Key Points

- WLFI Token launched with a $9.4B market cap and lost $2B within hours

- Whales dumped millions in tokens on Binance minutes after unlock

- Over 60% of WLFI Token supply is held in fewer than 10 wallets

- Traders fear another TRUMP or MELANIA token-style collapse

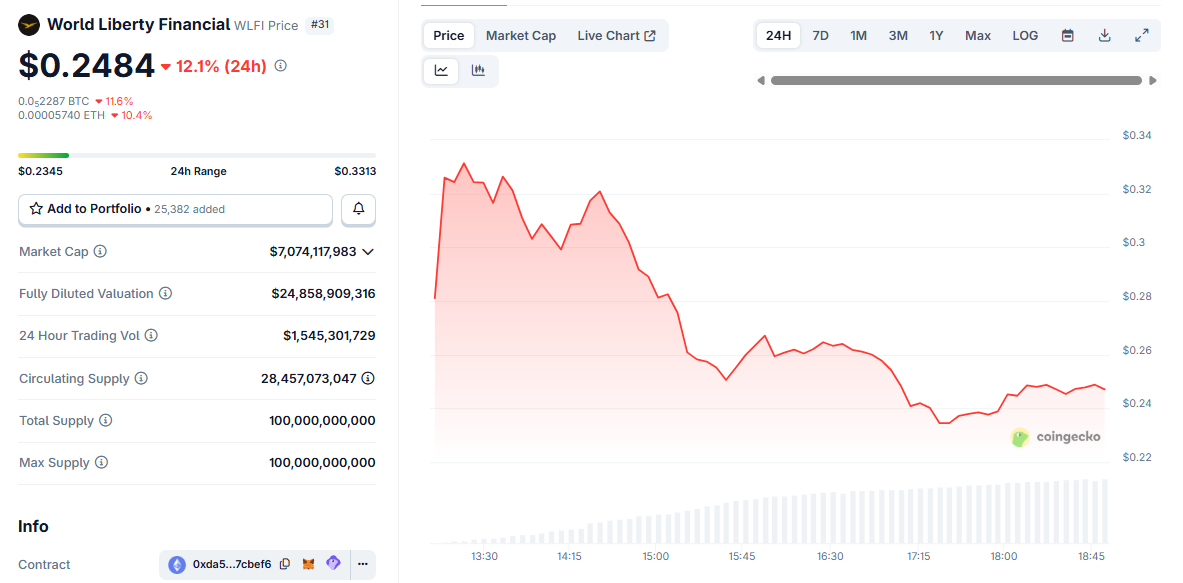

The WLFI Token, tied to the Trump family’s “World Liberty Financial” initiative, had one of the most dramatic crypto launches of 2025. It entered the market with a staggering $9.4 billion market cap, and within just four hours, more than $2 billion in value vanished.

Initially priced around $0.33, the WLFI Token briefly touched $0.35 before plunging to $0.24. The crash happened as presale investors began offloading massive token volumes on Binance, raising immediate red flags.

WLFI Price Chart After Launch. Source: CoinGecko – Techtoken

On-chain data showed that wallets holding between $15 million and $20 million worth of WLFI Tokens each sent their holdings to Binance minutes after the unlock. These early participants were allowed to trade 20% of their allocations, while the remaining tokens are locked under a vesting schedule.

This sell-off mirrors behavior seen in other politically linked tokens. Earlier this year, both TRUMP and MELANIA tokens surged on hype, only to lose more than 90% of their value later. The same concerns are now being raised about the WLFI Token.

Meanwhile, broader market volatility hasn’t helped. With Bitcoin recently dropping below $108K (read more), even high-profile launches like WLFI are struggling to maintain momentum.

Whale Activity and Supply Centralization Fuel Doubts

A core issue with the WLFI Token lies in its centralization. Fewer than 10 wallets control more than 60% of its total supply, many of them tied to Gnosis Safe multi-signature accounts, likely belonging to insiders.

WLFI Token Holder Distribution. Source: Bubblemaps – Techtoken

This tight supply control means that retail investors have little access to tokens. That lack of circulation makes the token extremely volatile and vulnerable to price manipulation.

The WLFI Token was first listed on Binance, with USDT and USDC spot pairs. While this offered initial liquidity, it also allowed early whales to dump tokens into the market, further worsening the price crash.

Still, some traders see potential for high-risk, high-reward opportunities. On derivatives platform Hyperliquid, a $6.8 million long position and a $1.3 million short were opened within hours of the launch. Such aggressive speculation signals just how volatile the WLFI Token market has become.

Many presale participants are sending their $WLFI to exchanges after claiming their tokens.

0xC3e7 claimed 60M $WLFI($19.2M) and deposited it to #Binance.

0x7ed4 claimed 53.33M $WLFI($17.1M) and deposited it to #Binance.

0x3881 claimed 46.67M $WLFI($14.9M) and deposited it to… pic.twitter.com/OqozovmYKo

— Lookonchain (@lookonchain) September 1, 2025

This kind of risky behavior isn’t limited to WLFI. It’s part of a larger trend. In fact, new altcoins like Pi Network are also facing heat as they struggle to meet expectations this September (read more).

Trump Family Holdings and Growing Criticism

The Trump family has been promoting the WLFI Token as part of its “patriot investor” strategy under the World Liberty Financial brand. On paper, their holdings in the token are worth over $6 billion, with Donald Trump reportedly owning about two-thirds of that amount.

Critics argue that this level of insider control puts the token’s entire future at risk. If the Trump family starts selling even a small portion of their tokens, it could trigger another steep drop in price.

The lack of a clear use case for the WLFI Token is also raising concerns. Many in the community see it as another speculative asset driven by branding rather than real-world utility. With overhyped political coins already burning investors, skepticism is rising.

It doesn’t help that other crypto regions are pushing for more sustainable approaches. For example, El Salvador is doubling down on becoming a crypto haven by focusing on regulatory clarity and Bitcoin adoption (read more).

Additionally, their Bitcoin reserve strategy offers a contrasting model of long-term accumulation versus short-term speculation (read more).

These developments show how some nations are choosing stability, while projects like WLFI Token may be falling into the same trap as hype-driven coins that fizzle out quickly.

What’s Next for the WLFI Token?

The debut of the WLFI Token was one of the biggest of 2025 in terms of market cap, yet its performance so far has exposed deep flaws in its tokenomics and investor trust.

With over 60% of the token supply in the hands of a few wallets, the risk of market manipulation remains high. Unless the WLFI Token team introduces transparency and real utility, traders may continue to flee.

Insider activity detected on $WLFI token 🚨

Within hours, insiders started dumping.

The price collapsed from $0.34 to $0.25 in less than three hours.

The wallets tell the story:

Top sellers in the first 24 hours:

•0x2d2419e6252729121c70285b045da2557128a131 sold 12.1M WLFI… pic.twitter.com/yW30y5ly1V— StarPlatinum (@StarPlatinumSOL) September 1, 2025

The crypto community is watching closely. Will this be a short-lived trend, or can the WLFI Token rebound and build credibility?

Other tokens are also seeing major developments. Solana ETFs, for instance, are nearing a 90% approval rate, fueling hopes for an $8B institutional boom (read more). Meanwhile, tokens with no roadmap or long-term strategy are being left behind.

Whether the WLFI Token becomes a symbol of politically charged hype or a legitimate financial product depends on what happens next and how fast trust can be rebuilt.