Key Points

- HBAR and XRP show a strong 0.97 short-term price correlation

- Analysts spot bullish falling wedge patterns for both tokens

- Price targets see XRP at $4.6 and HBAR at $0.4 by year-end

- Both projects drive growth through unique ecosystem strategies

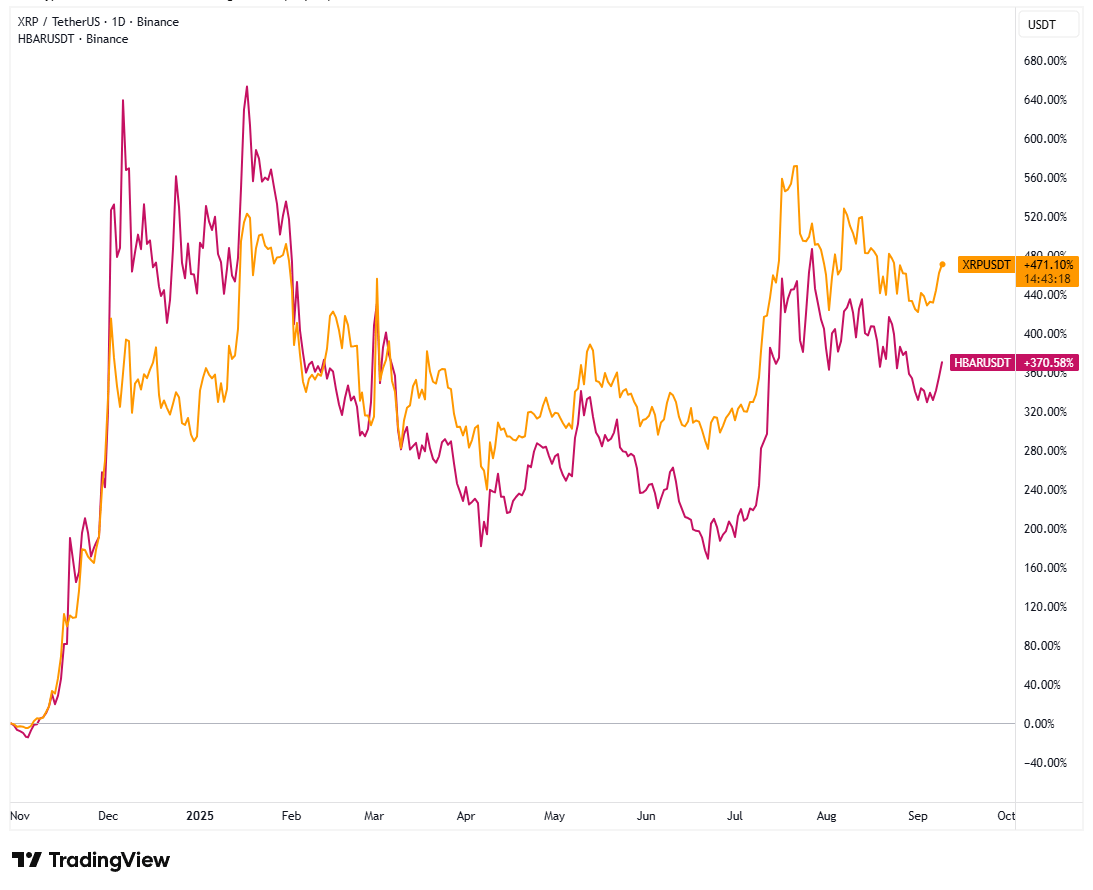

The HBAR XRP correlation has become one of the most talked-about dynamics in the crypto market. Over the past year, Hedera (HBAR) and Ripple’s XRP have shown remarkably similar price movements, capturing the attention of traders looking for patterns.

HBAR vs XRP Price Performance. Source: TradingView – Techtoken

Data from DefiLlama confirms just how strong this relationship is. The correlation between HBAR and XRP stands at 0.97 over seven days, 0.93 over one month, and 0.89 over the past year.

These numbers highlight that the two tokens often rise and fall together, both in the short and long term.

For traders, this correlation boosts confidence. If both tokens align on technical signals, analysts are more certain about their predictions.

Crypto analyst Steph Is Crypto points to a falling wedge pattern forming on both charts, which historically signals an upcoming breakout. As September progresses, the expectation is for both HBAR and XRP to push higher.

Similarities in Price Structure Between HBAR and XRP. Source: Steph Is Crypto – Techtoken

Using Fibonacci projections, Steph suggests XRP could surge to $4.6 while HBAR could hit $0.4. Similar bullish narratives have recently been seen in other altcoins like MYX Finance, where technical setups have sparked investor excitement.

$XRP AND $HBAR BREAKOUT IMMINENT!!! 👇 pic.twitter.com/W16hgnMhoA

— STEPH IS CRYPTO (@Steph_iscrypto) September 8, 2025

XRP and HBAR pursue separate paths to long-term growth

While the HBAR XRP correlation strengthens the narrative of synchronized price moves, each project is charting its own course when it comes to fundamentals.

Hedera, powered by hashgraph consensus, focuses on enterprise adoption. Its governing council includes major global companies, which enhances trust and legitimacy.

Hedera has been active in 2025, with initiatives around CBDCs, stablecoins, and decentralized finance gaining traction.

Its presence at SWIFT’s Sibos 2025 conference underscores its ambition to be a bridge between traditional finance and Web3 innovation. Similar efforts are seen across the industry, with launches like the USDD stablecoin on Ethereum highlighting how stablecoins are driving adoption.

Ripple’s XRP, on the other hand, is a cornerstone for cross-border payments. Ripple has expanded partnerships with major financial institutions while also launching its RLUSD stablecoin.

These efforts reinforce XRP’s role as a settlement asset for global banking. On top of this, positive updates in Ripple’s long-running legal battle with the SEC have restored confidence, making XRP a key player in regulatory discussions around digital assets.

Despite their different strategies, the similar price behavior of HBAR and XRP shows how market psychology often ties major altcoins together.

Investors watching one asset are increasingly monitoring the other, reinforcing the strength of the correlation.

Tokenomics impact on HBAR XRP correlation in 2025

One of the lesser-discussed factors behind the HBAR XRP correlation is tokenomics. The supply dynamics of each asset influence how they perform in different market cycles.

Both are long term holds in my opinion you’d be crazy not to hold until the next bull cycle – I think a lot of these coins that are gaining traction / utility aren’t going to have as big of a retracement in the bear market like previous bear markets

— Dylan Deloach (@dylanddeloach) September 8, 2025

XRP has a maximum supply of 100 billion tokens, with around 60% currently in circulation. This means a large portion remains locked, and future unlocks could create downward pressure on the price.

By contrast, HBAR has a total supply of 50 billion, with more than 84% already circulating. This reduces the risk of heavy unlocks and gives investors more confidence in its price stability.

$XRP has a total Supply of 100 billion tokens with 60% in circulation.$HBAR has a total supply of 50 billion tokens with 42b in circulation.

Think about that for a minute.

We are so early. Hello future#Hedera pic.twitter.com/RMAbypO1yZ

— R.J. (@RDiamondhands) July 16, 2025

Some market watchers argue that HBAR may outperform XRP in the next cycle precisely because of this difference. With fewer tokens left to be released, HBAR might experience less dilution compared to XRP, which still faces years of supply distribution.

This kind of tokenomics debate has also been highlighted in other cases like Kazakhstan’s crypto reserve plans, where national-level strategies focus on circulation and stability.

Similarly, when Solana suffered a $41.5M hack, investor trust and token supply mechanics were central to how the market reacted.

At the same time, this doesn’t weaken the correlation. Instead, it helps explain why the two tokens sometimes diverge slightly in performance, but quickly realign.

Over time, investors factor both technicals and tokenomics into their trading strategies, ensuring the correlation remains a useful signal.

For portfolio builders, the takeaway is clear: while both tokens are strongly correlated, their individual fundamentals matter when assessing long-term value.

Many see holding both HBAR and XRP as a way to balance risk while gaining exposure to different use cases in blockchain adoption. And as adoption spreads to mainstream apps like EasyBitcoin, the importance of strong fundamentals becomes even clearer.