Key Points

- Fidelity, VanEck, and Franklin Templeton amend Solana ETF filings

- Analysts say approval odds now exceed 90%

- Final SEC decisions expected by mid-October

- Solana ETFs projected to attract over $8B in inflows

Solana ETFs are quickly moving from concept to reality. Top financial firms like Fidelity, VanEck, and Franklin Templeton have revised their Solana ETF filings with the U.S. Securities and Exchange Commission (SEC).

The changes, filed on August 29, show a clear effort to meet regulatory expectations and mirror the process followed by Bitcoin and Ethereum spot ETFs.

James Seyffart, ETF analyst at Bloomberg, said these asset managers are having constructive discussions with the SEC.

Other players involved include 21Shares, Grayscale, CoinShares, Bitwise, and Canary Capital. All are racing to be part of what could become the first wave of Solana ETFs approved in the U.S.

NEW: A bunch of updated Solana ETF filings are being sent to the SEC. So far this afternoon we have Canary/Marinade, Franklin, and VanEck. Expecting the others to file over next couple hours. Likely just indicates positive back and forth between these issuers and the SEC pic.twitter.com/GSWZQuDZ6T

— James Seyffart (@JSeyff) August 29, 2025

At least 16 different Solana ETF products are currently under review. Some filings have decision deadlines in mid-October, which could kickstart a wave of approvals in the coming weeks.

The SEC’s willingness to provide feedback instead of rejecting the filings outright is being seen as a positive sign by market analysts.

It strongly hints at a cooperative approach similar to what led to Bitcoin’s recent market drop, becoming a major talking point among traders and regulators alike.

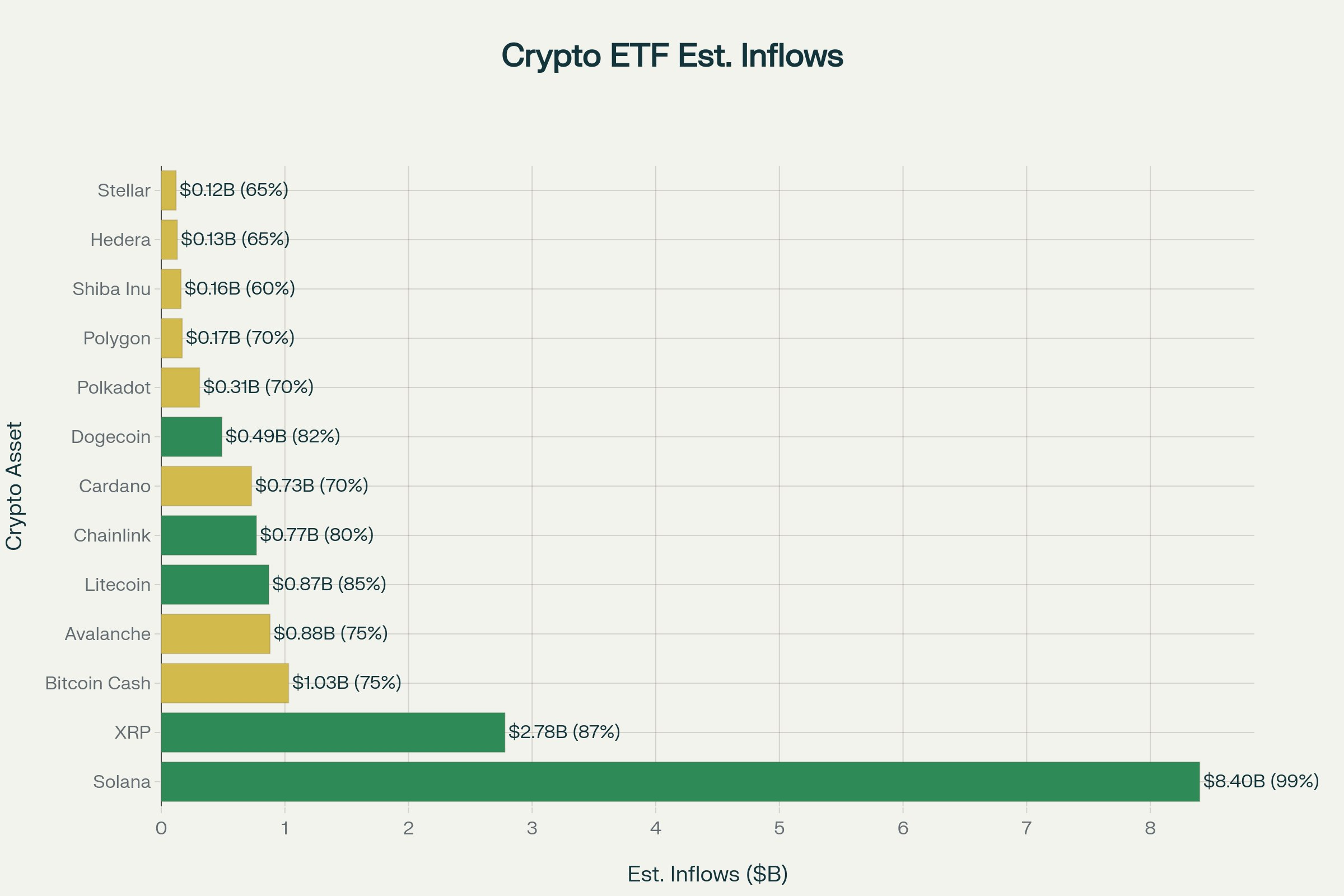

$8 Billion Inflows Predicted as Demand Soars

The level of interest in Solana ETFs is more than just hype.

Market analysts now expect these ETFs could attract over $8 billion in inflows once they go live. If true, this would place Solana firmly alongside Bitcoin and Ethereum in terms of institutional demand.

Solana ETFs Estimated Inflows. Source: Pixel Rainbow – Techtoken

Why the optimism? Solana has evolved into a top-tier blockchain network, with lightning-fast speeds and low transaction fees. It’s gaining attention from institutional investors for its use cases in DeFi, NFTs, and tokenized assets.

However, recent drops in Solana DEX trader activity may indicate some volatility in retail behavior even as institutional interest rises.

distribution of coins and timelines for the ETF’s pic.twitter.com/iRuOSko6hl

— PixelRainbow (33.3%) (@PixelRainbowNFT) August 29, 2025

That demand is already visible. Since launching in July, the REXShares Solana Staking ETF has seen steady growth. On August 29 alone, it received $11 million in new capital, pushing its AUM past $200 million.

Bloomberg analyst Eric Balchunas also noted that REX is restructuring the ETF into a registered investment company. This change is expected to reduce tax inefficiencies, making it more attractive for institutional players once spot Solana ETFs are approved.

Rex Solana ETF is converting to a Registered Inv Co from a C Corp which should eliminate the tax drag and make it more competitive to the coming tsunami of Solana spot ETFs (all of which just filed 3rd amendments (=virtual lock for approval) today as per @JSeyff pic.twitter.com/nQiGtPIIQo

— Eric Balchunas (@EricBalchunas) August 29, 2025

Solana’s rise in popularity shows just how fast things are moving in the digital asset space. What was once a high-risk altcoin is now being positioned as a core investment product for traditional finance, right alongside projects like Chainlink, which is seeing a drop in exchange reserves, signaling long-term holding trends.

Solana ETFs Set to Transform Institutional Crypto Access

As the countdown to SEC decisions continues, the rise of Solana ETFs could reshape how institutions approach crypto.

In the past, institutional investors had limited access to Solana. They had to rely on direct token purchases or risky offshore platforms. But with Solana ETFs on the horizon, that’s about to change.

Spot ETFs make it easier for large investors like pension funds, hedge funds, and asset managers to get exposure to Solana without holding the tokens directly.

These ETFs are fully regulated, providing a secure and compliant on-ramp to crypto markets.

This shift is more than symbolic. It shows a growing trust in Solana’s ecosystem, and a belief that it can sit at the same table as Bitcoin and Ethereum in portfolios across Wall Street.

Meanwhile, as traditional and crypto-native projects look to bridge the regulatory gap, new experiments like the Dogecoin legal trust backed by Elon Musk’s lawyer also reflect how mainstream the space has become.

As more firms join the ETF race and the SEC gives signals of progress, Solana ETFs could quickly become one of the most important financial products in the next stage of crypto adoption.

This wave of development shows that the appetite for Solana ETFs is not only real but growing fast.