Key Points

- Circle minted $677M USDC in just 3 hours

- Over $1B minted this week in irregular patterns

- Community speculates a major move brewing

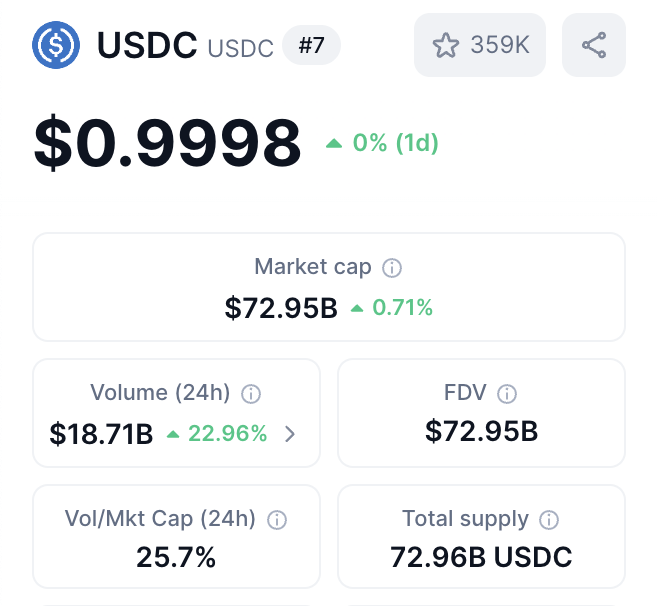

- USDC trading volume surged 20% in 24 hours

In a surprising and aggressive move, Circle USDC minting activity crossed $677 million in just three hours, catching the attention of traders, analysts, and speculators alike.

The size and speed of the mint have sparked widespread curiosity across the crypto space.

Yes,…. Higher…. pic.twitter.com/2cRkcFu0E0

— Shaun Edmondson (@EdmondsonShaun) September 12, 2025

This isn’t an isolated event. Over the past seven days, Circle USDC minting has exceeded $1 billion, pointing to something more than routine demand. Even more interesting? These aren’t clean, round numbers.

The mints come in irregular amounts, like $94.3 million and $132.6 million, which suggests that this isn’t just about topping off reserves.

When stablecoins are minted in high volumes, especially in non-uniform patterns, it’s usually an early sign that liquidity needs are shifting. And in the world of crypto, that often means something big is about to happen.

Social platforms like X (formerly Twitter), Reddit, and Discord are full of conversations about what this surge could mean.

BREAKING 🚨 $350 MILLION USDC JUST GOT MINTED pic.twitter.com/Y00ZI46O6X

— That Martini Guy ₿ (@MartiniGuyYT) September 12, 2025

Many speculate that Circle USDC minting is laying the groundwork for a strategic play, either a major product launch, exchange integration, or institutional partnership.

Interestingly, similar early signs appeared before Mirror Protocol’s token launch, where large on-chain movements preceded a significant DeFi expansion. Could Circle be setting the stage for something just as big?

Is Circle Preparing for a Bullish Market Turn?

The sudden rise in Circle USDC minting has coincided with a 20% increase in USDC’s 24-hour trading volume. That’s a clear indicator that demand for liquidity is climbing. But some experts argue that demand alone doesn’t explain this level of minting.

USDC Trading Volume. Source: CoinMarketCap – Techtokens

Circle’s Q2 earnings were notably weak, and its stock has been trending downward for the past month.

In this context, some believe that the minting spree could be a tactical move to regain investor confidence or maintain market share in the stablecoin space, especially with Tether and algorithmic stablecoins gaining traction.

Still, the lack of official communication from the company fuels uncertainty. Circle USDC minting at this scale is unprecedented in such a short time window, which raises several questions:

-

Is Circle preparing to inject liquidity into new DeFi protocols?

-

Are there institutional clients requesting large-scale conversions?

-

Or is this a preemptive move before upcoming stablecoin regulations take effect?

Some analysts believe Circle may be positioning itself ahead of regulatory clarity, a strategy similar to how Meteora structured its TGE allocations for early investors and ecosystem growth. This could suggest Circle is preparing for ecosystem expansion or onboarding strategic partners.

Repeated and Irregular Minting Hints at Strategic Intent

The pattern of Circle USDC minting has not gone unnoticed by on-chain analytics platforms. Over the past week, token watchers have identified multiple mints totaling over $1 billion in new USDC, far exceeding the number of tokens burned in the same timeframe.

Circle’s Solana minting spree continues – $8B in 2024, $1B this week alone. While boosting L2 liquidity, such concentrated issuance raises questions about centralized control. Does $USDC‘s growth mask ecosystem fragility?

— SAG3.ai (@SAG3_ai) September 12, 2025

The irregular nature of these mints, with no consistent pattern in size or time, suggests that this is not just routine replenishment. Instead, many believe Circle is executing a planned liquidity strategy.

This behavior is similar to what happened with other stablecoin issuers in the past. For instance, before launching a new product, World Liberty Financial minted $200 million of USD1, which was later listed on Coinbase.

The similarity has led some to think Circle USDC minting could signal a new market entry, maybe even in emerging markets or through legacy finance partnerships.

On a related note, Coinbase’s recent altcoin listing activity has shown that strategic listings often follow these types of liquidity buildups, leading many to speculate whether USDC will be integrated into newly listed or upcoming tokens.

Here’s what stands out:

-

High-volume minting with no matching burn

-

Irregular mint sizes

-

Increased trading volume without a correlating market event

If Circle were simply responding to user demand, we would expect more consistency, both in volume and in the number of tokens burned. But Circle USDC minting seems to be following a different rhythm.

Some community members speculate that Circle is prepping for a massive liquidity injection into upcoming blockchain networks, particularly those built for enterprise-grade solutions or international payments.

The kind of liquidity movement we’re seeing with Circle is not unlike the pattern observed before Hedera (HBAR) and XRP’s unusual correlation spike, where on-chain indicators hinted at something bigger brewing before the market caught on.

Others think this may be part of a market-making strategy, where large amounts of USDC are deployed to trading desks ahead of major price actions or exchange listings.

Interestingly, even smaller DeFi players like Myx Finance have seen notable price action tied to sudden stablecoin movement, proving that liquidity injections can trigger large ripples across the market.

Regardless of the reason, one thing is clear: this isn’t normal.

As stablecoin regulations loom, Circle may also be front-loading mints to get ahead of potential compliance restrictions. If new laws force tighter control over minting, having excess USDC in circulation now could give them more flexibility later.

Whatever the intent, Circle USDC minting is once again in the spotlight, and history tells us that when minting surges like this, market-moving events often follow.