Key Points

- SEC approves Grayscale GDLC Fund, the first multi-crypto ETP

- GDLC includes BTC, ETH, XRP, SOL, and ADA

- Approval under the Generic Listing Standards eases the path for future funds

- Institutional access to crypto could now accelerate

The U.S. Securities and Exchange Commission (SEC) just approved the Grayscale GDLC Fund, making it the first-ever multi-asset crypto Exchange-Traded Product (ETP) to be listed and traded on a U.S. stock exchange.

This is a major win for crypto investors, especially those looking for regulated exposure to diversified digital assets.

Grayscale Digital Large Cap Fund $GDLC was just approved for trading along with the Generic Listing Standards. The Grayscale team is working expeditiously to bring the *FIRST* multi #crypto asset ETP to market with Bitcoin, Ethereum, XRP, Solana, and Cardano#BTC #ETH $XRP $SOL…

— Peter Mintzberg (@PeterMintzberg) September 17, 2025

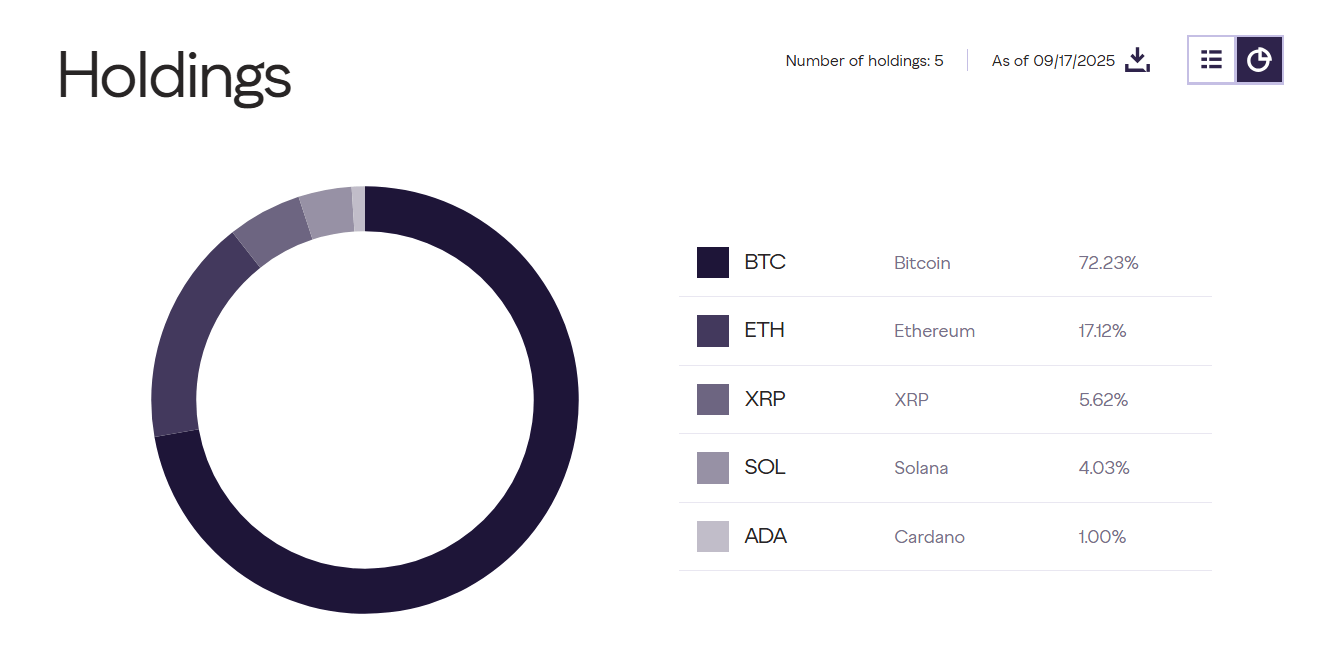

The Grayscale GDLC Fund includes some of the most popular cryptocurrencies on the market:

-

Bitcoin (BTC) – 72.23%

-

Ethereum (ETH) – 12.17%

-

XRP – 5.62%

-

Solana (SOL) – 4.03%

-

Cardano (ADA) – 1%

The fund has existed since 2018 but was only available over-the-counter (OTC). Now, with SEC approval, the Grayscale GDLC Fund will be listed on the NYSE Arca, giving retail and institutional investors easier access via traditional brokerages.

Grayscale Digital Large Cap Fund (GDLC) Portfolio Allocation. Source: Grayscale – Techtoken

What Is the Grayscale GDLC Fund?

The Grayscale GDLC Fund is designed to track a market cap-weighted portfolio of large-cap cryptocurrencies. Investors buy shares of GDLC to get broad exposure to crypto without needing to own or manage the individual tokens.

This setup makes the Grayscale GDLC Fund an attractive option for institutions who want regulated access without dealing with the technical complexities of wallets, private keys, and direct custody.

What’s important here is not just the approval of the Grayscale GDLC Fund, but the way it was approved.

UPDATE: While @Grayscale was given an approval order for their conversion of $GDLC into an ETF yesterday. There was a letter attached to that approval that is putting a Stay on their ability to actually convert at this time. pic.twitter.com/AiEp5tLOou

— James Seyffart (@JSeyff) July 2, 2025

Generic Listing Standards Could Fast-Track Future Crypto ETFs

The SEC gave the Grayscale GDLC Fund the green light under the Generic Listing Standards of NYSE Arca. That’s a game-changer.

Here’s why it matters:

Previously, each crypto fund needed a lengthy review and approval process. But under these standards, if a fund meets certain criteria, it can be listed more easily, saving time and cutting red tape.

Btw, one last note…

Lost in the news of the generic listing standards was that the SEC has *approved* the Grayscale Digital Large Cap ETF.

Holds btc, eth, *xrp*, *sol*, & *ada*. pic.twitter.com/WTHSBhgXTe

— Nate Geraci (@NateGeraci) September 18, 2025

This opens the door for other multi-crypto and single-asset ETFs to come next. The crypto world is already buzzing about who could be next in line after the Grayscale GDLC Fund.

One strong contender is Bitwise, which has also filed for ETFs focused on newer assets. For example, their AVAX ETF could become a reality following GDLC’s success.

Bitwise Could Be Next

Grayscale isn’t the only one aiming for ETF status.

Bitwise Asset Management is also seeking SEC approval to convert its Bitwise 10 Crypto Index Fund (BITW) into an ETF. BITW holds more assets than the Grayscale GDLC Fund and could soon follow the same regulatory path.

Analysts now believe that the approval of the Grayscale GDLC Fund increases the odds of Bitwise getting approved, and more crypto funds could be next.

To dive deeper into this evolving space, check out how altcoin ETF approvals are reshaping investor access across the board.

Boost to Altcoins and Investor Sentiment

This regulatory shift doesn’t just benefit Bitcoin and Ethereum. It also puts altcoins like XRP, Solana, and Cardano in the spotlight.

Investors in these projects now have fresh hope for dedicated altcoin ETFs, which could bring more institutional liquidity into the ecosystem.

We’re seeing increasing retail and institutional interest in projects that are part of the Crypto MAG 7, and GDLC covers several of them.

The timing also couldn’t be better.

Just days before this announcement, the Federal Reserve cut interest rates by 25 basis points. That move already had the market in a risk-on mood, and the Grayscale GDLC Fund approval is adding fuel to the fire.

At the same time, new crypto use cases are emerging in mainstream finance. For example, Bitcoin is even being considered for mortgage payments, signaling a broader shift in adoption.

Meanwhile, platforms like Pump.fun are riding this wave with creative strategies like livestream hype trading that capture Gen Z interest.

Now, traders and institutions alike are positioning for a potential altcoin rally in the months ahead, especially as regulatory green lights like this one for the Grayscale GDLC Fund build momentum.