Key Points

- Dormant whale shifts billions from Bitcoin to Ethereum

- BTC briefly dips below $108K, triggering $400M in liquidations

- Ethereum gains as Bitcoin traders suffer sharp losses

- Analysts warn of deeper drop if BTC doesn’t reclaim $112K

Bitcoin Drops Below $108K after a Major Whale Wallet, Dormant for Years, Suddenly Shifts Billions in BTC into Ethereum, Triggering Panic in the Crypto Market.

The sharp sell-off caused Bitcoin to fall to its lowest price since early July, shaking investor confidence and signaling potential for further downside.

On August 29, blockchain analytics firm Arkham Intelligence reported that a wallet holding over $5 billion in Bitcoin had begun transferring large amounts to new addresses before initiating substantial Ethereum purchases.

The whale transferred around $1.1 billion initially, then aggressively rotated into ETH, acquiring roughly $2.5 billion worth within a week.

BREAKING: $5 BILLION BTC WHALE BUYING UP TO $1 BILLION $ETH

A whale holding over $5B of BTC is currently buying $ETH. He just moved $1.1 BILLION of BTC to a new wallet and has started purchasing ETH through Hyperunit/HL.

This whale bought $2.5 BILLION of ETH last week, and… pic.twitter.com/cMQWrYBmZb

— Arkham (@arkham) August 29, 2025

Adding to the tension, Lookonchain reported that the same whale moved 4,000 BTC (worth over $430 million) into Hyperliquid, a decentralized derivatives platform.

This supported the theory that the whale was actively shifting from BTC to ETH, a move that echoed throughout the market.

The whale’s rotation not only surprised analysts but also flipped short-term market sentiment. Bitcoin’s sell pressure grew as traders feared further liquidation cascades. Meanwhile, Ethereum gained momentum, reflecting the capital inflow.

This Bitcoin OG deposited another 2,000 $BTC($217M) into #Hyperliquid in the past hour, selling it and buying $ETH spot.https://t.co/aHBeM2zTlk pic.twitter.com/0NvUwjrl79

— Lookonchain (@lookonchain) August 30, 2025

This comes on the heels of other market shifts, such as the DOGE treasury controversy involving Elon Musk’s lawyer, which has drawn attention to how major players are influencing token movements.

$400M Liquidated as Ethereum Longs Get Hit Hardest

As Bitcoin Drops Below $108K, total crypto market liquidations surged above $400 million in a single day, according to CoinGlass. Leverage traders were hit hard, particularly those betting on Ethereum’s continued rise.

-

Ethereum long positions lost $133 million

-

Bitcoin long positions lost $109 million

These liquidations caused a wave of panic across trading platforms, with many positions forcefully closed as prices whipsawed. Traders expecting stability or bullish continuation found themselves caught off guard by the whale-triggered shakeup.

While Ethereum slightly gained, Bitcoin dropping below $108K signaled broader weakness and a lack of buyer strength. The price has since struggled to recover key support levels, indicating that bearish sentiment still dominates.

This coincided with the expiration of $1.5B in Bitcoin and Ethereum options, adding further fuel to the volatility. The combination of options expiry and whale movement created a perfect storm that rattled crypto markets.

Analysts Warn of $100K Test if BTC Doesn’t Rebound

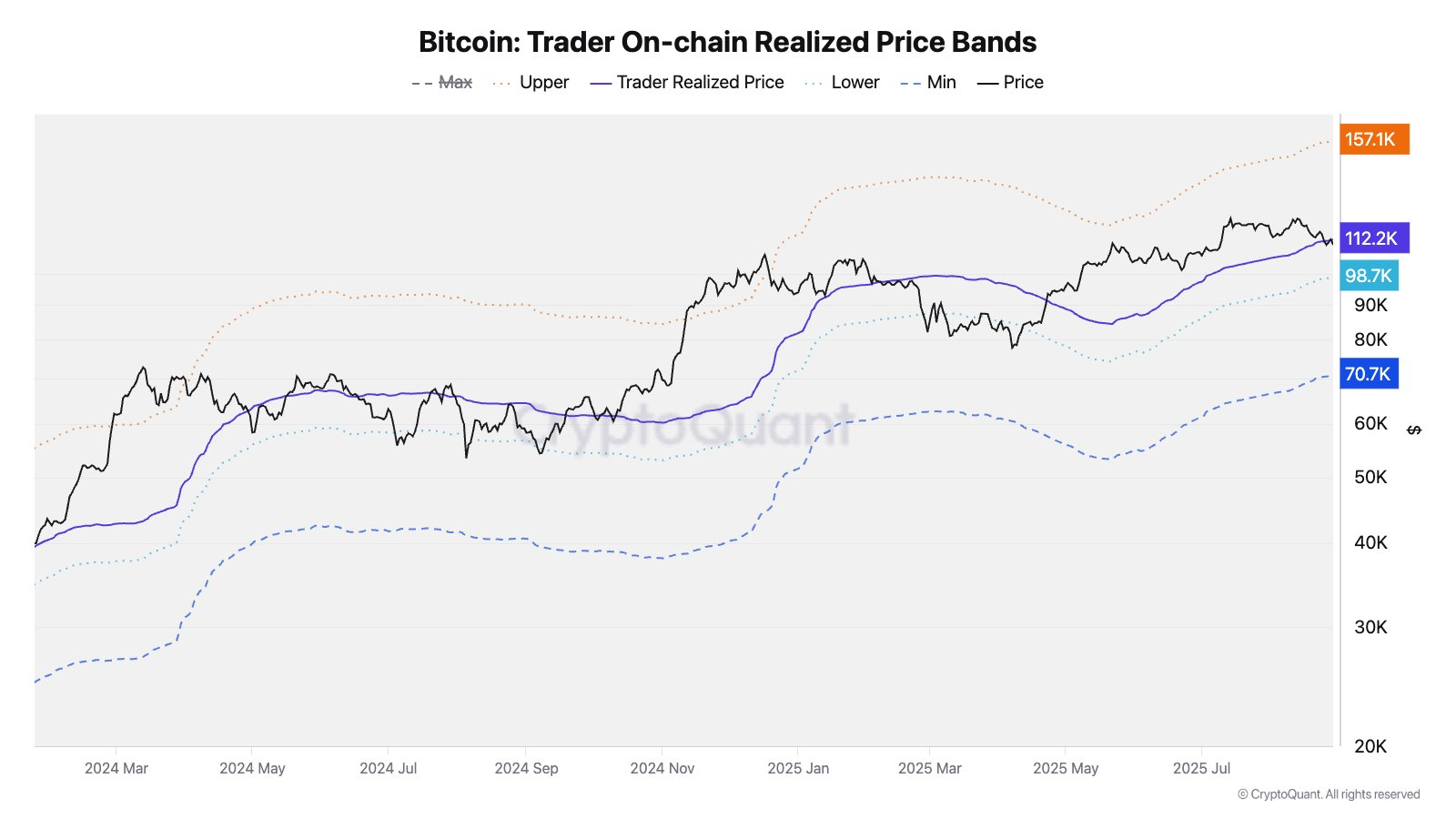

Market analysts are now watching closely as Bitcoin Drops Below $108K, with many warning that unless BTC regains the $112,000 level quickly, it may test lower support around $100,000.

Julio Moreno, head of research at CryptoQuant, highlighted the platform’s Bull Score index, which dropped to 20 this week, deep into “extremely bearish” territory.

Bitcoin Realized Price Bands. Source: CryptoQuant – Techtoken

He noted that Bitcoin has failed to sustain positive momentum since mid-August, and the recent whale moves have only accelerated the downtrend.

“Unless sentiment shifts fast and buying volume returns,” Moreno said, “Bitcoin could slip even further. We’re approaching a fragile psychological level at $100,000.”

Technical indicators also show weakness. Momentum oscillators are trending down, volume is decreasing, and support levels are thin between $108,000 and $100,000.

From a short-term valuation perspective, if Bitcoin doesn’t reclaim $112K quickly, then the downside support is around $100K. pic.twitter.com/xEfd3VOO6A

— Julio Moreno (@jjcmoreno) August 29, 2025

Until a strong recovery above $112,000 is confirmed, Bitcoin Drops Below $108K could be just the start of a larger correction.

Some see parallels with the recent Solana DEX activity drop, which also reflected declining trader confidence during volatile conditions across altcoin markets.

Ethereum Surge Sparks Rotation Trend Among Whales

The fact that the whale chose Ethereum as a destination has sparked interest in whether other large holders might follow suit. As Bitcoin Drops Below $108K, Ethereum saw a modest price increase, likely fueled by the massive accumulation from the whale.

Some analysts believe this might hint at a short-term capital rotation trend, where investors temporarily favor ETH due to its upcoming network upgrades, favorable staking yields, or perceived undervaluation compared to BTC.

However, others caution against reading too much into a single move. While the whale’s Ethereum purchases were large, it’s unclear if this marks a lasting shift in institutional preferences or a tactical reallocation based on internal strategies.

Still, the ETH inflows and the whale’s use of platforms like Hyperliquid suggest growing interest in DeFi-native solutions and alternative Layer 1s. If this trend continues, we may see more Bitcoin capital flow into Ethereum and even other altcoins in the near term.

Meanwhile, other assets such as WLFi and LINK have also been affected, as noted in recent coverage of the Dolo price crash and token selloffs, highlighting the interconnected nature of whale actions and broader market responses.