Key Points

- SEI integrates U.S. Commerce and Chainlink data for RWAs

- Daily users triple, stablecoin volume hits $5.5B

- Technical charts show bullish rounded bottom pattern

- Analysts forecast up to 54% SEI price rally by Q4

The SEI price is making waves again, and this time, it’s not just from retail speculation, it’s from serious infrastructure development.

Sei Network recently partnered with the U.S. Department of Commerce, allowing its blockchain to access real-time economic data.

United States Department of Commerce data is coming to Sei.

The @chainlink data standard will deliver U.S. GDP and other U.S. government macroeconomic indicators to Sei – powering institutional-grade markets with secure, trusted data.

Markets Move Faster on Sei. ($/acc) pic.twitter.com/jDOQ2msKTG

— Sei (@SeiNetwork) September 11, 2025

This was made possible through Chainlink Data Streams, which bring trusted government data on-chain, including key metrics like GDP and inflation.

Sergey Nazarov projects RWAs will surpass the entire crypto market.

With @chainlink Data Streams live on Sei, the rails for this trillion-dollar future are set — trusted data & institutional-grade settlement powering a tokenized global economy.

RWAs Move Faster on Sei. ($/acc) pic.twitter.com/x4IYI4TKji

— Sei (@SeiNetwork) September 11, 2025

This move turns Sei into a serious player in the tokenized real-world asset (RWA) market. It’s not just about charts and hype anymore, SEI is becoming a data-powered settlement layer for real institutions.

The data is compelling:

-

Daily active addresses have tripled to over 800,000

-

$5.5 billion in daily stablecoin volume shows deep liquidity

-

$1.53 billion in DEX volume was recorded in July alone

-

Over $243 million in new stablecoins have been issued in 4 months

-

$100 million in native USDC was minted in just 10 days, this growth mirrors what we saw during Circle’s USDC minting spike, showcasing rising demand for compliant stablecoins

Sergey Nazarov projects RWAs will surpass the entire crypto market.

With @chainlink Data Streams live on Sei, the rails for this trillion-dollar future are set — trusted data & institutional-grade settlement powering a tokenized global economy.

RWAs Move Faster on Sei. ($/acc) pic.twitter.com/x4IYI4TKji

— Sei (@SeiNetwork) September 11, 2025

These stats reveal that Sei isn’t just “keeping up”, it’s leading the stablecoin and RWA space. According to Nansen, Sei is emerging as a top base layer for stablecoins and institutional-grade crypto flows.

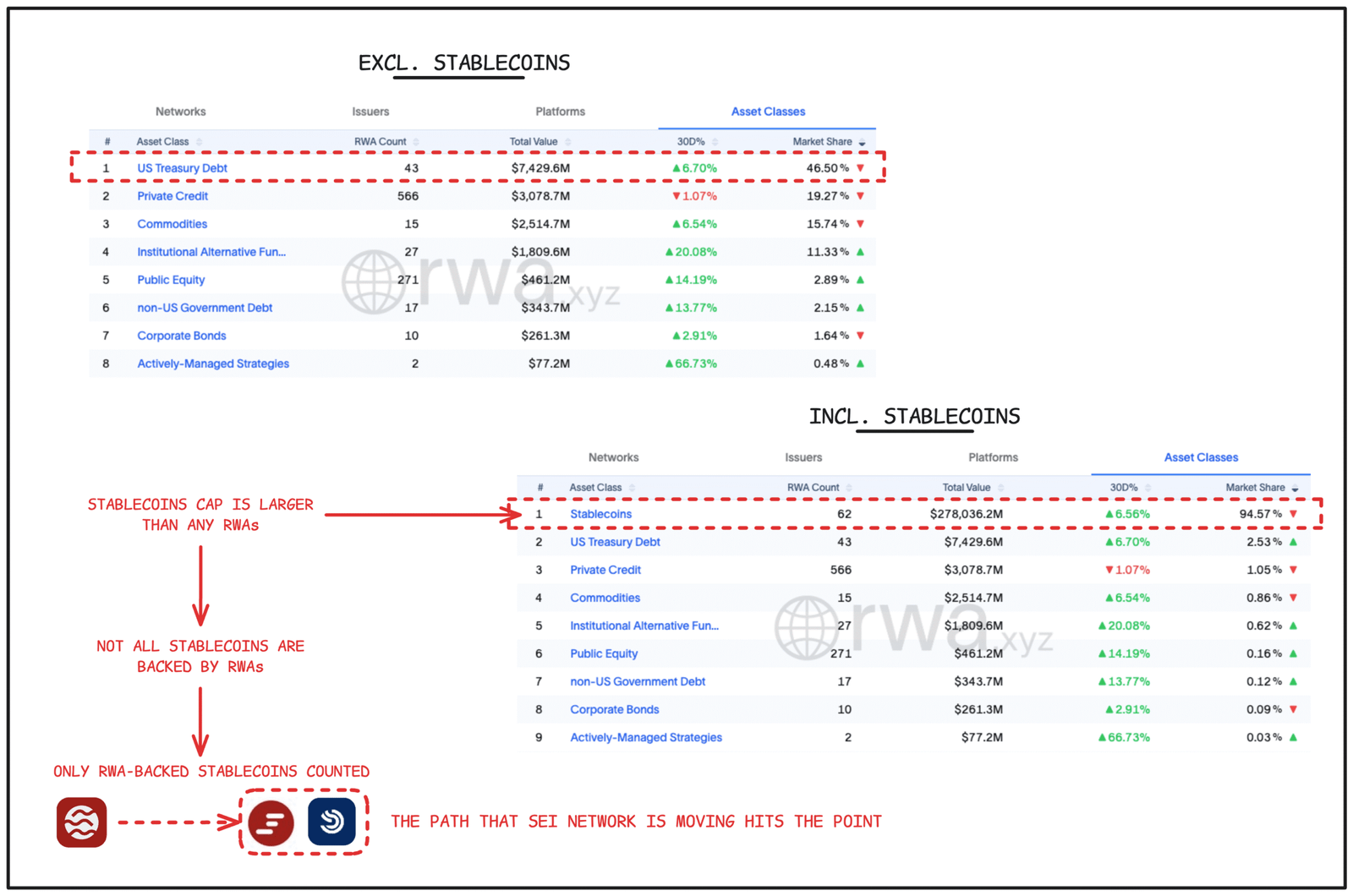

The network is also focusing heavily on RWA-backed stablecoins, like USDY, which are gaining traction fast. With stablecoins representing 94.5% of all RWAs, Sei’s strategy puts it in a strong position for exponential growth.

As one user on X pointed out:

“RWAs are moving faster on Sei than anywhere else.”

Great point, focusing on RWA backed stablecoins makes sense, and Sei’s adoption of them shows real longterm potential.

— Crypto Ege (@CryptoEgeHan) September 11, 2025

Another echoed the sentiment, highlighting Sei’s unique position in blending real-world finance with on-chain technology.

This trend aligns with broader tokenization efforts seen across ecosystems, including events like the Meteora TGE allocation, which also highlight how emerging platforms are redefining access to real-world value through Web3.

State of stablecoins and RWAs on Sei. Source: andrew.moh on X – Techtokens

Technical Analysis Suggests 54% SEI Price Rally Ahead

So what’s next for the SEI price?

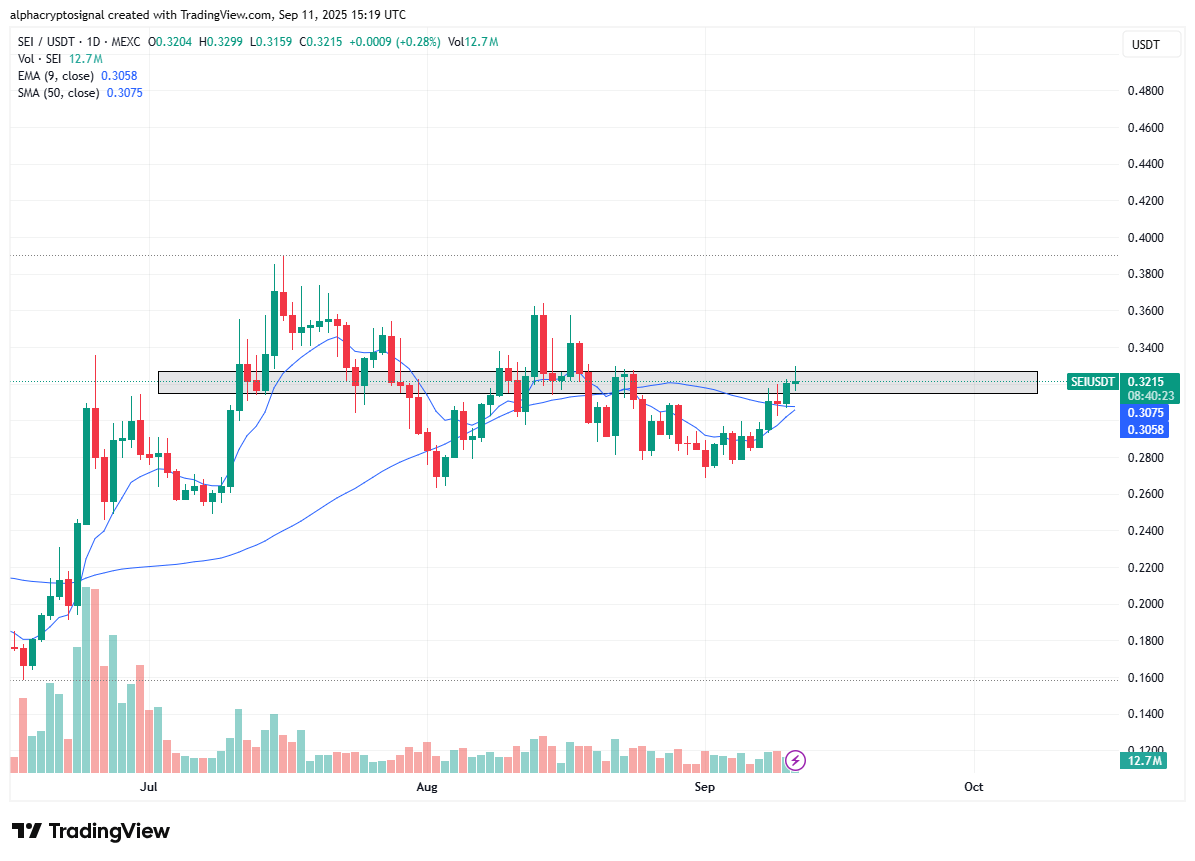

Charts are telling a bullish story. Analysts on X have pointed out that SEI is forming a rounded bottom pattern, a strong technical signal of a potential breakout.

Thoughts on #SEI:$SEI is pushing into a key resistance zone after a steady recovery from recent lows. The price is now testing the supply block while trading above both the 9 EMA and 50 SMA, which shows momentum is gradually shifting back in favor of the bulls. If buyers manage… pic.twitter.com/NMboNl08U5

— Alpha Crypto Signal (@alphacryptosign) September 11, 2025

Currently, SEI is trading above the 9-day EMA and 50-day SMA, which signals strong upward momentum. Technical indicators are aligning with the on-chain growth, giving both retail and institutional investors a green light.

SEI/USDT Daily Chart. Source: Alpha on X – Techtokens

Analyst Ali recently identified the current range as a “buy zone,” predicting that the SEI price could surge by 54%, potentially reaching $0.498 in the next wave.

Still, there’s a word of caution. Some experts suggest the possibility of a short-term fakeout before SEI resumes its upward trajectory. But for long-term believers in the project, the upside far outweighs short-term risks.

The rounded bottom is one of the most reliable reversal patterns in technical analysis. If SEI breaks through its current resistance, it could begin a multi-month rally that extends well into Q1 2026.

$SEI is in a buy zone, preparing for a 54% bullish breakout toward $0.498! pic.twitter.com/RJabrqRh0S

— Ali (@ali_charts) September 11, 2025

Just like the recent Mirror Token launch highlighted new narratives and trading opportunities, SEI’s movement could usher in another wave of speculative and institutional interest.

As interest in tokenized assets, ETFs, and stablecoins grows, the SEI price could become a barometer for the health and adoption of RWA-based DeFi systems.

SEI/USDT Daily Chart. Source: Ali on X – Techtoken

Why SEI Price Could Define the Future of Tokenized Finance

Beyond the charts, tech, and adoption metrics, there’s a larger narrative emerging, and the SEI price is at the center of it.

Sei is not just another layer-1 blockchain trying to attract DeFi apps. It’s building a trusted, high-speed, data-rich ecosystem for the tokenized economy. The integration of U.S. government data, combined with Chainlink’s institutional-grade oracles, gives Sei a strategic edge.

This puts Sei in the perfect position to become the base infrastructure for the trillion-dollar tokenized asset industry, a sector that could soon rival or even outgrow traditional crypto markets.

The SEI price reflects this momentum. As demand for on-chain RWAs and real-world settlement grows, networks like Sei, ones that can provide reliability, compliance, and scale, will be the biggest beneficiaries.

The correlation of growth between token infrastructure players like Sei and established platforms is also visible in trends like the HBAR-XRP correlation in 2025, which shows that institutional focus is no longer limited to Layer-1 giants alone.

Even centralized exchanges are catching on, as seen with the latest Coinbase altcoin listing, which shows growing interest in smaller cap tokens with real-world utility.

Whether you’re an investor, builder, or observer, it’s clear that Sei’s combination of fundamentals, technical strength, and adoption puts it in a league of its own.

If Sei continues to execute its vision, the SEI price might not just surge, it could redefine what the next generation of blockchain infrastructure looks like.