Key Points

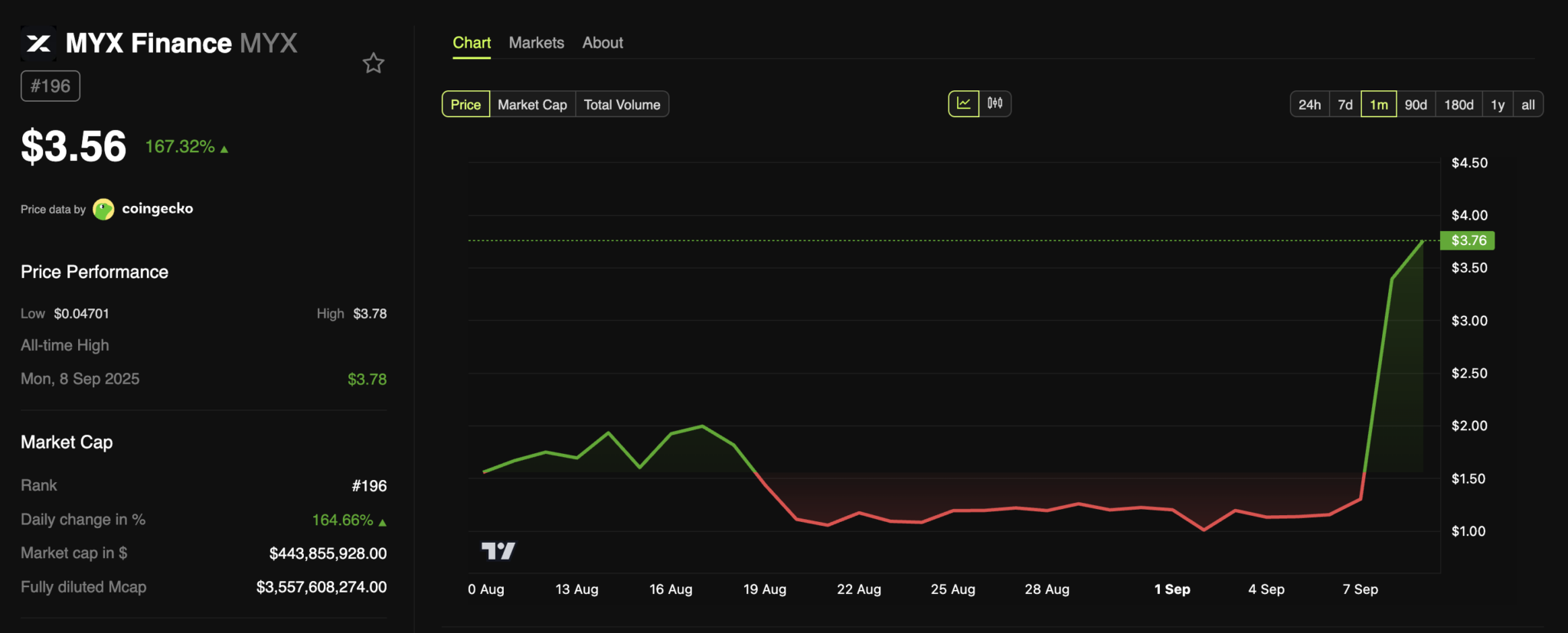

- MYX Finance (MYX) hit a new ATH of $3.78 after a massive 167% rally

- Market cap soared to $450 million; trading volume jumped 1,318%

- Whale activity, token unlocks, and thin liquidity spark manipulation concerns

- Analysts split on whether it’s a legit breakout or a risky setup

In the past 24 hours, MYX Finance shocked the crypto community with a staggering 167% price rally, climbing to a new all-time high of $3.78. Its market cap doubled to $450 million, and trading volume surged over 1,318%, with the bulk of activity coming from the centralized exchange Bitget.

#MYX did 200% massive moon shot from the bottom!$MYX #MYXUSDT https://t.co/5AYPTQGK8S pic.twitter.com/KsqsWxltDt

— CryptoBull_360 (@CryptoBull_360) September 8, 2025

This sharp rise follows a broader altcoin revival, similar to other surprising moves like the SUI token’s breakout earlier this month. But the MYX spike is drawing more suspicion than celebration.

Some analysts are warning that this could be yet another pump-and-dump event, especially given the pattern MYX Finance has shown in recent months. In August, the project saw a 1,950% rally followed by a crash of over 60%, closely aligned with a major token unlock.

MYX Finance (MYX) Price Performance. Source: Techtokens

Now, the same concerns are resurfacing, only this time, with higher stakes.

Token Unlocks and Whale Games Behind the Surge?

While MYX Finance positions itself as a decentralized exchange (DEX) for perpetuals, critics argue that the current price action doesn’t reflect organic adoption.

Suspicious Token Unlock Timing

Crypto analyst Dominic pointed out that 39 million MYX tokens were unlocked just as the price spiked, a red flag. The unlock created new supply at a moment of high demand, allowing insiders to sell at the top.

“Retail traders are being used as exit liquidity,” Dominic warned.

“Same pattern as last time, unlock tokens, pump price, then dump.”

Some people need jail time for real, today there where some questionable activities going on with $MYX Here’s a more detailed breakdown showing why $MYX looks manipulated and why traders should avoid it:

Several red flags I noticed myself that point to manipulation and insider…

— Dominic(evm/acc)💭 (@0xD0M_) September 7, 2025

This tactic mirrors some of the manipulation allegations made in the recent Tempo Blockchain project controversy, where coordinated trading also triggered concerns.

Whale-Driven Liquidations

According to Dominic, over $10 million in short positions were liquidated within a day, likely because whales drove the price up artificially. These liquidations then caused forced buys, pushing the price even higher and fueling the illusion of strong demand.

Such orchestrated moves often appear bullish to new investors but are actually engineered traps. Dominic said the event was “a textbook scam pump,” just like past cycles where the token’s theoretical value jumped from $3.9 million to $59 million, only to plummet soon after.

Thin Liquidity and Centralized Trading

Liquidity was another weak point. Most of the MYX Finance trading occurred on Bitget, which handled over 66% of volume. Thin liquidity means prices can be moved easily, making the market more vulnerable to manipulation — a common concern in the broader DeFi space.

Dominic also noted identical wallet behavior across PancakeSwap, Bitget, and Binance, multiple small buys routed to central wallets.

“This is a coordinated pump. Not organic. Not healthy,” he emphasized.

MYX Finance Divides Analysts as Debate Heats Up

Not everyone is convinced that MYX Finance is part of a malicious scheme.

Crypto research platform CoinWings highlighted that whales haven’t yet started heavy selling, which is unusual for a pump-and-dump pattern. If they were planning to dump, many argue they would have done it already.

#MYX The $MYX chain isn’t showing much activity, and whales haven’t made any large-scale sell-offs , meaning they currently have no plan to suppress the price.

If you want to know when it’s time to short, watch the whales on-chain.

Spot price drops are always preceded by whales… pic.twitter.com/Fp4iBgbrd1

— CoinWings (@CoinWingsIO) September 8, 2025

This has caused a divide similar to the market reaction during the Justin Sun WLFi freeze incident, where investor trust was tested after conflicting information emerged.

Still, with MYX Finance having a track record of timed rallies around token unlocks, analysts remain skeptical. Some believe this may be a staged exit, not a natural breakout.

Others argue that decentralized perpetual trading is gaining traction, and MYX Finance might simply be catching the wave, much like Bitcoin’s recent momentum toward $113,000, which has reignited interest across altcoins.

But there’s also a risk that investors are buying into hype, not fundamentals, something that has become common in crypto cycles. Similar warnings were issued during Michael Saylor’s Bitcoin strategy, where high leverage and timing raised financial risk concerns.

What’s Next for MYX Finance?

With the current momentum, MYX Finance is at a crossroads. Either it stabilizes and matures as a leading DEX token, or it repeats the boom-and-bust cycle that’s all too familiar in crypto.

If whales continue to hold and token unlocks are managed responsibly, MYX could potentially find a more sustainable path forward.

But if the current move was engineered, a sharp correction may be coming soon, especially if traders realize they’ve been used for liquidity.

For now, retail investors are advised to proceed with caution. Watch on-chain activity, analyze volume sources, and avoid chasing green candles blindly.

As more details emerge and wallets are tracked, the market will find out whether MYX Finance is the next rising star in DeFi, or a well-timed trap.