Key Points

- Bitwise joins VanEck and Grayscale in AVAX ETF filings

- AVAX crosses $30 after rallying nearly 30% this month

- Analysts warn of short-term correction risks

- Price targets range from $50 to $54 amid bullish momentum

Bitwise has officially entered the AVAX ETF race. The crypto asset manager filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) seeking approval to launch a spot Avalanche ETF, a product designed to hold AVAX, the native token of the Avalanche blockchain.

The proposed AVAX ETF will offer direct exposure to AVAX instead of relying on futures or derivatives. By holding the actual asset, Bitwise aims to give investors cleaner, simpler access to Avalanche without the complexity of managing wallets or private keys.

Bitwise will use the CME CF Avalanche, Dollar Reference Rate, New York Variant to determine the ETF’s daily net asset value (NAV). Custody will be handled by Coinbase Custody Trust Company, LLC, one of the largest institutional crypto custodians in the U.S.

Interestingly, Bitwise has not yet disclosed which exchange the ETF will be listed on or what its ticker symbol will be.

Still, this filing adds another heavyweight to the growing list of firms racing to gain regulatory approval for the AVAX ETF, alongside VanEck and Grayscale, who submitted their applications in March and August respectively.

According to Bitwise, the product is designed to help investors strategically and tactically allocate capital into Avalanche without the technical hurdles of on-chain activity.

This wave of ETF filings could mark a major turning point for AVAX, pushing it into the spotlight for traditional finance (TradFi) investors who are looking for blockchain exposure via familiar, regulated products.

The trend is similar to the recent developments in DAO governance participation, where on-chain tools are making it easier for institutions to join Web3 ecosystems.

AVAX Price Jumps 30%, What’s Driving the Surge?

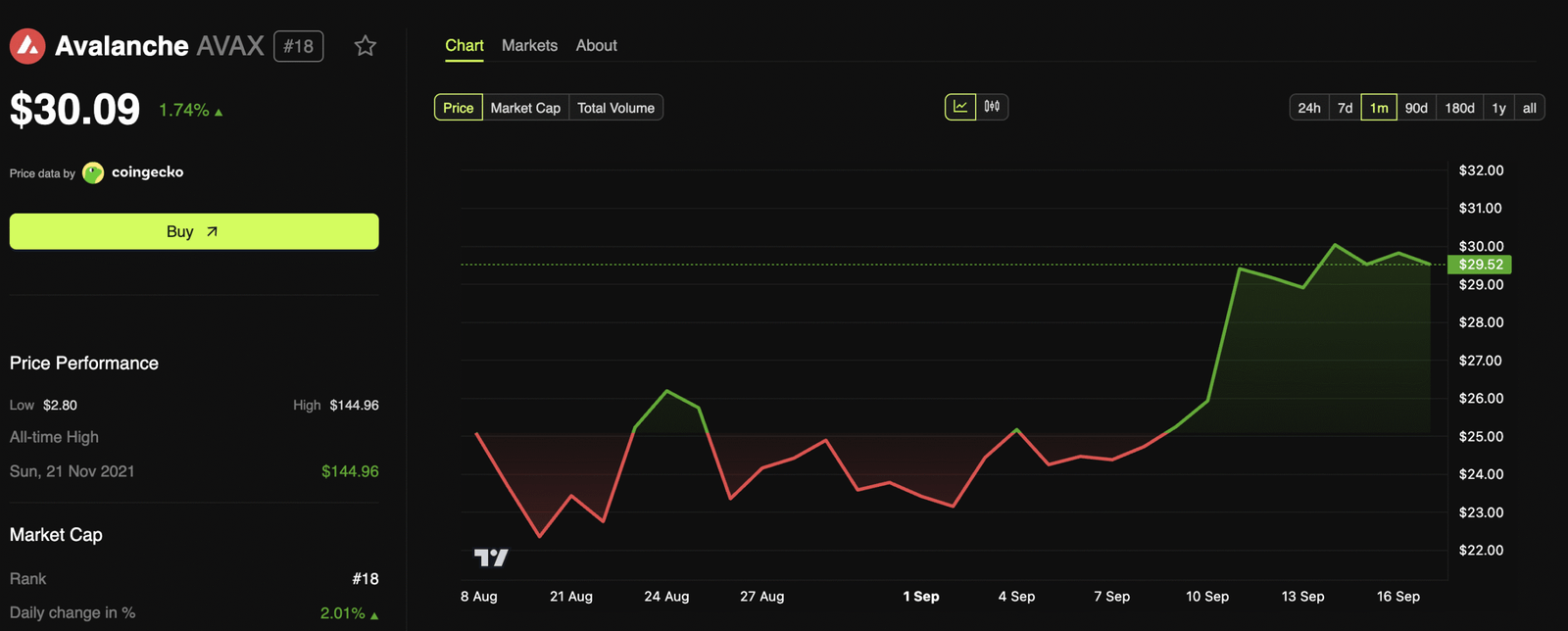

The AVAX ETF news comes at a time when Avalanche is experiencing a notable price rally. AVAX has surged nearly 30% in September, crossing the $30 threshold for the first time since February 2025.

Avalanche (AVAX) Price Performance. Source: Techtokens

As of now, AVAX is trading at $30.09, driven by strong momentum across both technical and fundamental indicators.

Here’s what’s fueling the run:

-

Daily active addresses on Avalanche are steadily rising, suggesting more users are interacting with the network.

-

AVAX recently broke out of an ascending triangle, a bullish chart pattern that typically signals further gains.

-

Broader market recovery is lifting altcoins, and AVAX is benefiting from increased investor attention.

This is similar to how the hype around new meme tokens like Pump.fun livestreams has pushed certain assets into rapid growth mode, driven largely by community and media buzz.

Analysts are setting new price targets for AVAX between $50 and $54, levels last seen in late 2024. According to crypto analysts on X (formerly Twitter), AVAX is now “ready to run,” and is considered one of the top altcoins to watch.

However, traders are also cautious.

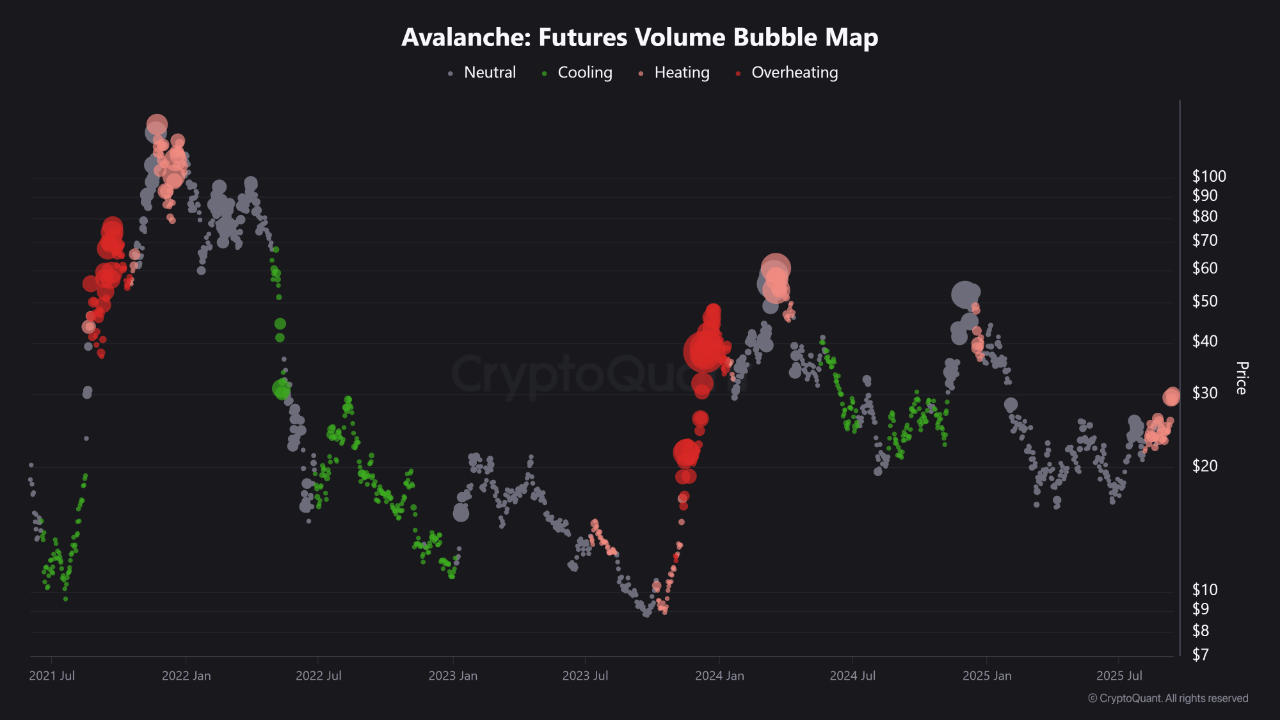

CryptoQuant’s Futures Volume Bubble Map shows a sharp spike in leveraged positions on AVAX. This could lead to short-term volatility as even minor price dips might trigger liquidations, amplifying downward moves.

AVAX Futures Volume Bubble Map. Source: CryptoQuant/Burakkesmeci – Techtoken

We’ve seen similar market stress impact other protocols during major events, like the recent THORChain exploit that shook DeFi circles.

AVAX Price Prediction. Source: X/cryptoWZRD_- Techtokens

That said, analysts believe that while short-term pullbacks are possible, the long-term uptrend remains strong. The buzz around a potential AVAX ETF is likely contributing to the optimism, as institutional demand could further push the token’s adoption and valuation.

⚠️ HIGHER TO GO 👀

The range has broken…

🚨 $AVAX has let loose! The range and Ascending triangle has broken.. $54.00 is next 🚀

Patience Pays 🧘🏻 pic.twitter.com/sGzWlSfGFD

— CRYPTOWZRD (@cryptoWZRD_) September 15, 2025

Institutional ETFs Could Accelerate Avalanche Adoption

The push for an AVAX ETF isn’t just about capturing gains—it’s about accelerating Avalanche’s path to mainstream adoption.

ETFs are a trusted financial product for traditional investors. If the AVAX ETF gets approved, it would bring regulated exposure to AVAX through standard brokerage accounts, making it accessible to retirement funds, hedge funds, and individual investors who prefer conventional markets over crypto exchanges.

For Avalanche, this could be a game-changer.

More inflows from institutional investors could lead to:

-

Greater liquidity for AVAX in the open market

-

Price stability from long-term holders

-

Wider ecosystem growth, as more users and developers join the network

Also, launching an AVAX ETF alongside similar products for Ethereum, Bitcoin, and Solana puts Avalanche in the same conversation as the Crypto Market Top Layer-1s.

$AVAX Easily one of the top coins to be buying right now. Ready to run shortly we should see a $50 $USD Avalanche. pic.twitter.com/2qkkYMDzUo

— Nirvan 🟥🟩 (@Nir7ann) September 15, 2025

If Bitwise, VanEck, or Grayscale succeed in gaining SEC approval, it would signal regulatory confidence in AVAX and open the door for future institutional-grade Avalanche products, including mutual funds, index funds, and even derivatives.

The broader impact? Avalanche could become a serious contender for enterprise adoption, DeFi platforms, and tokenized real-world assets (R, WAs)sectors where secure, scalable blockchains are in high demand.

It’s similar to how Crypto’s Magnificent 7 are driving innovation in real-time on-chain utility and developer traction.

What’s Next for AVAX and the ETF Battle?

As of now, all eyes are on the SEC.

Bitwise’s application adds pressure to the regulator, who now has multiple AVAX ETF filings to consider. If one gets approved, it could trigger a domino effect, similar to what we saw with Bitcoin spot ETFs earlier in the year.

Meanwhile, AVAX continues to show strength in both price and network activity.

If the coin maintains its momentum, and if the AVAX ETF gets the green light, it could unlock billions in potential inflows, helping Avalanche solidify its position in the crypto top 10.

Investors should watch for the following:

-

SEC response timelines for Bitwise, VanEck, and Grayscale

-

AVAX price action around the $35 and $40 resistance levels

-

On-chain growth indicators like daily active wallets and TVL

-

Any updates from Bitwise on the ETF listing exchange and ticker

With strong fundamentals, growing demand, and institutional attention, the future looks promising for AVAX, and even more so if a U.S.-regulated AVAX ETF hits the market soon.