Key Points

- The US added only 22,000 jobs in August, the lowest growth since 2021

- Unemployment rate jumps to 4.3%, sparking slowdown concerns

- Bitcoin nears $113,000 as investors move toward safe-haven assets

- Market eyes Fed rate cuts after labor data disappoints

Bitcoin nears $113,000 as cracks in the US labor market send shockwaves through financial markets. Investors are rapidly shifting into crypto, hedging against what looks like a sharp economic slowdown.

In August, the US economy added just 22,000 jobs, well below expectations of 75,000. This marks the slowest job growth since 2021. In the same report, unemployment rose to 4.3%, its highest level since October 2021.

What’s even more concerning is that the June and July job numbers were revised downward, wiping out a combined 285,000 jobs from previously reported figures.

You can’t make this up:

Last month, the May and June jobs reports were revised lower by -258,000 jobs.

Today, the BLS revised the June jobs report lower AGAIN by another -27,000 jobs.

That’s a total of -285,000 jobs in 2 months.

What is happening here?

— The Kobeissi Letter (@KobeissiLetter) September 5, 2025

These revisions add fuel to concerns that the labor market is deteriorating faster than expected.

“That’s a total of -285,000 jobs in 2 months. What is happening here?” one analyst posted on social media.

The picture gets even worse. According to Bloomberg, only 1,494 new jobs were announced by American companies in August, the lowest since August 2009. Meanwhile, layoffs jumped 39% to 85,979 in the same month.

In a major shift, unemployed Americans now outnumber job openings. July data shows 7.24 million unemployed people vs. 7.18 million job openings, the first time this has happened since April 2021.

Despite 3.7% year-over-year wage growth, which outpaces inflation at 2.7%, the broader data points to a stalled economy. Hiring is slowing, layoffs are rising, and companies are hesitating to invest or expand.

JUST IN: Another WEAK jobs report. The US economy added only 22,000 jobs in August. That’s much weaker than expected.

The unemployment rate rose to 4.3% –>Highest since October 2021.

June job growth was revised down to -13,000 (!). July was revised up slightly to 79k (from… pic.twitter.com/qCzGwx6Zro

— Heather Long (@byHeatherLong) September 5, 2025

At the same time, crypto markets are heating up. While Bitcoin sell pressure has eased for now, macro concerns continue to influence buying behavior across the board.

You don’t realize how weak the economy is right now.

If you have a job, hold onto it for dear life.

Because if you get fired, it’s going to take you years to find another one. pic.twitter.com/U7tET4y4f1

— Spencer Hakimian (@SpencerHakimian) September 4, 2025

Rate Cut Expectations Drive Bitcoin Nears $113,000 Narrative

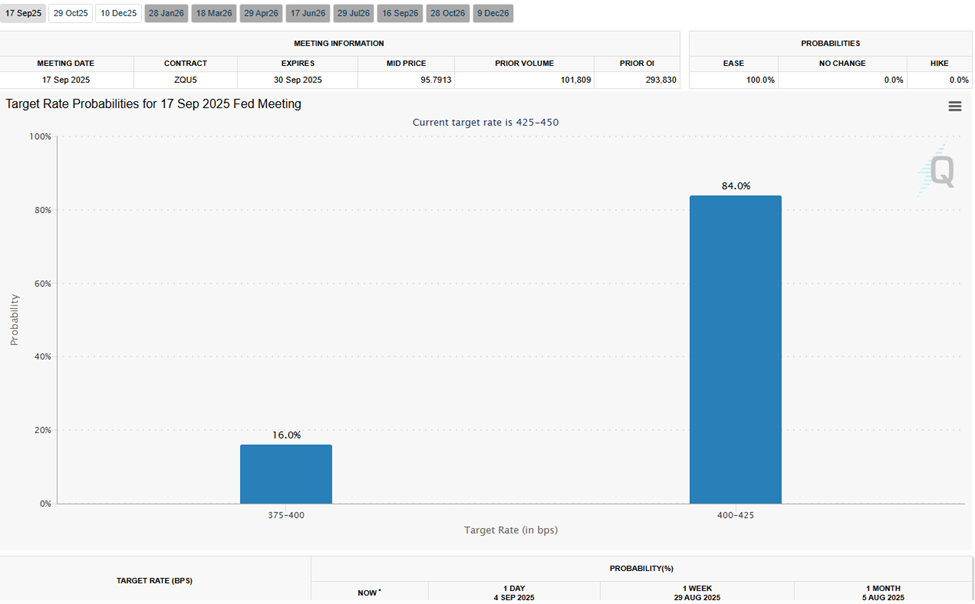

The financial world is now watching the Federal Reserve’s next move closely. The labor data suggest that the Fed may have little choice but to cut interest rates sooner than previously expected.

According to the CME FedWatch Tool, the probability of a rate cut at the Fed’s September meeting has increased sharply. Markets are pricing in at least two rate cuts by the end of the year, up from zero just a month ago.

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Bank of America has updated its forecast, now predicting two rate cuts in 2025, a significant change from its earlier prediction of none.

In response, Bitcoin nears $113,000, trading at $112,974 at the time of writing. That’s a 2% gain in 24 hours, as the digital asset benefits from growing demand for non-traditional investments.

Bitcoin (BTC) Price Performance. Source: TradingView – Techtoken

“When the Fed pivots, Bitcoin flies,” said one market strategist. “The numbers are clear.”

Lower interest rates typically weaken the US dollar, boost liquidity, and make speculative assets more attractive, all of which benefit Bitcoin.

This trend confirms Bitcoin’s growing reputation as a macro hedge. In times of economic stress, investors are increasingly turning to Bitcoin as a store of value and a tool for portfolio diversification.

The move also highlights risks faced by institutional players. Recently, Michael Saylor’s Bitcoin empire made headlines for carrying over $8.2 billion in Bitcoin-backed debt. Rising volatility could make these positions more vulnerable in future downturns.

Bank of America predicts the Federal Reserve will cut interest rates twice in 2025, compared to its previous forecast of no rate cuts.#XAUUSD #GOLD #FED #NFP

The Fed will need to consider its actions. It is expected to discuss a larger rate cut.Gold prices will continue to… pic.twitter.com/BFPkmM83O8

— DC (@CD_XAUUSD) September 5, 2025

Bitcoin Nears $113,000 Amid Rising Global Economic Fears

The rally in Bitcoin nears $113,000 isn’t just about the US. Global fears are also contributing to the crypto market’s rise.

Across Europe and Asia, growth is slowing. China’s economic data remains weak, and the Eurozone is battling energy shocks and persistent inflation.

Central banks worldwide are grappling with tough decisions, and the global macro picture is becoming more uncertain by the day.

This uncertainty is pushing investors into assets that are:

-

Decentralized

-

Borderless

-

Non-correlated with traditional markets

Bitcoin fits that profile perfectly.

Even altcoins are catching attention. Solana’s price has doubled, driven by growing ecosystem activity and strong developer momentum. Similarly, the SUI blockchain has shown breakout potential, attracting institutional interest and new liquidity.

AI is also disrupting jobs, and political tensions, including the US elections and ongoing global trade friction, are adding fuel to the fire.

With traditional markets looking increasingly fragile, Bitcoin near $113,000 represents not just a price milestone but a shift in market sentiment.

Institutional activity is being mirrored by movements in Ethereum as well. The Ethereum Foundation sold 10,000 ETH recently, raising questions about upcoming market dynamics and developer funding.

“We’re seeing growing demand from institutional clients to gain exposure to Bitcoin,” said a senior analyst at a major investment firm. “This is not a retail-driven rally.”

The Bitcoin nears $113,000 headline reflects more than market movement, it captures a larger narrative around trust, monetary policy, and the global shift toward decentralized finance.