Key Points

- SUI sees $300M institutional accumulation and Robinhood Legend listing

- Social dominance grows, reaching near the top 10 crypto discussions

- Fees drop to $0.00799, over 100x cheaper than Ethereum

- Eyes on $4.3 breakout; failure could see price fall below $3

SUI Momentum is heating up as the blockchain project receives a powerful combination of institutional interest, retail exposure, and blockchain efficiency.

Leading the headlines is the $300 million purchase of SUI tokens by SUI Group Holdings, a publicly listed company. Their total holdings now exceed 101.7 million SUI, valued at approximately $332 million.

In tandem with this accumulation, Robinhood Legend, the platform’s new crypto-focused app, added SUI and HBAR to its trading options. This move significantly expands access for U.S. investors and further builds SUI Momentum in mainstream markets.

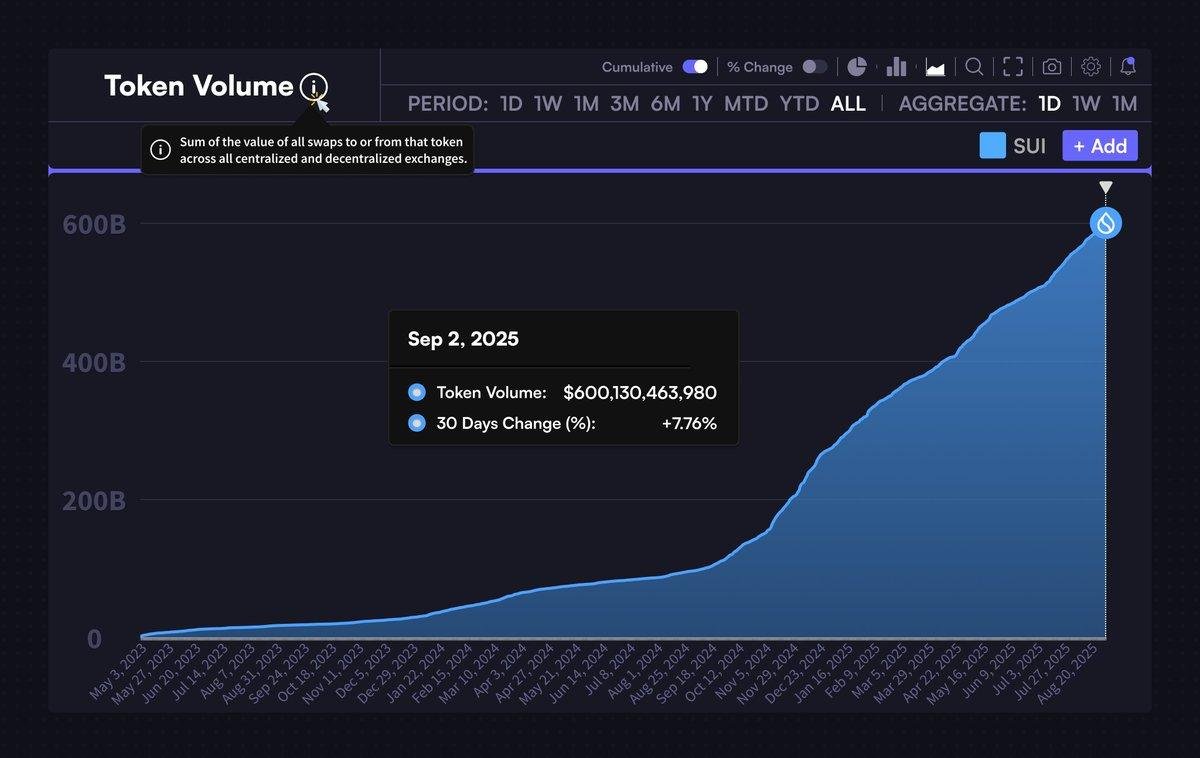

SUI token volume. Source: X – Techtoken

But it’s not just big money fueling the rise. The underlying tech gives SUI a competitive edge. In August, the average transaction fee was just $0.00799, a striking contrast to Ethereum’s $1.10 per transaction. This means SUI transactions are nearly 140 times cheaper, a major win for users and developers alike.

According to the Sui Foundation, the network’s fee structure is designed to remain stable across epochs, regardless of traffic spikes. That’s a big deal in a space where network congestion often leads to soaring costs and delays.

JUST IN 🗣️💧$SUI has reached a total token volume of $600 billion. Gain +7.76% in the last 30 days!

Ready for #SUItember 🚀 pic.twitter.com/F2MP8dokz1

— Sui Community💧 (@Community_Sui) September 3, 2025

Thanks to these improvements, SUI Momentum is also evident in usage stats. The total token volume has reached $600 billion, showing a +7.76% increase in just the last 30 days. This suggests more people are not only holding SUI but actively using it in real applications.

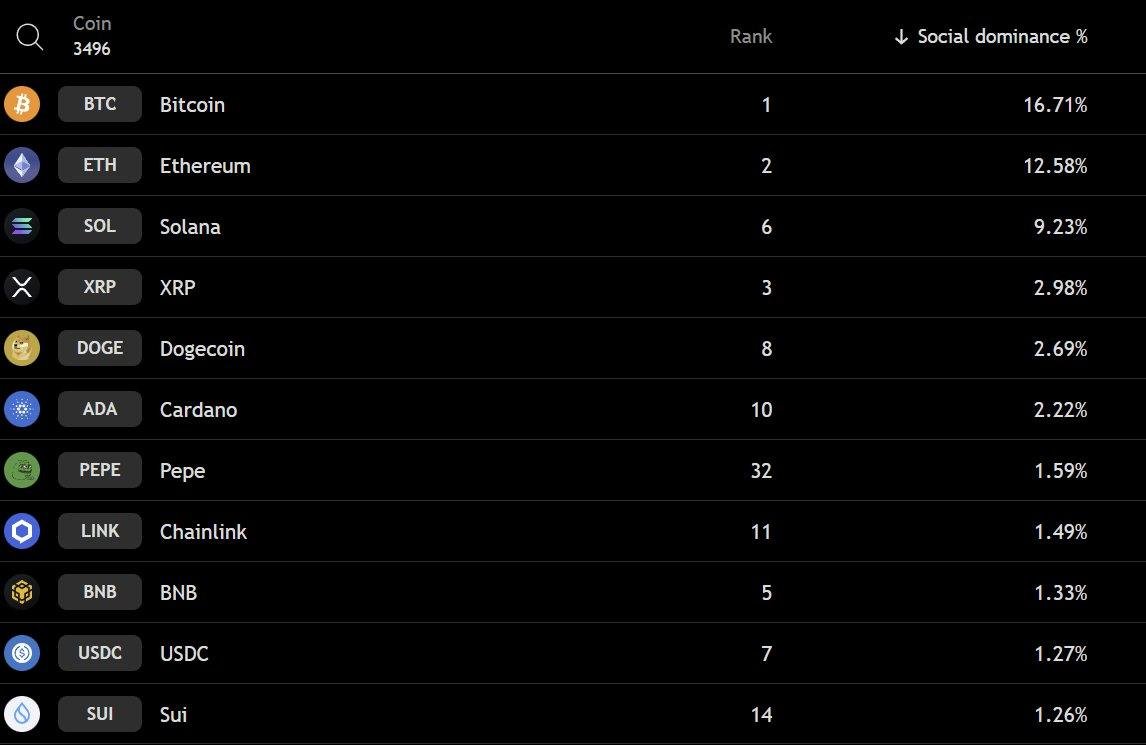

Social Hype and Visibility Drive Market Sentiment

Beyond transactions and trading, SUI Momentum is riding a wave of attention across social media and crypto forums. Data shows that SUI’s “social dominance” metric has risen steadily, pushing the project toward the top 10 most-discussed cryptocurrencies.

Social dominance for SUI. Source: GandalfCrypto – Techtoken

Social dominance measures how frequently a token is mentioned compared to other projects. When this number rises, it typically reflects growing community interest, media coverage, and public sentiment. Right now, SUI is catching fire across platforms like X (formerly Twitter), Reddit, and Discord.

Social Dominance for SUI keeps growing, pretty close to getting in the top 10 now.

More and more people are talking about the chain and we’re going mainstream.

Plan is simple, buy more $SUI, and buy more of its top meme, $LOFI 🥶 pic.twitter.com/mRFjKcFGd0

— GandalfCrypto (@gandalfcryptto) September 3, 2025

Why does this matter? In crypto, hype can drive real value, especially in a market where investor behavior is often influenced by narrative. For example, Solana saw massive momentum this year after doubling in price, fueled largely by social and institutional chatter.

The higher SUI climbs in these rankings, the more likely it is to attract new users, traders, and media coverage, feeding the cycle of SUI Momentum.

It’s also worth noting that many influencers and analysts have been calling attention to SUI’s strong fundamentals and upside potential.

These voices amplify the momentum and help convert attention into action, whether through buying, trading, or building on the network.

Price Faces Critical $4.3 Level in Make-or-Break Moment

Despite strong fundamentals, SUI Momentum could face a speed bump if it can’t break through the key $4.3 resistance level. Currently trading between $3.3 and $3.4, the token is still 37% below its all-time high of $5.35 from January 2025.

$SUI 1W update

Bouncing off the Support for the 3rd time. $SUI is printing a nice looking Ascending Triangle 👀

The longer we stay below the $4.3 Resistance the better, but it’s time to finally break out 🚀

🎯 $10 Target remains! pic.twitter.com/tJG6BJgLIt

— CryptoBullet (@CryptoBullet1) September 3, 2025

Technically, there are mixed signals. The weekly chart shows an Ascending Triangle, a bullish pattern with strong potential for an upward breakout. If SUI can close above $4.3 with volume, some experts believe it could target $10 in the near term.

“The longer we stay below the $4.3 resistance, the better, but it’s time to finally break out,” one analyst commented, pointing to growing accumulation and retail interest.

SUI 1W chart. Source: CryptoBullet – Techtoken

But the 4-hour chart paints a more cautious view. Some analysts note that SUI is stuck in a Descending Triangle, with resistance from the 50SMA. If SUI drops below $3.42, the next key support sits near $3, which is seen as the first major demand zone.

A failure to hold this level could reverse recent gains, dampening SUI Momentum and setting the stage for short-term bearish action. This kind of volatility isn’t uncommon, especially when whale movements cause sudden price shifts.

SUI 4H chart. Source: Umair – Techtoken

However, many are watching the weekly close for confirmation of direction.

Can SUI Momentum Sustain or Fade?

The big question now is: Can SUI Momentum keep growing, or will resistance and technical weakness slow it down?

With institutional investors locking in long positions, retail interest rising, and transaction fees remaining impressively low, SUI has the ingredients for long-term growth.

Add to that a growing developer ecosystem, and it’s clear why some see SUI as more than just a short-term play.

Momentum is always influenced by the broader market. For instance, Bitcoin’s recent sell pressure and Ethereum’s activity have shifted focus across altcoins. Meanwhile, macro sentiment, like El Salvador’s position as a crypto safe haven, also plays into investor decisions.

However, everything now hinges on the $4.3 breakout zone. A move above this could confirm a new bullish phase, pushing prices higher and validating the fundamentals.

A drop below key support levels, on the other hand, could shake investor confidence.

Still, as of now, SUI Momentum remains strong, fueled by fundamentals, growing utility, and a rising community footprint.