Key Points

- Altcoin open interest just surpassed Bitcoin for the first time since Dec

- Correlation with Nasdaq, S&P 500, and gold is breaking down

- Analysts flag signs of overheated risk appetite across alt markets

- A 20–30% pullback may be a typical reset before the next rally

The crypto market top might be closer than many traders think.

A key signal came from the derivatives market: open interest in altcoins has surpassed Bitcoin for the first time since December 2024. This shift shows that more traders are now betting on altcoins instead of the traditionally safer Bitcoin.

This is really concerning! ⚠️

Altcoins (except ETH) open interest is about to flip Bitcoin open interest (OI) for the first time in 9 months.

The last 2 times it happened were in December 2024 and March 2024, and both times alts formed a local top within 2 weeks. pic.twitter.com/ipgMVldVfu

— Ted (@TedPillows) September 12, 2025

According to crypto analyst arndxt, this is one of the strongest signals of a market getting overheated. When traders pile into altcoins, it usually means risk appetite is high, often too high. Historically, this has been a warning sign of a crypto market top.

“The last 2 times this happened, altcoins topped within two weeks,” said analyst Ted Pillows.

ALT OI > BTC OI for the first time in 9 months since the Jan 2025 local top. Time to pay attention. @WClementeIII @cointradernik pic.twitter.com/QvboJWuvVr

— CryptoCondom (@crypto_condom) September 13, 2025

In both those previous cases, December 2024 and March 2024, the surge in altcoin open interest marked the end of short-term rallies. The market cooled off soon after, with altcoins experiencing sharp pullbacks.

This doesn’t mean the bull market is over. But it does suggest the current uptrend may be running on fumes.

Some altcoin communities, such as those involved in DAO governance, are seeing renewed participation, which could be a sign of speculative hype peaking.

Correlation Breakdown Adds to Fragile Outlook

Another key signal comes from how Bitcoin is behaving in relation to traditional markets.

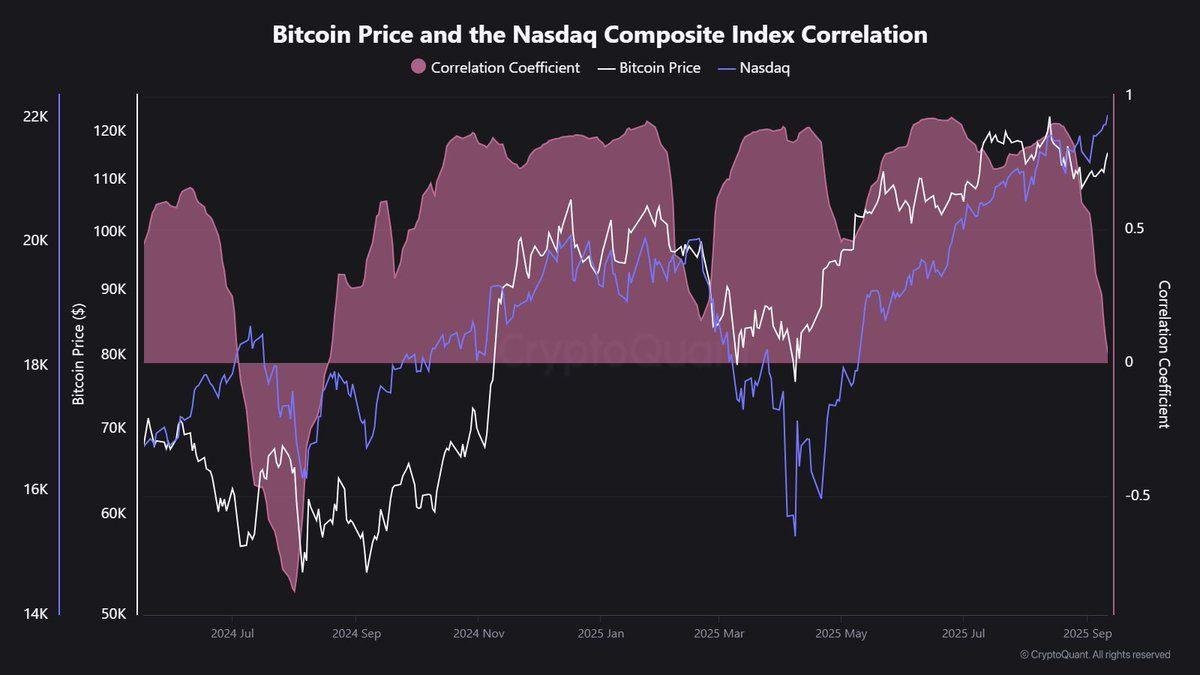

Bitcoin’s correlation with the Nasdaq has turned negative, its lowest point since September 2024. This means that instead of moving in the same direction as tech stocks, Bitcoin is now drifting away. The same goes for its relationship with the S&P 500 and even gold.

“BTC is clearly lagging behind tech,” noted analyst Maartunn.

Bitcoin/Nasdaq Correlation. Source: X/JA_Maartunn – Techtoken

This breakdown in correlation is being interpreted by some analysts as a shift in market structure, one that could suggest we are approaching a crypto market top.

Why does this matter?

When crypto follows broader markets, it often means there’s a shared risk sentiment. But when that correlation breaks, it usually means crypto is moving based on internal factors like speculation, leverage, or trader emotions, all of which are more volatile.

Bitcoin-Nasdaq correlation just dropped negative,j to its lowest level since September 2024 📉

BTC is clearly lagging behind tech. pic.twitter.com/WrQi9FmuYh

— Maartunn (@JA_Maartun) September 14, 2025

According to CryptoQuant data, the weakening of these correlations means Bitcoin is no longer tied to the moves of more stable assets.

This independence might sound good at first, but in reality, it often signals fragility, another common feature of a crypto market top.

We’ve also seen altcoins like SEI surge alongside stablecoin volumes, adding to the growing sense of a market that’s heating up too fast, too soon.

Altcoins Heating Up Fast, A Classic Warning Sign

The rise in altcoin activity is another key indicator to watch.

Right now, speculative money is pouring into altcoins at a faster rate than it is into Bitcoin. This isn’t the first time it’s happened, and history shows that such behavior has usually been followed by short-term corrections.

Investors are betting big on small caps and meme coins, hoping to catch the next 10x. But this kind of speculation rarely ends well unless the market remains healthy and supported by strong fundamentals, which is currently under debate.

Projects launching new tokens like the recent Mirror Token debut only add to the hype. These launches often pull in short-term liquidity, which can exaggerate volatility, especially during uncertain market phases.

This behavior shows that the market may be entering an overheated phase, a key ingredient for forming a crypto market top.

And it’s not just price surges. The recent ThorChain hack shook investor confidence, showing how vulnerabilities can spark sudden outflows, especially in hot altcoin ecosystems.

A Pullback Could Be a Healthy Reset

Despite these fragile signals, most analysts agree on one thing: a pullback doesn’t mean doom.

In fact, 20–30% corrections are common in bull markets. They act as a reset, cooling off extreme greed, reducing leverage, and preparing the market for its next move.

“Wouldn’t be the first time a dip shows up before the next leg,” said analyst Ted Pillows.

I covered this yesterday, and Altcoins (except $ETH) Open Interest has surpassed Bitcoin Open Interest.

In December 2024 and March 2024, this marked the local top within 2 weeks (see the chart).

To be clear, I’m talking about a local top, not a cycle top.

In a bull market,… https://t.co/rd2U4AbVS8 pic.twitter.com/oeDBX8JNbi

— Ted (@TedPillows) September 13, 2025

Pullbacks serve a critical function. They remove excess noise from the market and allow high-conviction investors to re-enter at lower prices. It’s a necessary step before moving higher, especially in long-term bull runs.

This is why some analysts are calling the current conditions not a crash warning, but a setup for the next wave, assuming the fundamentals remain strong.

Wouldn’t be the first time a dip shows up before the next leg

— Ted (@TedPillows) September 13, 2025

Stablecoin activity is often a signal of capital movement, and recent trends in Circle’s USDC minting suggest that institutional players are still deploying capital, a potentially bullish sign post-pullback.

Still, timing is everything.

With the upcoming FOMC (Federal Open Market Committee) meeting expected to influence global markets, many are watching for increased volatility. In the past, crypto has responded with sharp swings around such macroeconomic events.

If markets react negatively to the Fed’s tone or actions, it could serve as the spark that confirms a crypto market top, even if just a temporary one.

What Happens Next?

Rising altcoin speculation, falling correlations with traditional markets, token launches, and increased fear of missing out (FOMO) are classic signs of a fragile market setup.

Whether this points to a short-term crypto market top or just a healthy correction in a long-term uptrend remains to be seen. But what’s clear is that traders should stay cautious, manage their risk, and prepare for a potential shift in momentum.

The coming weeks, especially after the FOMC announcement, could shape the next major move.