Key Points

- Ethereum Foundation Sell 10000 ETH Sparks Market Debate

- Sale aims to fund research, grants, and ecosystem projects

- Strong institutional buying could absorb the pressure

- ETH range: $4,200 support, $4,500 resistance zone

The Ethereum Foundation‘s sell 10000 ETH has sparked renewed attention across the crypto space. With Ethereum trading around $4,341, this move would release nearly $44 million worth of ETH into the market.

But with institutions showing strong interest, the impact might be smaller than expected.

0/ Transparency Notice: Over several weeks this month, EF will convert 10K ETH via centralized exchanges as part of our ongoing work to fund R&D, grants, and donations.

Conversions will take place over multiple smaller orders, rather than as a single large transaction.

— Ethereum Foundation (@ethereumfndn) September 2, 2025

Why the Ethereum Foundation Selling 10000 ETH Isn’t a Red Flag

The Ethereum Foundation (EF) officially confirmed it will sell 10,000 ETH over the next few weeks through centralized exchanges. The decision is part of its plan to fund ongoing research and development, ecosystem grants, and charitable efforts.

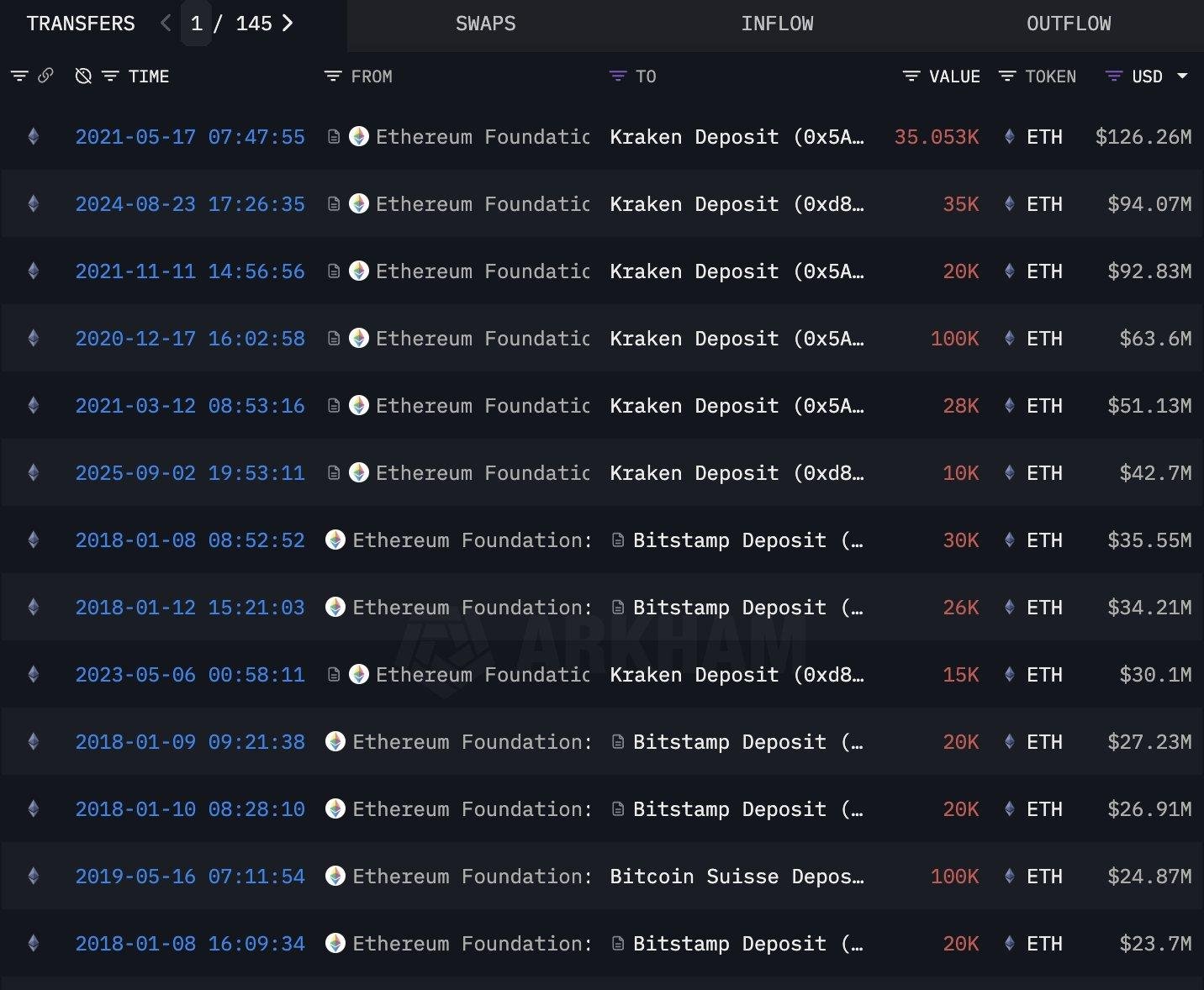

While this isn’t the first time the Ethereum Foundation has sold ETH, the scale and transparency of the sale are catching attention. Over the past decade, EF-tagged wallets have sent around $2.78 billion worth of ETH to exchanges.

Source: Cornor on X.

However, this time, the Ethereum Foundation’s sale of 10,000 ETH has been made ahead of time, reducing speculation and market panic.

In fact, this proactive communication has drawn praise from the community. One X (formerly Twitter) user noted, “At least they’re being upfront about it now,” referencing past criticisms where EF was accused of sending mixed signals, promoting Ethereum while selling quietly behind the scenes.

The Ethereum Foundation sold nearly $100 million worth of assets over the past few months.

I criticized this because they were making bullish posts at the same time.

Fortunately, they’re being honest about it this time. https://t.co/lDB15MlMHP pic.twitter.com/DmBTqEKwVK

— Maartunn (@JA_Maartun) September 2, 2025

The Ethereum Foundation’s sell 10000 ETH event is not happening in a vacuum. Recent on-chain data shows that in just one week, institutional buyers and treasuries absorbed over 403,800 ETH. That’s over 40 times what EF is planning to sell.

Moreover, major digital asset treasury companies (DATCOs) like BitMine and SharpLink have been buying aggressively. This structural demand acts as a counterbalance to any temporary selling pressure caused by the Ethereum Foundation’s sale of 10000 ETH.

An X user summed it up well:

“One ETH treasury company bought more ETH in 3 months than what EF sold in the last 10 years.”

The ecosystem has seen similar investor-driven strength recently. For example, Solana’s price doubled as smart money flooded into its ecosystem, suggesting that major players continue to support blockchain infrastructure projects.

$SBET For comparison, a single $ETH treasury company bought more $ETH in the past 3 months (90 days) than what the Ethereum Foundation has sold in the last 10 years. 👀 https://t.co/UE023yDCVQ

— The Future is Now 🧬🚀 (@web3_eth) September 2, 2025

Market Outlook: Will Ethereum Weather the Sale?

Technically speaking, Ethereum is at a key crossroads. After touching near its all-time highs in late August, the price pulled back and found support around $4,200. That level has now acted as a short-term floor, while $4,500 remains the critical resistance.

If ETH breaks above $4,500, the next upside targets are $4,650 and $4,800. These price zones align with bullish momentum seen in past market cycles.

However, analysts remain cautious in the short term. According to Benjamin, a well-followed crypto analyst, Ethereum could dip back to its 21-week EMA in the next 4–6 weeks. He believes this would be a healthy reset before a potential push to new all-time highs.

Translation:

Ethereum is going to drop to the 21W EMA and then go to new all time highs https://t.co/VEs4BYsPnQ pic.twitter.com/NZdOiDBplK

— Benjamin Cowen (@intocryptoverse) September 2, 2025

“Ethereum will likely drop to its 21W EMA before rallying again. That’s a typical move in strong bull cycles,” Benjamin explained.

So, where does the Ethereum Foundation sell 10000 ETH event fit in all this?

Despite the negative sentiment such a sale might trigger, the macro indicators remain positive. The sale appears to be cyclical and mission-driven, not speculative or panic-driven. The Foundation is using its holdings responsibly to continue building out the Ethereum ecosystem.

Events like the recent WLFI token crash due to whale selloffs show how transparency can help reduce market fear. In EF’s case, the early announcement may help prevent the type of volatility seen in surprise dumps.

And most importantly, the market seems deep and liquid enough to handle it. Institutional demand is high, treasuries are buying, and retail interest remains strong.

Historically, Ethereum Foundation sell 10000 ETH-type events have had short-lived effects on price. For example, past EF sales were often followed by short corrections, but then Ethereum rebounded strongly as long-term fundamentals kicked in.

This time, the improved transparency may even reduce the typical downside volatility. Market participants have time to digest the news, assess liquidity, and position accordingly.

This makes the Ethereum Foundation sell 10000 ETH less about panic and more about long-term capital planning.

Ethereum Community Reaction and What to Watch Next

The Ethereum community’s response to the announcement has been more measured than in previous cases. While skepticism remains, the open communication has calmed much of the speculation.

For many, the Ethereum Foundation sell 10000 ETH plan is viewed as part of a larger, healthy economic cycle. Foundations sell to fund development, treasuries buy to hold for the long term, and the market continues to grow.

Still, short-term traders are keeping a close eye on the $4,200 level. A decisive close below that could invite more selling, while reclaiming $4,500 would reignite bullish momentum.

In any case, this sale is unlikely to derail Ethereum’s broader trajectory. As long as higher highs and higher lows continue on the chart, and institutional demand stays strong, the Ethereum Foundation’s sell 10000 ETH event will be just another small wave in a much larger tide.

As countries like El Salvador position themselves as Bitcoin havens and increase their Bitcoin reserves, crypto’s role in global finance continues to expand. Ethereum, as the largest smart contract platform, is at the heart of that transformation.

However, not all crypto projects are seeing smooth growth. The Pi Network’s struggles in September highlight the importance of trust, transparency, and sustainable tokenomics, something the Ethereum Foundation seems to be emphasizing through its upfront communication.