Key Points

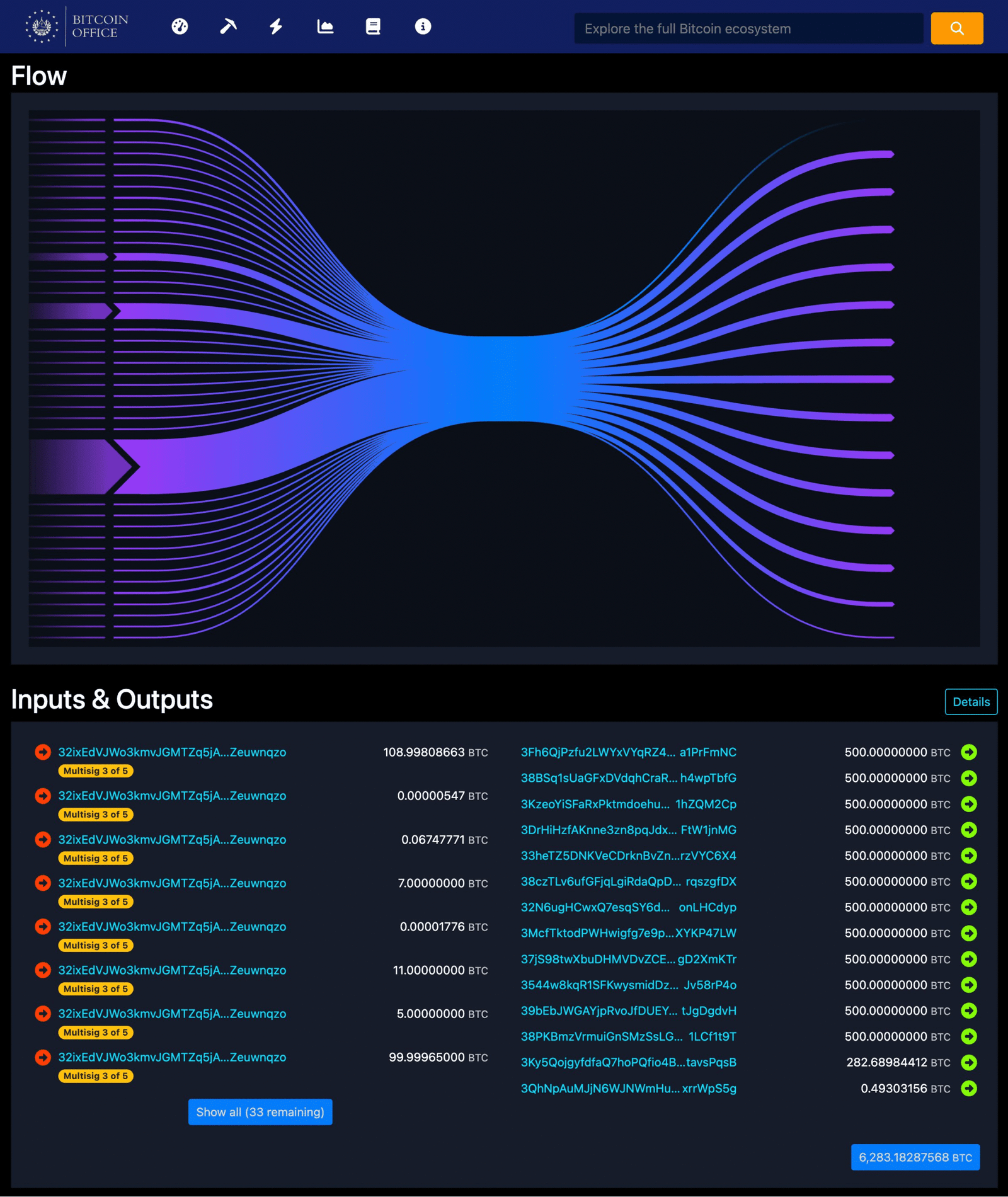

- Government moves BTC to 14 new addresses

- No single wallet holds more than 500 BTC now

- Aims to reduce risks from future quantum computing

- Total Bitcoin stash worth $681M spread for security

In a bold move to protect its digital wealth, the country has restructured its entire Bitcoin treasury. As of August 30, El Salvador moved its 6,284 BTC, worth around $681 million, from a single address into 14 separate wallets.

This decision marks a significant upgrade in how the El Salvador Bitcoin Reserve is managed.

Each of these new addresses holds no more than 500 BTC, according to the country’s National Bitcoin Office. The main reason behind this shift? Security, and more specifically, preparing for the future threat of quantum computing.

While quantum computers haven’t yet reached the level where they can crack Bitcoin’s encryption, experts warn it’s only a matter of time. Once quantum systems mature, they could potentially break the cryptographic algorithms that secure Bitcoin wallets.

Previously, El Salvador stored its entire Bitcoin reserve in one address that was repeatedly used. This made the public key visible on the blockchain and exposed the nation’s holdings to potential long-term security risks.

Now, the El Salvador Bitcoin Reserve is scattered across unused addresses. These only reveal public keys when funds are spent, making it much harder for potential hackers, even quantum-powered ones, to breach them.

“Limiting funds in each address reduces exposure to quantum threats,” explained the Bitcoin Office. “Unused addresses with hashed public keys remain protected.”

El Salvador is moving the funds from a single Bitcoin address into multiple new, unused addresses as part of a strategic initiative to enhance the security and long-term custody of the National Strategic Bitcoin Reserve. This action aligns with best practices in Bitcoin…

— The Bitcoin Office (@bitcoinofficesv) August 29, 2025

Transparency is also a part of the strategy. The government published the list of addresses used for holding the El Salvador Bitcoin Reserve to maintain public accountability.

This precaution mirrors steps being taken across the industry as crypto volatility rises. Just last week, we saw Bitcoin drop below $108K, reminding everyone how quickly things can shift in the market.

Industry Experts Back the Government’s Move

Leaders in the crypto space are applauding this shift in the El Salvador Bitcoin Reserve model.

Stacy Herbert, who heads the National Bitcoin Office, called the change both “precautionary” and “strategic.”

El Salvador was the first to establish a Strategic Bitcoin Reserve and we continue to lead the way on establishing best practices for this era of true sovereignty and freedom money.

This is the way 🇸🇻🚀 https://t.co/Z3GsITwqAB pic.twitter.com/bKmEvwqCn5

— Stacy Herbert 🇸🇻🚀 (@stacyherbert) August 29, 2025

“El Salvador was the first to establish a Strategic Bitcoin Reserve,” she said. “We continue to lead on best practices for this era of true sovereignty and freedom money.”

Nick Neuman, co-founder of Bitcoin custody platform CasaHODL, also praised the country’s forward-thinking strategy.

“Great to see large/public BTC holders taking proactive steps to protect against future quantum threats. El Salvador continues to be a good model for how nations should manage bitcoin treasuries.”

The move follows recent criticism from the International Monetary Fund (IMF), which claimed that the nation hasn’t significantly increased its holdings in recent months. Instead, it noted that most activities were internal transfers.

El Salvador’s New Bitcoin Reserve Management. Source: Mononaut. – Techtoken

Still, the El Salvador Bitcoin Reserve currently stands at 6,284 BTC, with the most recent redistribution confirmed by on-chain analysts like Mononaut, the pseudonymous founder of Mempool.space.

And President Nayib Bukele remains bullish. He hinted that the nation’s Bitcoin stash could reach $1 billion by the end of 2025, signaling an ongoing commitment to crypto as part of the country’s financial future.

El Salvador’s Bitcoin Office just migrated their Strategic Reserve holdings into 14 new addresses with up to 500 BTC per UTXO.

This marks the transition to a new wallet management strategy aiming to avoid address reuse. https://t.co/ZX6PvfYGiL pic.twitter.com/rop3kmaLnY

— mononaut (@mononautical) August 29, 2025

This mirrors global crypto developments. For instance, Dogecoin’s treasury under Elon Musk’s lawyer has drawn attention for centralized control risks, while Chainlink’s exchange reserves have reached a 6-year low, suggesting long-term holder confidence.

Quantum Threats and Long-Term Security of National Reserves

The shift in the El Salvador Bitcoin Reserve management comes at a time when more nations and institutions are beginning to evaluate the long-term risks of quantum computing.

While quantum threats may sound like science fiction, the risk is very real. When a Bitcoin wallet makes a transaction, its public key becomes visible. If quantum computers advance to the point of breaking encryption, wallets with exposed public keys could be vulnerable.

The new setup of the El Salvador Bitcoin Reserve prevents that. By splitting its holdings across unused addresses, the government ensures that public keys remain hidden unless a transaction is made.

This means attackers, quantum or otherwise, have nothing to target until the funds are moved.

This approach aligns with what experts refer to as “quantum-resilient custody”, a model of crypto storage that minimizes exposure and reduces potential damage in case of a future breach.

The strategic use of multiple addresses also gives the El Salvador Bitcoin Reserve more flexibility.

With smaller amounts stored in each wallet, future transactions can be conducted with less risk, and each address remains isolated from the others in case of compromise.

Other nations may soon follow suit, especially as the crypto derivatives market also gains traction. Just this week, $1.5B in Bitcoin and Ethereum options expired, impacting market liquidity and strategy across the board.

Even institutional products like Solana ETFs, which are seeing a surge in approval chances, indicate that national crypto strategies must evolve quickly and securely.