Key Points

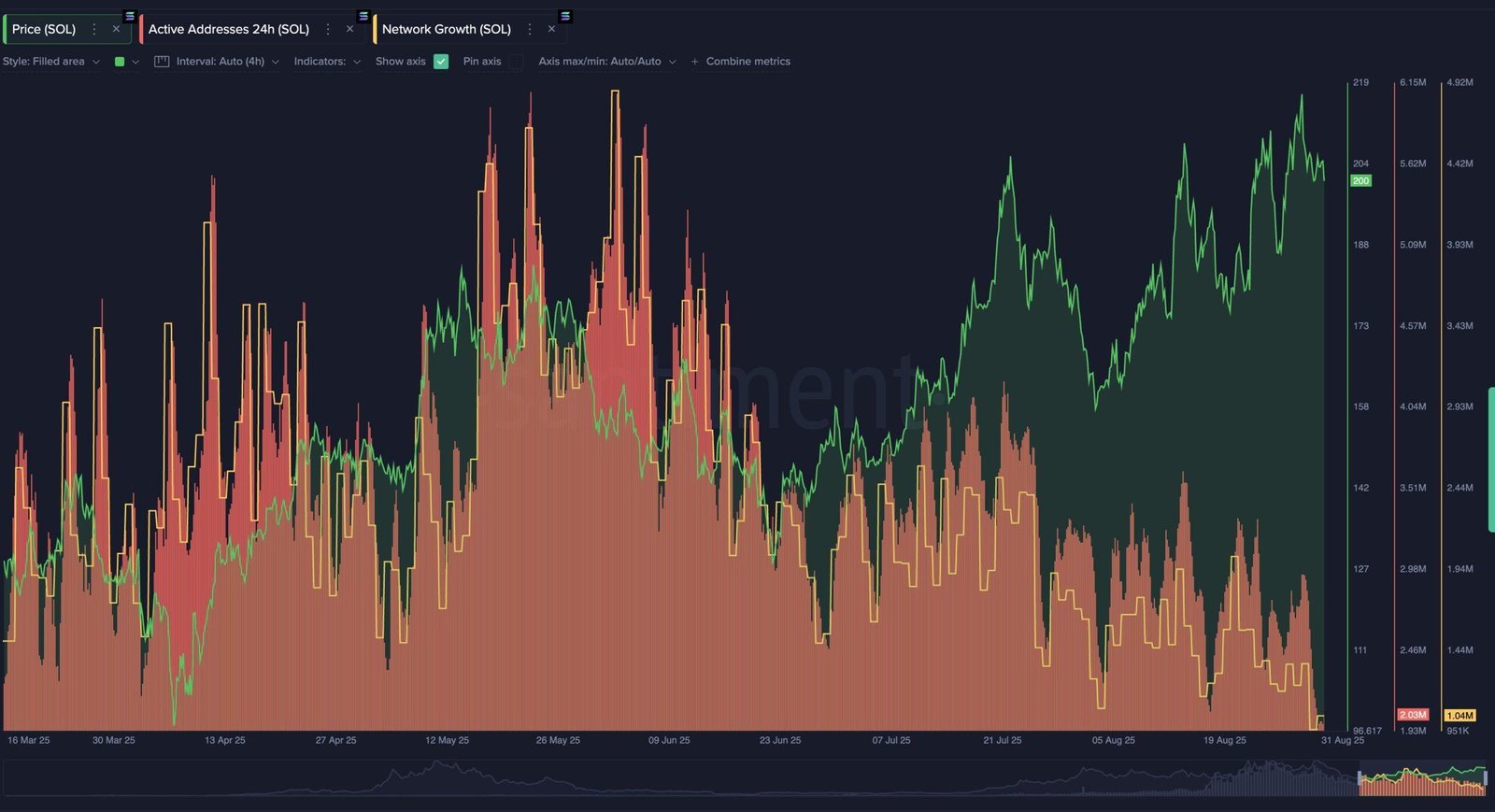

- Solana Price Doubles in 4 months amid weak activity

- Active addresses fell from 6M to 1M since May

- Bearish divergence signals a 90% reversal chance

- ETFs and corporate holdings keep sentiment high

Solana Price Doubles, but not because more people are using the network. In fact, the opposite is happening.

Since May 2025, Solana’s daily active addresses have crashed 80%, falling from 6 million to just 1 million users per day. Network growth, which tracks how many new wallets are joining, has also plummeted from 4.9 million to 1 million.

Source: Santiment – Techtoken

So, while the Solana price doubles, its core usage is dropping fast. Blockchain analytics firm Santiment says this creates a textbook case of bearish divergence, a situation where the price goes up but key on-chain metrics move in the opposite direction.

“We’re seeing a classic bearish divergence. Price is climbing, but the fundamentals aren’t backing it,” said Maksim, founder of Santiment.

We’ve just launched our first set of on-chain metrics for Solana (social metrics existed before)!

Early data shows familiar patterns – right now, we’re seeing a classic bearish divergence: price pushing up while network activity lags.

Historically, this often signals a trend… pic.twitter.com/nl3KkaCHYU

— Maksim (@balance_ra) September 1, 2025

According to Santiment’s report, historical data show that 90% of the time, such divergences lead to a sharp trend reversal.

Even Solana’s decentralized exchanges (DEXs) are showing weakness. Trading activity on Solana-based platforms has dropped by 90% year-over-year, as covered in this deep dive on Solana DEX trends, signaling lower demand and less real usage within the ecosystem.

Despite all of this, Solana Price Doubles, leaving many wondering whether the rally is sustainable or just hype.

ETF Optimism and Corporate Buying Keep the Hype Alive

So, why is the Solana price doubling while usage is crashing? The answer lies in market sentiment and big bets from institutions.

In recent months, asset management giants like Fidelity, VanEck, and Franklin Templeton have all updated their Solana ETF filings with the SEC. Analysts now say there’s a 90% chance that at least one Solana ETF gets approved soon.

For more on this, see our coverage of Solana ETFs nearing 90% approval and $8B inflows.

That potential approval could lead to a massive $8 billion in institutional inflows, according to forecasts. This expectation alone has driven huge buying pressure on SOL tokens in the spot market.

“The market is pricing in ETF approvals and institutional adoption, not current usage,” a BeInCrypto analyst said.

🚨BREAKING: Sharps Technology has closed a $400M private placement to launch a Solana treasury strategy, planning to buy $SOL in the open market. Total proceeds could reach $1B if all warrants are exercised, making it one of the largest Solana treasury firms. pic.twitter.com/W8ZdptEJh0

— SolanaFloor (@SolanaFloor) August 28, 2025

At the same time, public companies such as Sharps Technology, Artelo Biosciences, and Ispecimen have announced that they’re building strategic SOL reserves.

These companies have collectively raised hundreds of millions of dollars to add Solana to their crypto treasuries.

🚨BREAKING: @ArteloBio (Nasdaq: ARTL) raised $9.475M through a private placement to launch its Solana treasury strategy, becoming the first publicly traded pharma firm to adopt $SOL as a reserve asset. Lead investor Bartosz Lipiński, ex‑Solana Labs, will advise via @cubexch,… pic.twitter.com/acfcEaGsp8

— SolanaFloor (@SolanaFloor) August 4, 2025

These corporate moves mirror earlier trends seen in Bitcoin, where public companies like MicroStrategy led the charge in pushing prices higher despite weak usage data.

So while the Solana Price Doubles, it seems the engine behind this rally isn’t real user demand, it’s future speculation and institutional positioning.

New @solana Treasury Company: iSpecimen (NASDAQ: ISPC)

iSpecimen to Establish $200m Corporate Treasury Built Around #Solana Cryptocurrency with BlockArrow

Woburn, MA – August 7, 2025 – iSpecimen Inc. (NASDAQ: ISPC), a technology-enabled company modernizing the way human… pic.twitter.com/coBn3Tk4Lc

— MartyParty (@martypartymusic) August 7, 2025

Traders Bet on Momentum as Fundamentals Decline

Retail and institutional traders alike seem to be ignoring the weak fundamentals. Instead, they’re doubling down on price action and macro narratives. As the Solana price doubles, many traders are buying in with the hope of riding the next big crypto wave.

From April to September, SOL jumped from under $100 to over $200, creating massive short-term profits for early buyers. But the fundamentals don’t match this price surge.

Solana Price Performance. Source: Techtoken

If network usage continues to fall while the price rises, the risk of a sharp correction increases significantly. Bearish divergence is not just a chart pattern; it’s a signal that something under the surface isn’t right.

Still, momentum traders and short-term investors often follow charts, not fundamentals. This has created a disconnect where the Solana price doubles without real growth backing it.

Analysts warn that once the ETF hype settles or if the SEC delays approvals, the price could snap back quickly, especially if no new users or real activity support the current valuation.

Other altcoins are also facing similar instability. For example, WLFI token recently lost $2 billion in value due to large whale dumps, showing how fragile sentiment-based rallies can be.

Is Solana’s Price Rally Built to Last?

With Solana’s price doubling in just a few months, the key question is whether this rally is sustainable or a bubble waiting to pop.

Network metrics like daily active addresses, DEX volume, and new wallet growth are all falling. These are the core indicators of real usage in a blockchain ecosystem.

When they decline sharply while the price goes up, it usually means the rally is sentiment-driven rather than fundamental.

Yes, the potential approval of a Solana ETF is a big deal. And yes, corporate crypto holdings can drive demand. But without a strong user base and increasing on-chain activity, long-term price growth becomes difficult to maintain.

Right now, investors are betting that new money will keep flowing in. But if that narrative changes, the downside risk becomes real.

We’ve seen this movie before with other networks. Just like Pi Network’s ongoing struggles or El Salvador’s Bitcoin experiment, hype doesn’t always guarantee sustainable results.

So while Solana Price Doubles and excitement fills the market, history reminds us: price without fundamentals is rarely sustainable.