM) has enabled optimized capital efficiency and trading fees, especially around volatile assets like memecoins.

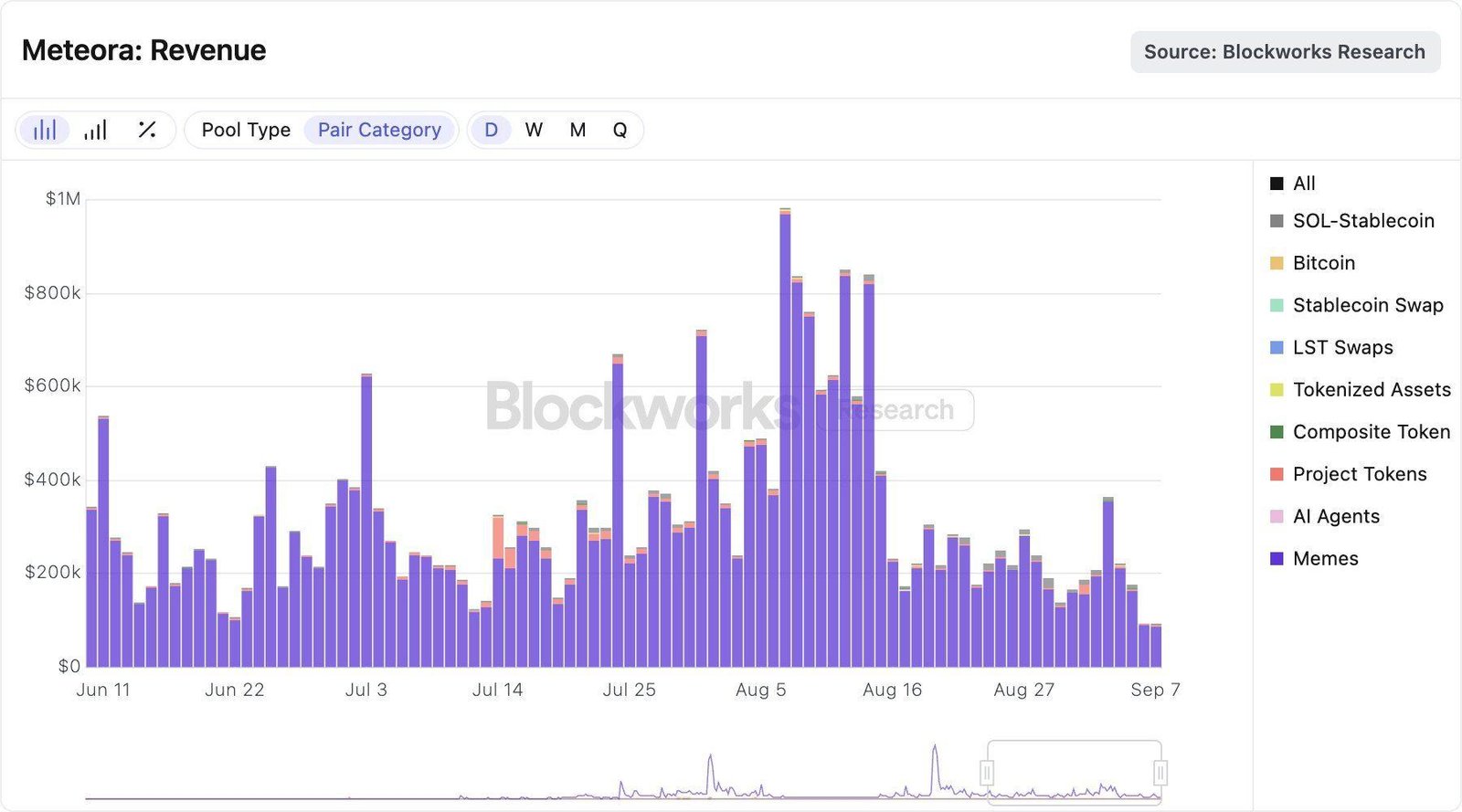

In just the last 30 days, the protocol has generated $10 million in revenue, mainly from memecoin trades. August 2025 marked its second-best performance month, with $5.5 billion in SOL-stablecoin trading volume.

Meteora revenue. Source: Blockworks – Techtokens

This highlights the platform’s central role in Solana’s fast-moving DeFi scene, which recently faced challenges like the Solana hack hitting a Swiss crypto exchange, exposing vulnerabilities in the broader ecosystem.

2/Meteora has made around $10M in revenue the past 30 days. Almost all of this revenue is from memecoin trading activity. pic.twitter.com/kuEc7IEg7Z

— Blockworks Research (@blockworksres) September 9, 2025

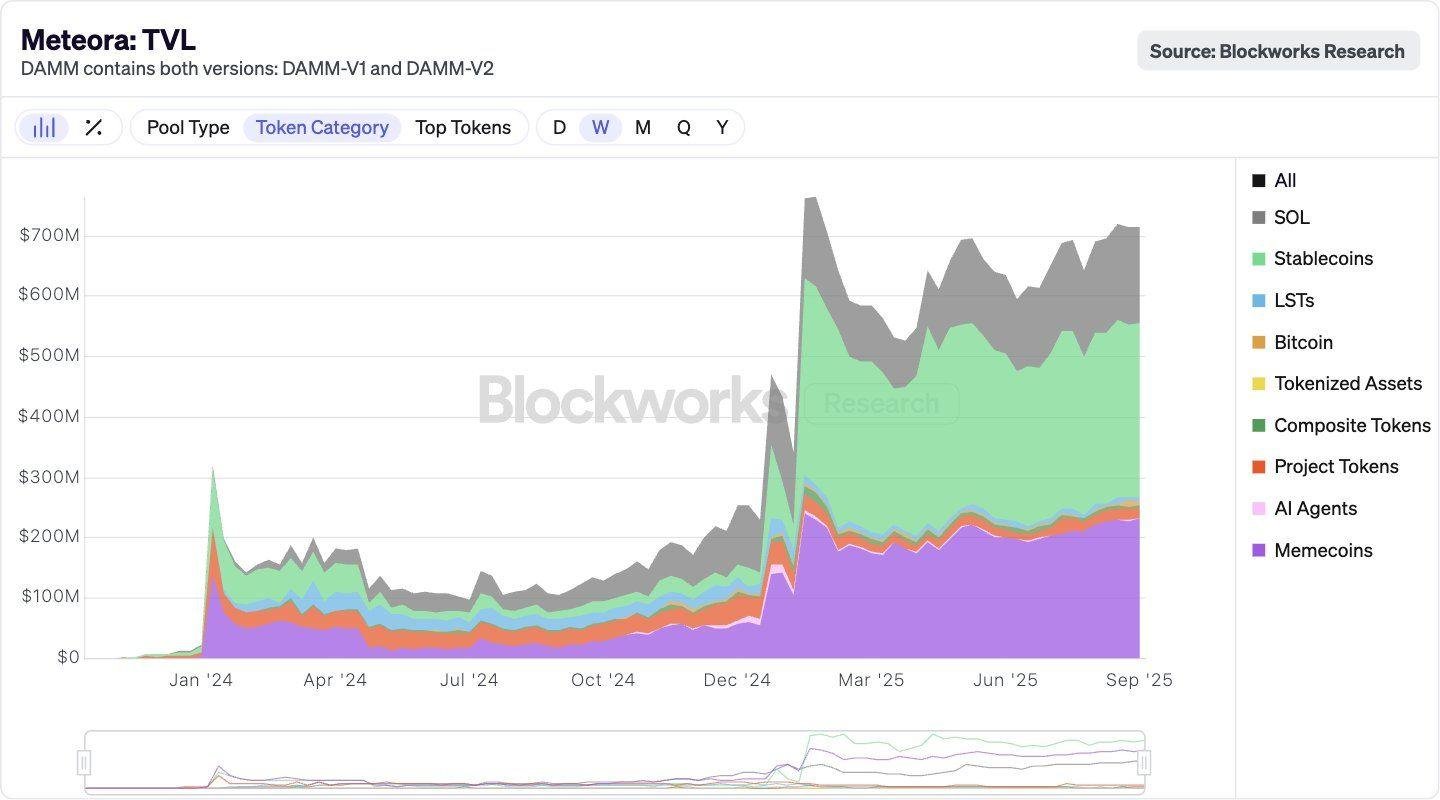

Meteora now holds over $700 million in total value locked (TVL), including $300 million in stablecoins and $150 million in SOL. Furthermore, 80% of DEX aggregator traffic, primarily via Jupiter, flows through Meteora’s liquidity pools.

Meteora TVL. Source: Blockworks – Techtoken

With more than $15 billion earned in LP fees just last month from retail pools, particularly meme coin pools, the platform has built a strong foundation. The Meteora TGE will determine whether that foundation is strong enough to support a sustainable token ecosystem.

4/ Meteora has over $700M in TVL, with $300M in stablecoins and over $150M in SOL. pic.twitter.com/C3XzdTQ1zJ

— Blockworks Research (@blockworksres) September 9, 2025

Allocation Imbalance and Transparency Gaps

Despite the hype, the Meteora TGE also raises serious concerns. The MET token will be distributed based on a points system, but the data shows heavy concentration in a small subset of wallets.

Here’s the breakdown:

-

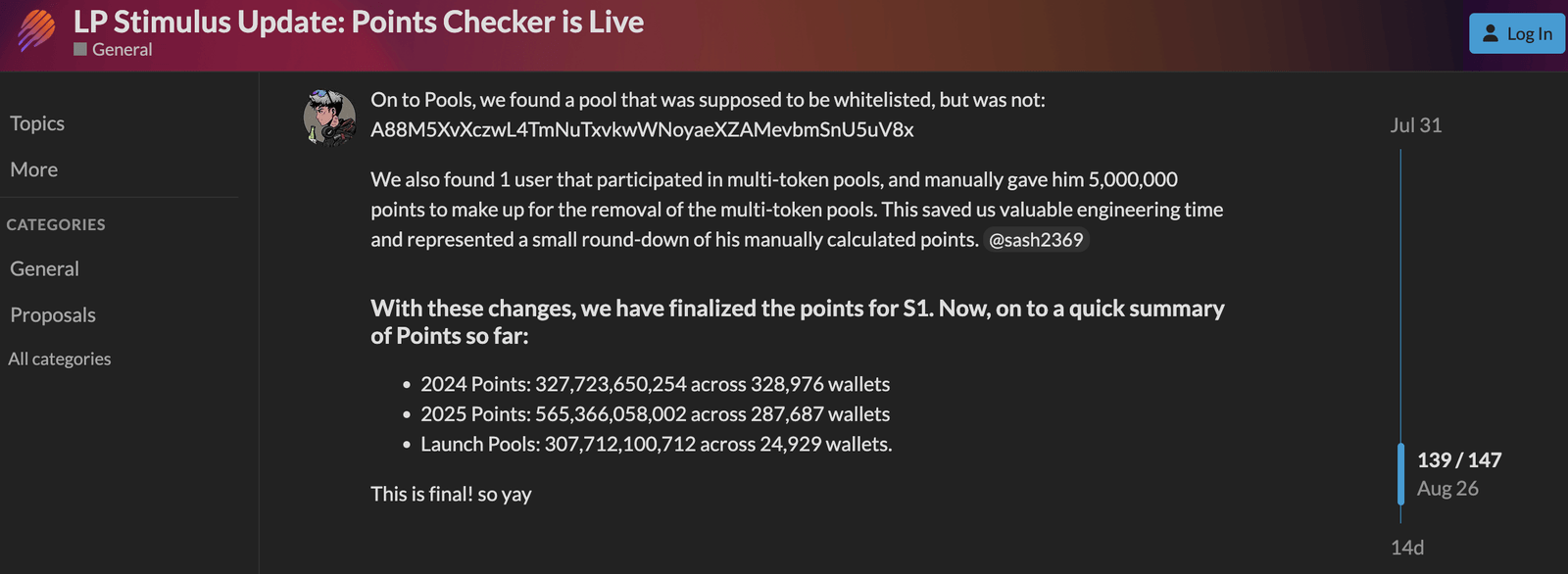

In 2024, 327.7 billion points were spread across 328,976 wallets

-

In 2025, 565.3 billion points were spread across 287,687 wallets

-

But the launch pool alone received 307.7 billion points across just 24,929 wallets

This imbalance means a few players could dominate the early MET token distribution. Add in the Airdrop Claim mechanism, which allows users to quickly sell their tokens, and you’ve got the perfect setup for potential sell pressure.

3/5

The Phase we are at now.We’re officially entering “TGE Readiness Mode”.

What does this mean?

For the next few weeks, the focus is simple: build hard, ship fast.We’re scaling Meteora’s frontend and backend infrastructure to handle 10x more users, with major upgrades to…

— Meteora (@MeteoraAG) September 10, 2025

Even more concerning, the full Meteora TGE tokenomics have not yet been revealed. Key information is missing, including:

-

Total supply

-

Community allocation

-

Team and DAO vesting schedules

-

Cliff periods and unlock rates

So far, the only disclosed figure is that 25% of the MET supply will go toward Liquidity Rewards and the TGE Reserve. Without a detailed breakdown, it’s impossible to assess how balanced or sustainable the token model truly is.

Number of Points allocated in Meteora. Source: Meteora – Techtoken

The lack of transparency is reminiscent of concerns in other token ecosystems like MYX Finance’s price trajectory and how token models can influence long-term price stability.

How Meteora TGE Could Impact Solana DeFi

The Meteora TGE isn’t just another token launch, it’s a litmus test for how Solana’s DeFi projects can scale while maintaining fairness and transparency. If the launch is dominated by whales or quickly turns into a sell-off event, it could dampen momentum not just for Meteora, but for the broader ecosystem.

The best-case scenario? The Meteora TGE rolls out with well-planned tokenomics, balanced allocations, and enough staking or locking incentives to prevent immediate dumping. This would reinforce trust in the project and offer a model for other DeFi protocols to follow.

The worst-case? Poorly managed distribution leads to high volatility, early profit-taking, and loss of credibility. That could weaken retail participation and damage Meteora’s reputation in the long term.

To avoid this, the team must act quickly to release detailed tokenomics, explain how sell pressure will be managed, and show how MET will integrate with Meteora’s liquidity engine. Retail users are watching closely—and without transparency, trust could quickly evaporate.

This scenario draws comparisons to broader market trends seen in listings such as the Coinbase altcoin additions, where visibility doesn’t always translate to stability.

What’s Next for Investors and Airdrop Hunters?

With the Meteora TGE only weeks away, both seasoned investors and airdrop hunters are preparing their strategies. Some are already tracking wallet activity and analyzing points distribution to estimate how many MET tokens they might receive.

Others are eyeing the launch with caution, waiting for full tokenomics before committing. Their main questions are:

-

Will there be incentives to hold MET?

-

What role will MET play in liquidity pools or staking programs?

-

Will early investors have an unfair advantage?

How the team answers these will influence whether the Meteora TGE becomes a bullish breakout or a temporary spike followed by a deep correction.

The correlation between investor sentiment and token performance has been seen in past patterns like the HBAR and XRP correlation, where market timing and clarity of information played a key role in success.

Meanwhile, accessibility for new users exploring DeFi could be enhanced by beginner-friendly apps like EasyBitcoin, which help onboard users before events like the Meteora TGE potentially flood the ecosystem with new participants.

With over 600,000 wallets involved in the points system and significant capital already committed to the protocol, Meteora has a rare opportunity to make this one of the most successful DeFi launches on Solana.

But to pull it off, Meteora TGE must deliver more than hype, it needs trust, transparency, and long-term value.