Key Points

- Bitcoin Sell Pressure Mounts as Whales Dump 100K BTC

- Galaxy Digital wallets see massive BTC outflows

- $43B in corporate Bitcoin buys help hold prices steady

- Volatility remains low despite selling pressure

Bitcoin (BTC) started September on a positive note after a rough August, where it dropped over 13%. But fresh on-chain activity suggests that this bounce may be short-lived, as signs of Bitcoin sell pressure emerge.

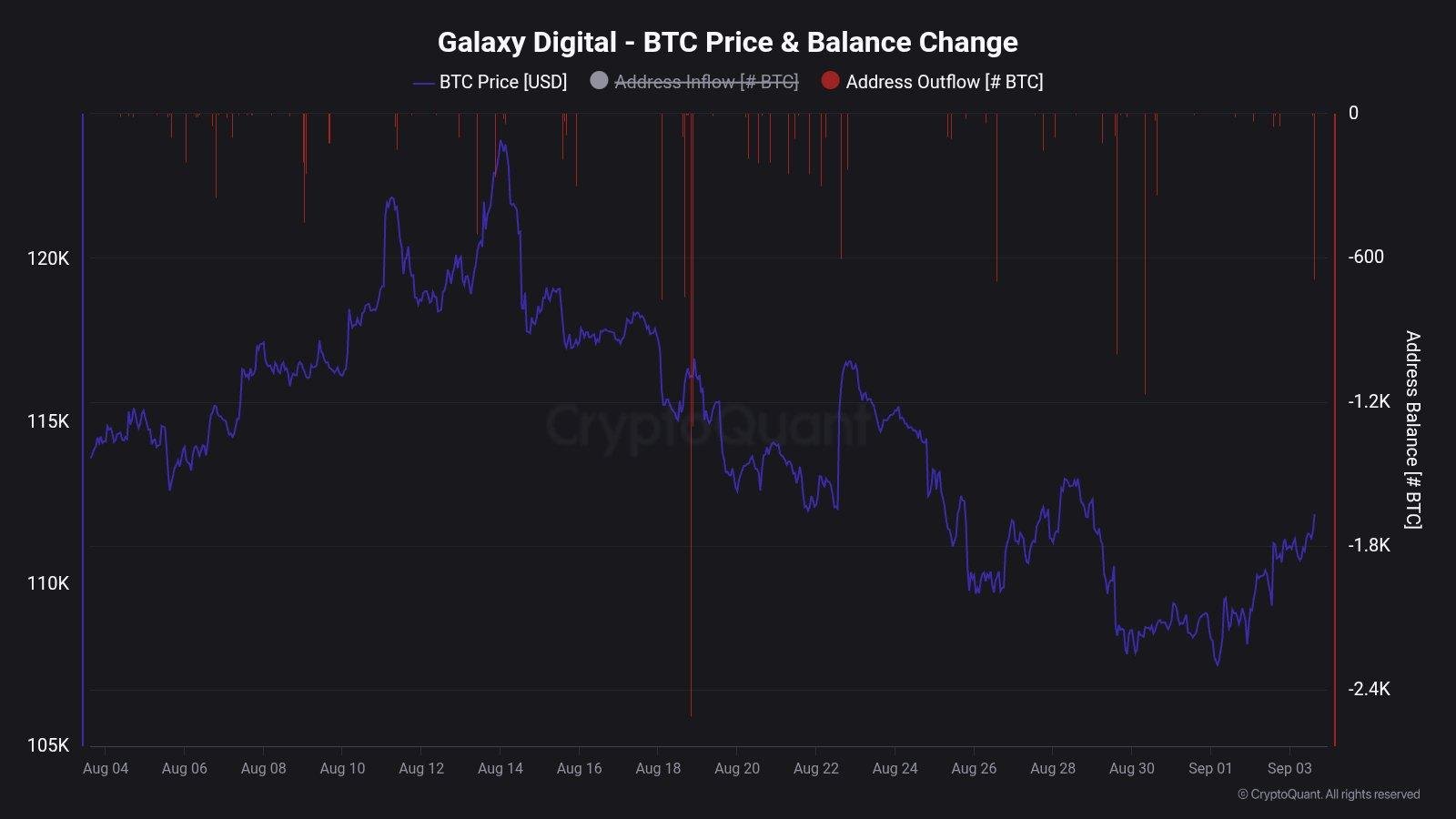

At the center of this concern are large BTC outflows from wallets associated with Galaxy Digital, a prominent crypto asset management firm. Just this week, a sudden hourly outflow of 691 BTC on September 4 sparked fresh fears among analysts and traders.

Galaxy Digital Balance Change. Source: CryptoQuant. – Techtoken

This isn’t the only sign. Over the past month, Galaxy Digital’s wallets have shown repeated movements, each ranging from 600 to 2,400 BTC.

These large transactions often hint at possible sales, which add to the ongoing Bitcoin sell pressure that could drag prices down.

On-chain analyst Maartunn commented:

“This kind of outflow can precede near-term sell pressure, watch liquidity, spreads, and price reaction.”

Galaxy Digital Wallets Flashing Red 🚨

Hourly Outflow: -691 BTC

This kind of outflow can precede near-term sell pressure—watch liquidity, spreads, and price reaction. pic.twitter.com/CIjW6t2PqV

— Maartunn (@JA_Maartun) September 3, 2025

Adding more complexity, a Bitcoin whale wallet dormant for over 12.8 years suddenly moved 0.25 BTC. While the amount is small, it still holds nearly 480 BTC.

The reawakening of such old wallets, similar to whale-related dumps in other tokens like WLFI, can signal future selling and further increase market stress.

After being dormant for 12.8 years, a $BTC wallet has moved 0.25 $BTC, valued at $28,000.

The wallet still holds 479.44 $BTC, worth $53.56 million.https://t.co/l4SavCtYfw pic.twitter.com/XtREh3onEk

— Onchain Lens (@OnchainLens) September 4, 2025

Whales Dump 100K BTC as Institutional Demand Fights Back

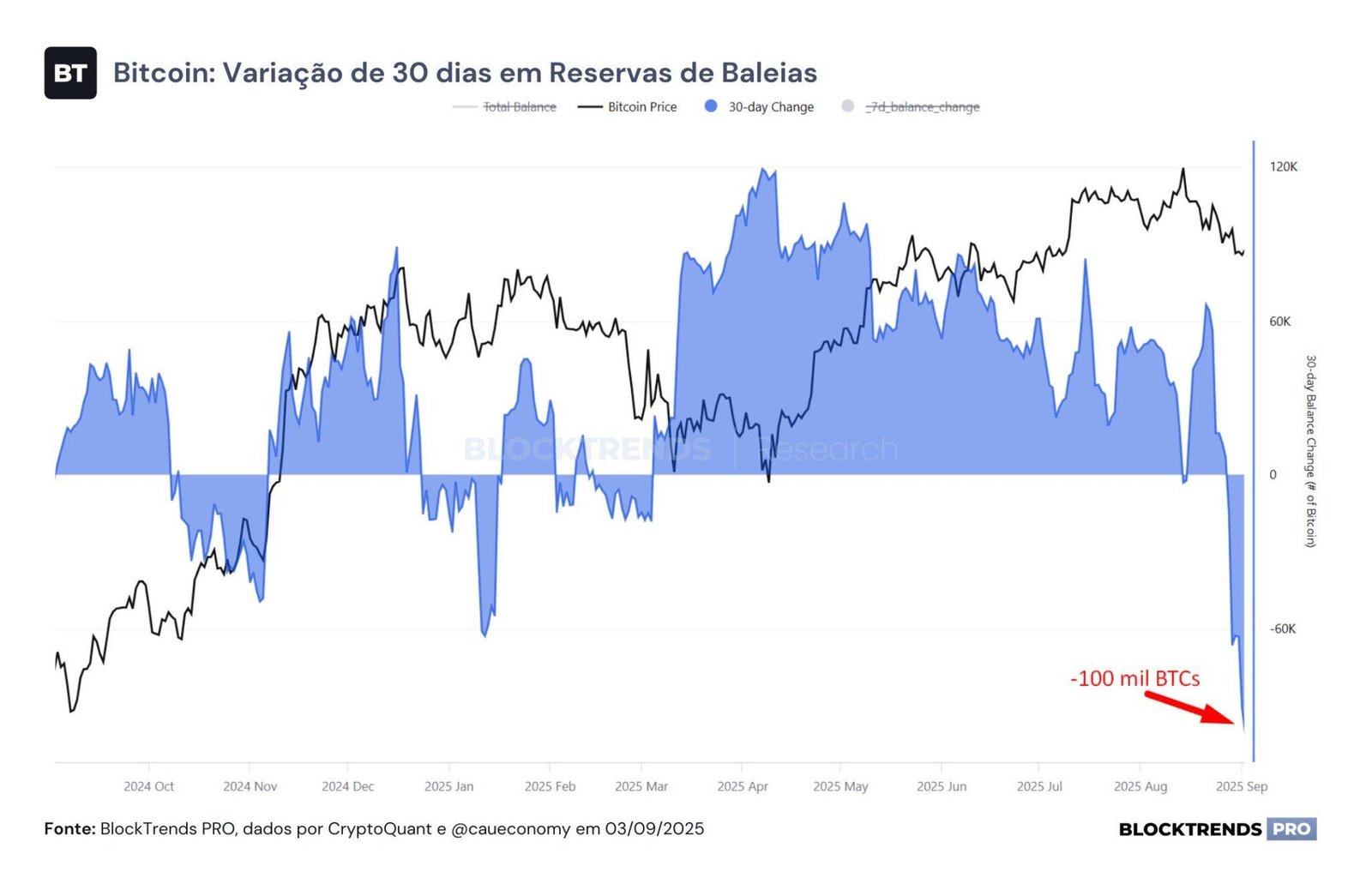

It’s not just Galaxy Digital. Across the board, whales have been offloading Bitcoin heavily. According to data from BlockTrends, over 100,000 BTC was dumped in August alone, making it the largest monthly sell-off since 2022.

Historically, such aggressive selling would tank prices. But this time, Bitcoin has shown surprising resilience, and that’s due to growing institutional demand.

Corporations have already purchased $43 billion worth of Bitcoin in 2025, the highest yearly inflow to date. In the first eight months alone, $12.5 billion has been added, surpassing the total from 2024.

🚨 Empresas acumularam US$ 43 bilhões em Bitcoin em 2025, o maior fluxo da história.

Nos primeiros 8 meses, investiram US$ 12,5 bilhões , superando todo o ano de 2024, e hoje detêm mais de 6% do total de BTC, 21 vezes mais que em 2020. pic.twitter.com/tSyhevSTsY

— BlockTrends (@BlockTrendsBR) September 3, 2025

Now, corporate entities hold over 6% of all BTC, compared to just 0.3% in 2020. That’s a 21x increase in just five years.

This unprecedented accumulation is acting as a shield, absorbing Bitcoin sell pressure that would have crippled the market in previous cycles.

Analyst Cauê Oliveira put it clearly

Baleias venderam mais de 100 mil Bitcoins nos últimos 30 dias.🚨

Esse é o maior processo de venda mensal desde 2022.

Sim, baleias estiveram dumpando a maior quantidade de bitcoin deste ciclo, mas o preço não sofreu tanto quanto em outros períodos. pic.twitter.com/3lrAB62AFA

— Cauê Oliveira (@caueconomy) September 3, 2025

“Yes, whales are dumping the most Bitcoin we’ve seen in this cycle, but the price hasn’t suffered. That’s a sign of healthy demand on the other side.”

Meanwhile, volatility is dropping. Data from Ecoinometrics shows that Bitcoin’s 30-day realized volatility is now lower than 83% of the past 10 years.

Bitcoin Whale Balance Changes. Source: BlockTrends – Techtoken

That’s despite ongoing macroeconomic uncertainty and shifting regulatory landscapes.

“Uncertainty yes; panic, no,” they wrote.

The market structure is evolving, and not just for Bitcoin. Similar shifts are happening in Ethereum, where the foundation recently sold 10,000 ETH, triggering temporary sell-offs.

These sell events, combined with massive buys, are now part of a broader trend that reflects maturity in crypto markets.

Even Solana’s explosive price action amid whale exits and inflows shows how institutional interest can outweigh traditional selling patterns.

How the Market is Adapting to Bitcoin Sell Pressure

The rise in Bitcoin sell pressure is being met by a counterforce: institutional confidence.

This dynamic is stabilizing Bitcoin and reducing fear-based volatility. But it also marks a new reality: Bitcoin is no longer driven solely by whales or retail hype. It’s moving toward becoming a macro asset, backed by long-term corporate conviction.

Still, sell pressure can’t be ignored. Ongoing outflows from major players like Galaxy Digital, combined with dormant whales reactivating, point to possible short-term price resistance.

This could explain why many traders are proceeding with caution, even as prices hold steady.

At the same time, Bitcoin is proving to be more than just a speculative asset. Some nations, like El Salvador, are doubling down on Bitcoin as a safe-haven asset, reinforcing the idea that BTC is entering a new era.

Meanwhile, not all tokens are enjoying the same stability. Projects like Pi Network are facing adoption struggles, proving that even in a bullish macro environment, weaker networks are still exposed to negative sentiment and uncertainty.

As we move further into Q4 2025, it’s clear the crypto market is evolving. The power balance between whales and institutions is shifting. And while Bitcoin sell pressure remains a real threat, the forces countering it are stronger than ever.