Key Points

- Scroll suspends DAO, shifts to central control

- Hyperliquid votes on USDH ticker ownership

- Ronin migrates to Ethereum via Optimism L2

- Buybacks, DRIP data, and dYdX reward reforms emerge

This week delivered a wild ride in the world of DAO governance.

In just seven days, major protocols like Scroll, Ronin, Hyperliquid, Aave, and dYdX announced big governance changes. From suspending DAOs to reshaping reward systems and battling over token tickers, the decentralized ecosystem is clearly entering a new phase.

Top 7 important DAO proposals/discussions to follow in the last 7 days 🧠🧵 pic.twitter.com/iVuJbHubf6

— Pink Brains (@PinkBrains_io) September 14, 2025

Let’s start with Scroll, which shocked the market by suspending its DAO and centralizing decision-making. Their goal is speed, a faster development cycle in the crowded Layer-2 race.

But this move raised deep concerns around transparency and user participation. The tension between centralization and decentralization continues to define DAO governance discussions across the space.

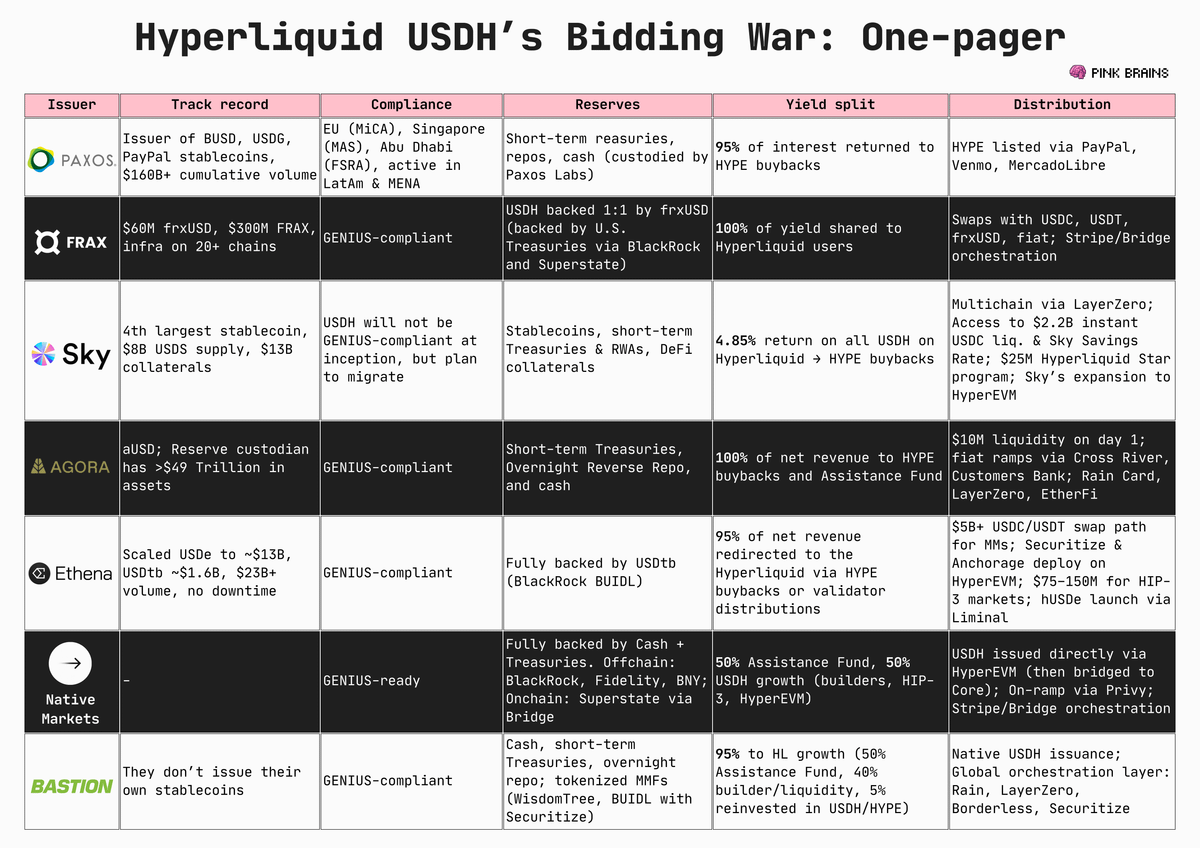

Over at Hyperliquid, a validator vote on the ownership of the USDH ticker has turned into a full-blown governance war. If a single group secures control, it could impact the development and fees around one of the protocol’s key stablecoins.

This isn’t just a branding debate, it’s a critical DAO governance issue that could affect liquidity strategies on the platform and even influence norms across DeFi.

These changes echo recent narratives seen in projects like Meteora’s TGE allocation, where governance and token distribution choices sparked significant debate in the community.

Capital, Control, and Consolidation Across the Ecosystem

Governance doesn’t end with votes and proposals. This week, DAO governance took center stage in broader financial decisions across DeFi.

Ronin Network took a giant leap by migrating to Ethereum as an Optimism-based Layer-2 chain.

Important update about the Scroll DAO:

At Scroll, we’re united in our vision to drive the organization forward as a cohesive force, capitalizing on the exciting momentum building across the ecosystem.

While all accepted proposals will move forward as planned, no new proposals…

— Scroll (@Scroll_ZKP) September 11, 2025

The shift promises improved security, better tooling, and enhanced interoperability, but also signals a broader trend: sidechains moving closer to Ethereum’s ecosystem for stronger trust guarantees.

Buyback and burn mechanisms also made headlines. WLFI DAO launched a new plan to reduce token supply and drive price support. It sounds bullish, but execution matters.

If a DAO lacks consistent revenue or transparency in how buybacks are handled, it could backfire. Again, smart DAO governance will be the deciding factor in whether these mechanisms deliver real value.

Over at dYdX, the DAO is exploring a leaner approach: ending protocol-level trading rewards and consolidating incentives under the dYdX Surge program.

This signals a clear shift in DAO governance strategy, from mass reward distribution to targeted capital efficiency. It’s a sign that DAOs are maturing financially and starting to treat incentive spending like real businesses do.

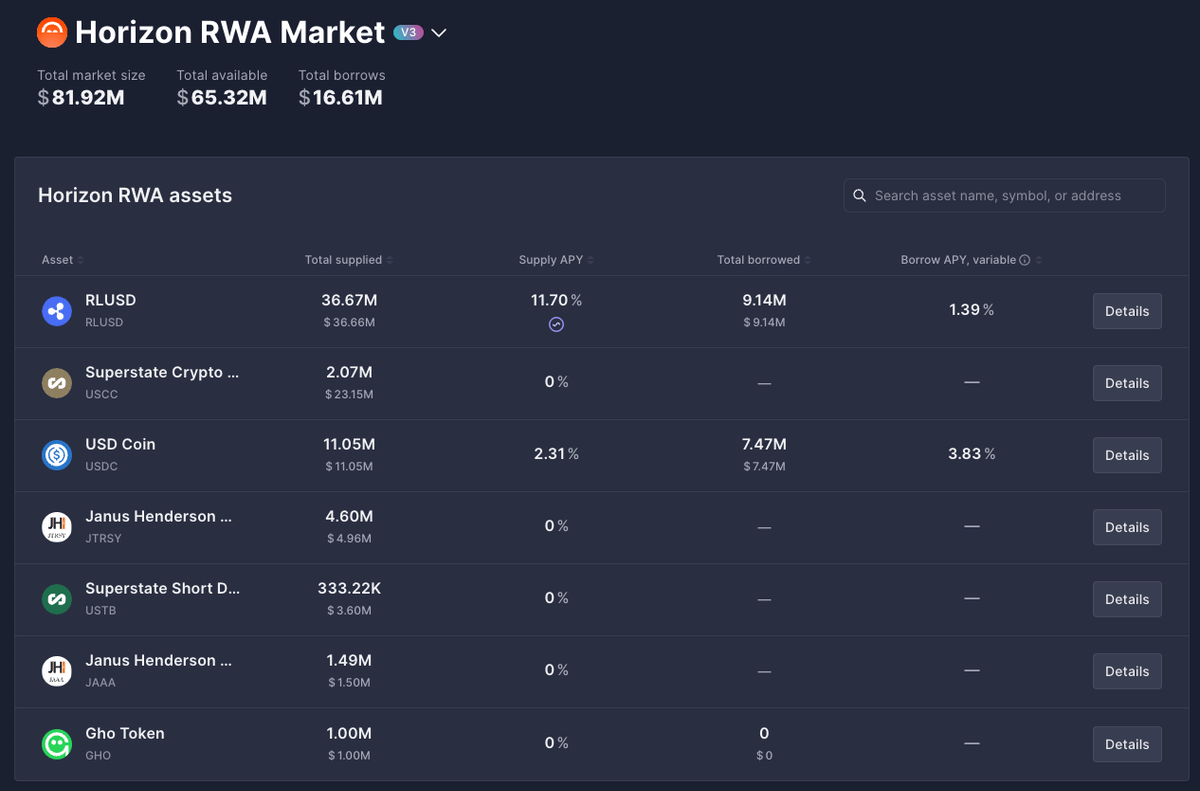

Aave Horizon, meanwhile, shared strong early results in its first-week report, with growing liquidity and protocol adoption. And Arbitrum DAO published data from its DRIP program, showing that even as incentives are pulled back, lending and borrowing activity remains stable.

It’s proof that infrastructure-driven growth can hold up, even without high-volume reward farming.

This aligns with recent patterns we’ve seen in platforms like Sei, whose price surged alongside stablecoin integrations, showing how capital efficiency and proper governance can still fuel ecosystem growth even in tough markets.

Are DAOs Losing Their Decentralized Edge?

A bigger question looms: is DAO governance slowly drifting away from its decentralized roots?

The Scroll suspension brought this issue to the surface. Is centralizing for speed a betrayal of the DAO model, or a necessary move in today’s high-stakes market? Critics argue that DAOs were meant to empower communities, not reinforce top-down control.

Important update about the Scroll DAO:

At Scroll, we’re united in our vision to drive the organization forward as a cohesive force, capitalizing on the exciting momentum building across the ecosystem.

While all accepted proposals will move forward as planned, no new proposals…

— Scroll (@Scroll_ZKP) September 11, 2025

But on the other side, founders say it’s impossible to move quickly or scale under slow, inefficient DAO governance structures.

And it’s not just Scroll. Even protocols still operating as DAOs are exploring tighter control over decision-making. Hyperliquid’s vote could lead to centralization of key assets like stablecoin tickers. dYdX is streamlining rewards into a single pipeline.

USDH ticker war. Source: X – Techtoken

WLFI is managing buybacks from a central treasury. These are signs of DAO governance adapting to real-world conditions, but also moving away from its original ideals.

These shifts aren’t unique. Projects like Mirror Protocol are also evolving their tokenomics and distribution models post-launch, sparking new debates around governance and decentralization.

We’re seeing a new phase in the DAO journey: one where decentralization isn’t always the priority.

Aave Horizon. Source: X – Techtoken

Instead, efficiency, revenue, and control are becoming the new pillars of decision-making. Whether this helps or hurts the space will depend on how DAOs balance their roots with their ambitions.

What’s clear is that DAO governance is no longer a niche experiment. It’s now a core engine driving capital, trust, and technology decisions across the crypto space.

Every vote, proposal, and structural change now has real implications for the future of web3.

As DAOs become more sophisticated, we also see growing demand for security, especially in the wake of major incidents like the THORChain hack, which exposed governance blind spots in protocol-level response frameworks.