Key Points

- Strategy holds 636,505 BTC but carries $8.2B in debt

- $735M stock dilution raises trust and governance concerns

- 97% of BTC wallets exposed, sparking systemic risk fears

- Critics say equity erosion and volatility may backfire long-term

Michael Saylor’s Bitcoin empire has become one of the most talked-about plays in crypto finance, and not always for the right reasons.

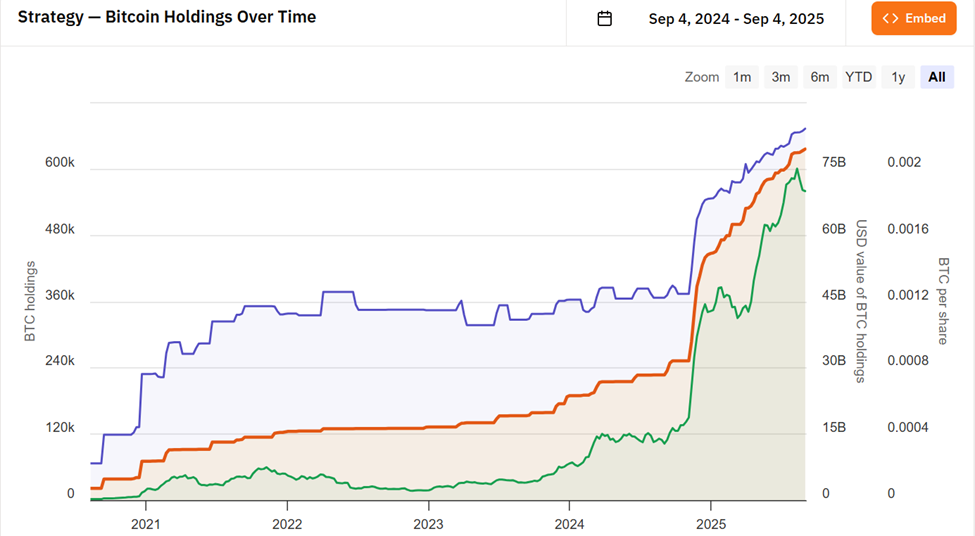

Through his company, Strategy (formerly MicroStrategy), Saylor has shifted the business from software to full-blown Bitcoin accumulation. With 636,505 BTC on the books, now worth close to $60 billion, the Michael Saylor Bitcoin empire is undeniably massive.

MicroStrategy’s BTC Holdings. Source: Bitcoin Treasuries – Techtoken

But it’s the foundation of that empire, made up of $8.2 billion in debt and a fresh $735 million in stock dilution, that’s drawing fire.

In July, Strategy’s management promised not to dilute shares between 1x and 2.5x net asset value (mNAV). But just weeks later, that safeguard was quietly removed. Then, the company issued new stock, right within that same range, causing an uproar.

“This was never about Bitcoin; it’s about Saylor cashing in,” said Jacob King, CEO of WhaleWire.

$STRC is $MSTR’s stealth weapon.

While others sell stock to survive, Saylor launches 1-month paper to print fiat → buy BTC → boost NAV — all while keeping equity tight.

This isn’t leverage.

It’s a Bitcoin yield curve in disguise.Hyperbullish. 🟧📊 pic.twitter.com/rpTKSr6tC0

— financialconspirator (@financialcnspr) July 22, 2025

Critics say the sudden change in guidance hurts investor trust and shows signs of weak corporate governance. Meanwhile, supporters argue that Saylor is simply executing a long-term vision: swapping fiat debt for Bitcoin dominance, one strategic move at a time.

The Michael Saylor Bitcoin empire is less about short-term gains and more about rewriting how companies hold and use treasury assets. But the risks are growing, and fast.

The situation also reflects broader market sentiment, where Bitcoin sell pressure continues to impact large-scale holders, driving volatility across crypto.

Strategy has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 $BTC acquired for ~$46.15 billion at ~$73,320 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/FLRjCKDMQO

— Michael Saylor (@saylor) August 18, 2025

From Transparency to Potential Systemic Risk

A new layer of concern emerged when blockchain analytics firm Arkham identified and linked 97% of Strategy’s Bitcoin wallets, effectively confirming its reserve assets publicly.

On the surface, this level of transparency is rare and valuable. It shows real holdings and proof of reserves, something crypto investors often beg for.

But there’s a dark side.

With nearly $60 billion worth of BTC now connected to visible wallet addresses, any large movement could shock the market.

If they ever move that BTC from the wallets, expect a market collapse. We just discovered a new point of failure. Congrats!

— Solano (@solanosx) May 29, 2025

“If they ever move that BTC from the wallets, expect a market collapse,” warned a veteran trader.

This level of exposure turns the Michael Saylor Bitcoin empire into a single point of failure in the broader ecosystem. A security breach, unexpected BTC transfer, or major sell-off could ripple across the crypto markets instantly.

Recent events, like the Ethereum Foundation’s sale of 10,000 ETH, have already shown how insider movements can trigger waves of market fear and price drops.

Some also worry about personal safety. With Strategy’s wallets now traceable and Saylor’s profile rising, the risk of being targeted, both digitally and physically, increases.

The updated MSTR Equity Guidance from MicroStrategy, allowing flexible issuance of shares to acquire Bitcoin based on mNAV multiples, could potentially hurt the company by diluting shareholder value, eroding investor confidence, putting downward pressure on the stock price, and…

— Fooch (@foochinator) August 19, 2025

Saylor’s strategy has tied the company’s value directly to Bitcoin’s volatility. A significant drop in BTC price could stress Strategy’s debt repayment ability and drive its stock down, along with ETFs and funds that hold $MSTR.

Even fast-moving projects like Sui, which recently saw a momentum breakout, are affected by macro-level sentiment shifts triggered by big holders and risky moves.

Financial Innovation or Just Financial Engineering?

The Michael Saylor Bitcoin empire isn’t just about buying BTC, it’s about creating entirely new financial instruments to do so.

Over the past year, Strategy introduced products like STRK, STRF, STRD, and STRC, essentially Bitcoin-backed securities that allow the firm to raise capital while preserving share control.

This isn’t traditional leverage. According to Saylor, it’s the creation of a Bitcoin-native yield curve, a new layer of financial infrastructure built on top of BTC.

“While others sell stock to survive, Saylor launches 1-month paper to print fiat → buy BTC → boost NAV, all while keeping equity tight,” said one market commentator.

Saylor wants to turn Strategy into a Bitcoin financial powerhouse, using corporate debt, convertible notes, and equity sales not as a last resort, but as part of a larger monetary strategy.

Supporters view this as visionary. They believe the Michael Saylor Bitcoin empire is laying the groundwork for a Bitcoin-based economy, free from fiat decay.

Critics, however, see smoke and mirrors.

They argue that behind the innovative language lies old-fashioned risk: high leverage, shareholder dilution, and a CEO with too much control.

Even worse, if BTC prices fall or markets turn, the Michael Saylor Bitcoin empire could collapse under its own weight, turning a bold bet into a cautionary tale.

We’ve already seen how fast sentiment can turn. The WLFi token crash shows how quickly $2 billion can vanish when trust disappears. It’s a reminder that large bets can bring large consequences.

Meanwhile, rivals like Solana continue gaining traction. The recent price doubling of SOL shows that not all growth requires heavy leverage or risky debt structures.