Key Points

- Pi reserves on exchanges exceed 420M, signaling sell pressure

- Over 164M tokens to be unlocked this month alone

- Valour’s Pi-backed ETP & key upgrades fail to lift price

- Investors still eye a rebound to $0.64 despite bearish signs

Pi Network entered September with a shaky outlook, trading flat around $0.35. While loyal supporters remain hopeful, a combination of rising supply and flat demand is placing heavy downward pressure on price action.

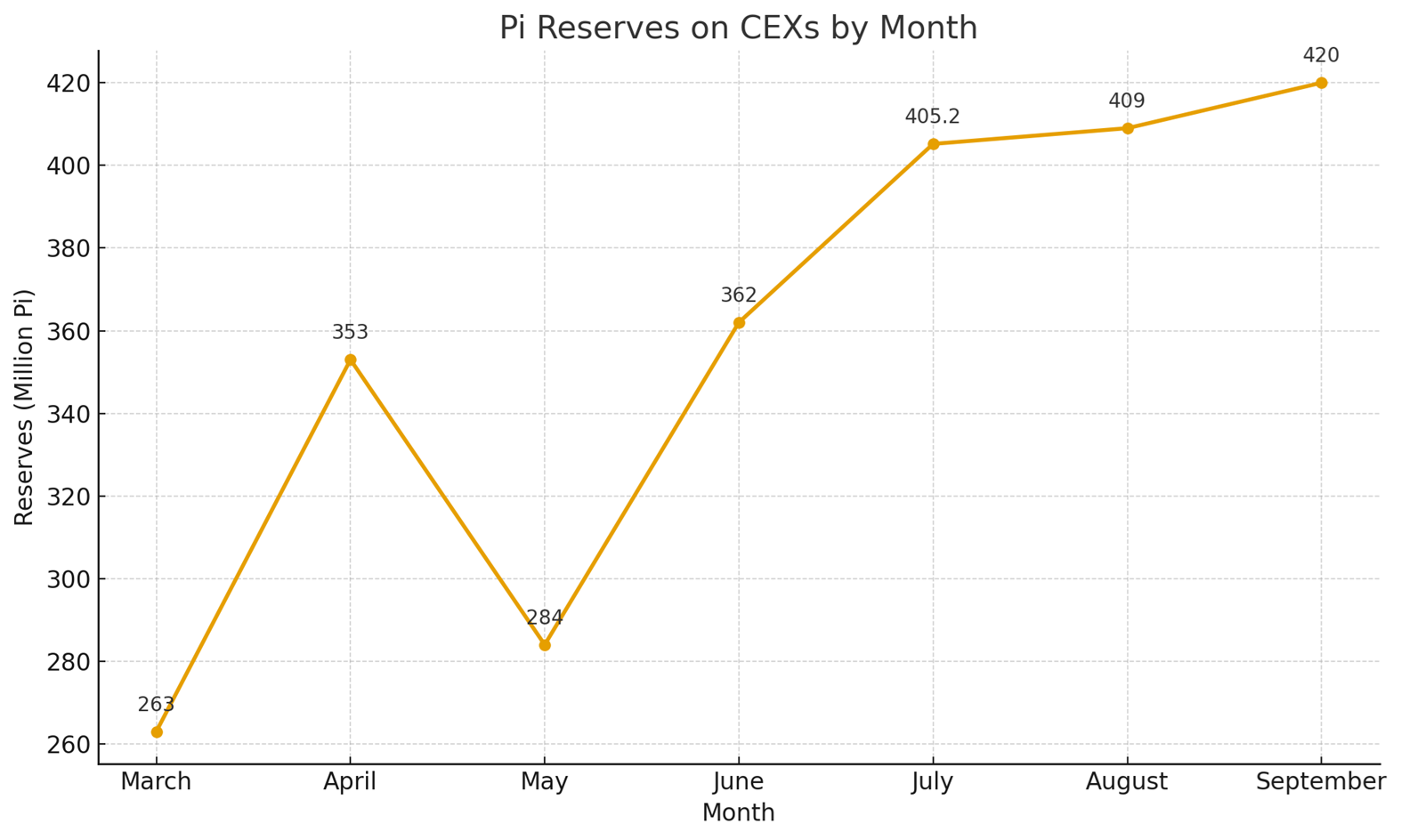

One key concern is that over 420 million PI tokens now sit on centralized exchanges, an all-time high, according to Piscan. When tokens flood exchanges and daily trading volume stays low (under $100 million), it’s usually a warning sign that more sell-offs could be coming.

Pi Coin Supply on Exchanges. Source: Techtoken

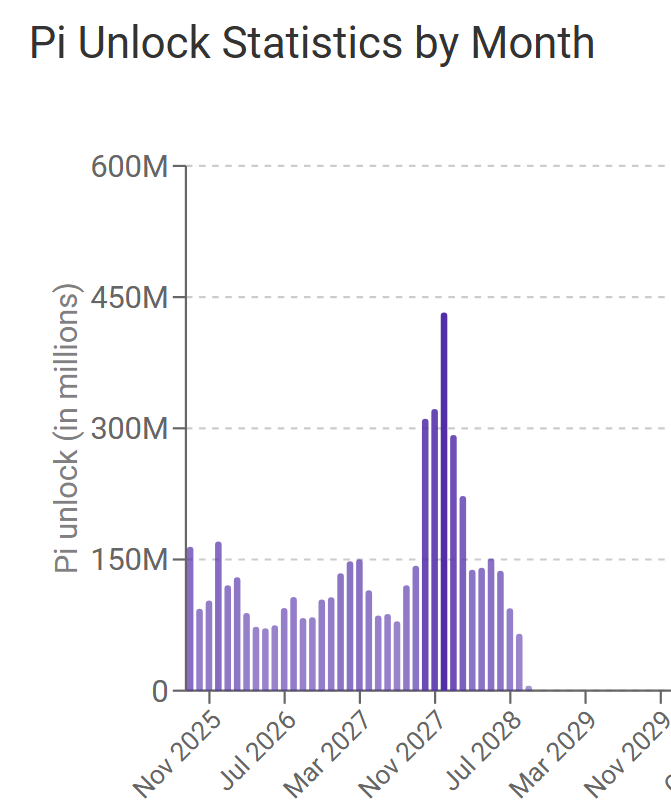

This comes at a time when over 164 million PI tokens are set to unlock in September, part of the network’s regular token release roadmap.

In bearish markets, unlocks typically trigger sharp drops, as new supply overwhelms limited demand, something that’s also been seen in other assets like Chainlink’s exchange reserves.

Monthly Pi Unlock Statistics. Nguồn: Piscan.

Exchange Reserves Rise as Bullish Developments Fall Flat

The recent data from Piscan reveals a rapid increase in exchange reserves, up from 409 million to 420 million PI in just two weeks. With no matching rise in demand, Pi Network could be facing a major liquidity crunch.

Surprisingly, a series of positive developments has failed to push the price higher. These include:

-

The launch of Pi Node on Linux allows more users to run decentralized nodes outside of Windows systems.

-

A protocol upgrade to version 23, improving the network’s efficiency and decentralization.

-

A new Pi-backed Exchange Traded Product (ETP) launched by European asset manager Valour, now listed on Sweden’s Spotlight Stock Market.

While such moves often generate buying interest, similar to recent momentum seen in Solana ETF approvals, the Pi Network hasn’t enjoyed that same effect. Instead, prices have remained tightly range-bound between $0.34 and $0.36, frustrating investors.

Pi Network (Pi) Price Performance. Source: BeInCrypto.

Pi Network (Pi) Price Performance. Source: Techtoken

Even amid upgrades and mainstream exposure, Pi Network seems to be lacking the catalyst needed to break out.

Community Optimism Grows Despite Bearish Indicators

Still, many in the Pi Network community, known as Pioneers, continue to hold out hope. The big question they’re asking: If everything looks bearish, why hasn’t the price dropped further?

Some suggest that whales are quietly accumulating, soaking up tokens at current levels in anticipation of a future rally.

Technical indicators also show MACD and RSI bounces, and a price structure that resembles altcoin accumulation phases, a pattern seen before sharp rallies in projects like Dogecoin, which recently made headlines with its new treasury backed by Musk’s lawyer.

“Linux node + KYC upgrades, bullish MACD & RSI bounce, Swapfone listing + whale buys. With fresh momentum, a push toward $0.64 is possible,” investor Drop Spark commented.

$PI up 4.98% in 24h, beating market avg +0.48%.

WHY: Linux node + KYC upgrades, bullish MACD & RSI bounce, Swapfone listing + whale buys.

With fresh momentum, a push toward $0.64 is possible if new exchange listings and whale accumulation continue. pic.twitter.com/J0QAlU0k2z— Drop Spark (@dropsparkx) August 30, 2025

There’s also growing interest from broader market watchers. Pi Network recently reappeared on CoinMarketCap’s Trendline and Bullish Sentiment lists, a signal that attention may be returning.

Pi Network Accumulation Price Structure. Source: Whale.Guru

However, others remain skeptical.

“We might see $0.20 before $1,” warned veteran Pi follower Moon Jeef, referencing the all-time high in exchange reserves.

$PI in exchanges hit 417M.

This is a new ATH.

The selling pressure continues.

We might see a 0.2 before $1. #PiNetwork pic.twitter.com/r9UTK8YCDT— MOON JEFF 🪐 (@CRYPTOAD00) August 29, 2025

Such skepticism mirrors the caution surrounding other crypto markets, like the recent Bitcoin price drop below $108K and the strategic treasury moves by countries like El Salvador, adding more Bitcoin to reserves.

The real test will be whether new listings, stronger trading volume, or another upgrade cycle can shift momentum in Pi Network’s favor.

BREAKING: $Pi is currently the most trending coin on CoinMarketCap with a price increase of 8% today !!! pic.twitter.com/Wzwp8Wk90U

— Pi News (@PiNewsMedia) August 31, 2025

Key Events to Watch for Pi Network in September

As the month unfolds, a few triggers could change the game for Pi Network:

-

New exchange listings: These could increase liquidity and open the door for more global traders.

-

Further whale activity: Accumulation at current levels would suggest growing confidence among major players.

-

Ecosystem updates: Continued upgrades could improve user experience and attract developer attention.

-

Market-wide sentiment: A broader crypto recovery could lift assets like PI along with others.

With 164 million tokens unlocking and exchange reserves climbing, Pi Network needs a strong narrative to avoid slipping further. The coming weeks could define its short-term trajectory, whether that means a slow bleed or a surprise breakout.