Key Points

- Chainlink Exchange Reserves Drop as 3 Altcoins Surge

- Chainlink, Numeraire, and Toncoin reserves dropped sharply

- LINK hit a 1-year low after the US Commerce partnership

- NMR soared 120% as JPMorgan committed $500M

- TON reserves dropped after Robinhood listing, Verb’s $558M buy

In the final week of August, a key trend emerged across three major altcoins, Chainlink, Numeraire, and Toncoin. All three tokens saw their exchange reserves decline, which usually signals long-term accumulation and less short-term selling pressure.

When traders pull assets off centralized exchanges, it’s often a bullish sign. It suggests investors plan to hold instead of sell. This shift could be setting the stage for a strong Q4, especially for altcoins showing real-world use, partnerships, and rising adoption.

Interestingly, this comes as market sentiment becomes more selective in altcoin investments. We’ve already seen tokens like WLFi and LINK react sharply to whale moves and ecosystem updates, as shown in this DOLO Price Crash and WLFi-LINK Analysis.

Now, let’s take a deeper look at each of the three altcoins showing strong off-exchange accumulation signals.

Chainlink Exchange Reserves Hit One-Year Low

Chainlink (LINK) leads the pack in this trend. According to Santiment, Chainlink exchange reserves dropped to just 186.6 million LINK in late August, the lowest in over a year.

Just a month earlier, that number was 212 million. Over 25 million LINK tokens have been moved off exchanges in that time.

This shift coincides with two major developments:

-

Launch of Chainlink Reserve: Introduced in early August, this platform now holds over 193,000 LINK. It’s designed to increase transparency and reinforce trust among long-term holders.

-

Partnership with U.S. Department of Commerce: This strategic alliance brings macroeconomic data, like GDP and the PCE Index, on-chain. It’s a bold move that further validates Chainlink’s importance in bridging traditional finance with blockchain.

These updates significantly boosted investor sentiment. Previously, when LINK prices rose, exchange reserves also increased, a sign that investors were preparing to sell. But now, LINK’s price is climbing while exchange reserves are dropping, flipping the narrative completely.

LINK Supply on Exchanges. Source: Santiment. – Techtoken

This reversal is similar to other recent market patterns where on-chain metrics hint at long-term growth, even if short-term price action stays quiet, like the recent surge in Solana DEX trading volume dips, explored in this report.

With strong institutional engagement and on-chain utility, Chainlink exchange reserves dropping is a sign that investors are now more confident in LINK’s long-term value.

RESERVE UPDATE

Today, the Chainlink Reserve has accumulated 42,298.22 LINK.

As of August 28th, the Chainlink Reserve holds a total of 193,076.00 LINK.https://t.co/oxMv5N3rFC

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink… pic.twitter.com/mMyEE8uSK3

— Chainlink (@chainlink) August 28, 2025

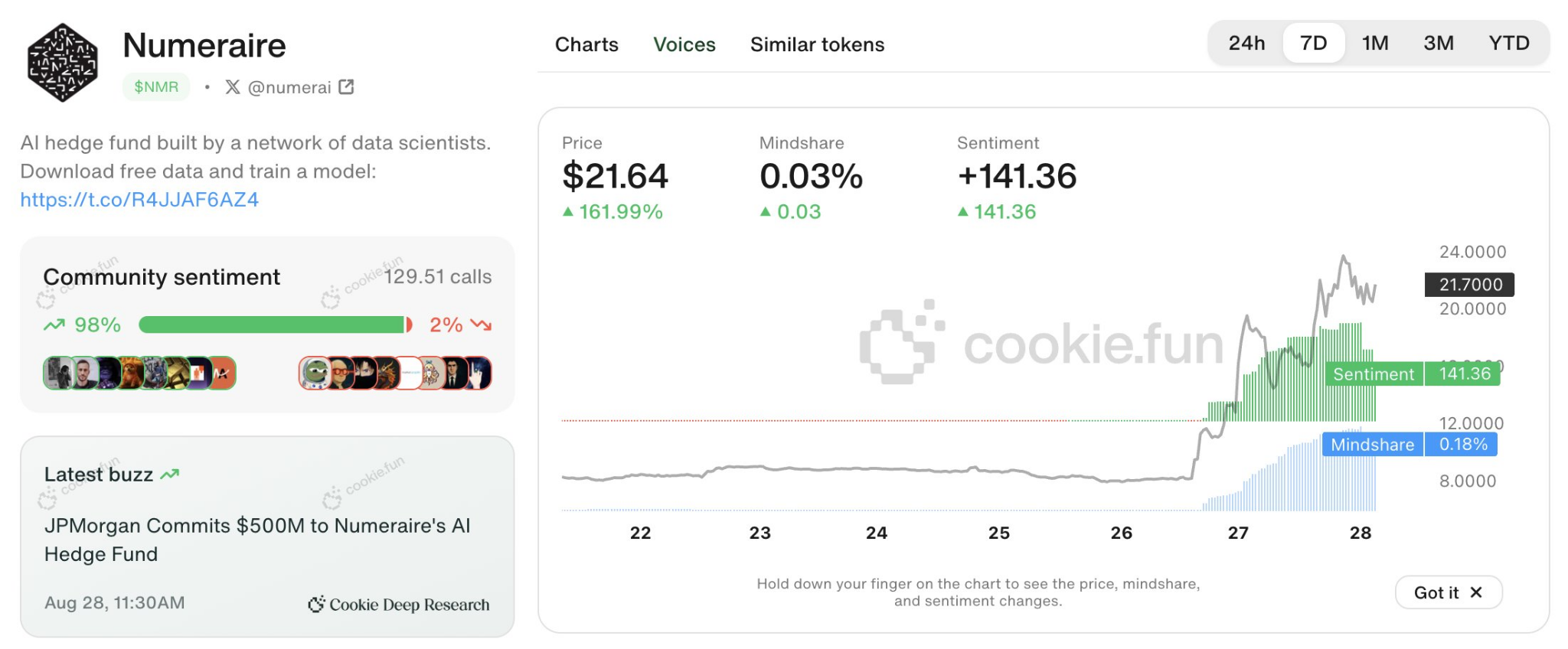

Numeraire Surges After JPMorgan Commits $500M

Numeraire (NMR) stunned the market in August, rising over 120% in just days. Its 24-hour trading volume exploded from $460 million to more than $1 billion, following a major announcement from Wall Street giant JPMorgan.

JPMorgan pledged $500 million in fund capacity to Numerai, the platform behind NMR. This news quickly pushed the token’s visibility and sparked a shift in investor behavior.

NMR Supply on Exchanges. Source: Santiment. – Techtoken

According to Santiment, NMR exchange reserves dropped to 1.61 million, marking a major shift from a long-term trend of increasing reserves. Over 350,000 tokens were removed from exchanges compared to earlier this year.

For context, NMR had been sliding from highs above $70 to lows below $7, largely due to consistent sell pressure. This trend was tied to rising reserves. But the recent drop could mark the start of a reversal, suggesting accumulation by confident buyers.

Numeraire Sentiment and Mindshare. Source: Cookie.fun – Techtoken

Additionally, mindshare and sentiment metrics from Cookie.fun revealed a significant increase in NMR attention following JPMorgan’s announcement.

“JP Morgan committed half a billion to Numerai. Mindshare and sentiment surged from near flat lines to soaring levels after the news broke. $NMR followed, climbing over 160% since,” said Cookie DAO.

J.P. Morgan committed half a billion to @numerai.

Mindshare and sentiment jumped from near flatline to soaring levels after the news broke, and $NMR followed, climbing over 160% since.

Indication of Wall Street’s growing influence on the crypto markets? pic.twitter.com/UdNBT0cTkR

— Cookie DAO 🍪 (@cookiedotfun) August 28, 2025

This is another sign of how traditional finance is starting to impact crypto markets, a trend also noted in the $15B Bitcoin and Ethereum options expiration that recently shook the market. More details can be found here.

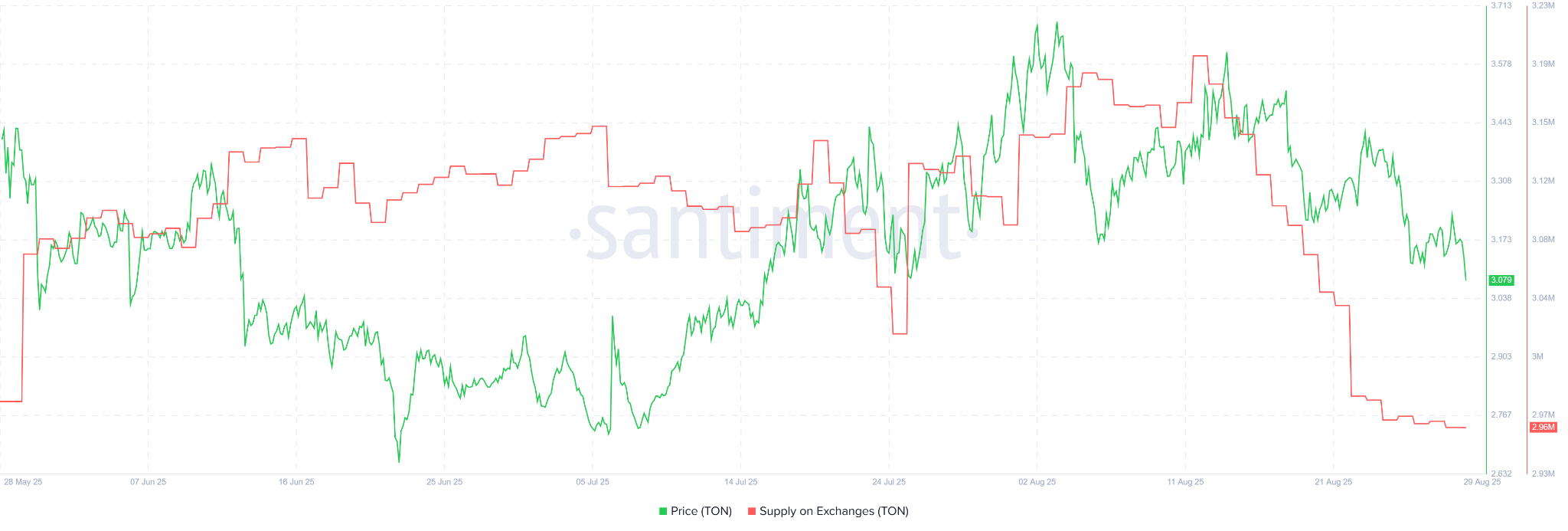

Toncoin (TON) Reserve Drops Trigger Bullish Buzz

Toncoin (TON), known for its strong Telegram integration, also joined the trend. By the final week of August, TON exchange reserves had fallen to just 2.96 million tokens, down from 3.2 million just a week earlier.

This is TON’s lowest reserve figure in three months and points to growing interest from both retail and institutional players.

TON Supply on Exchanges. Source: Santiment. – Techtoken

The drop followed two big developments:

-

Robinhood Listing: TON became available to Robinhood users, giving it exposure to a broader U.S. investor base.

-

Verb Technology’s Strategic Buy: NASDAQ-listed Verb Technology announced a $558 million private placement. The goal? To make TON its main treasury asset, aiming to control over 5% of the total TON supply.

This move wasn’t just a corporate treasury choice; it was a bold investment in the network’s future. Verb’s private placement included over 110 institutional and crypto investors, and most of the funds were directed to buying Toncoin.

Great to see 💎

— TON 💎 (@ton_blockchain) August 28, 2025

The bullish signals don’t end there. According to IBC Group’s Mario Nawfal:

“Toncoin just listed on Robinhood. 36.2 million new users onboarded. Monthly active wallets on TON soared to 12.4 million, a 110× growth. TVL rose from $537K in January to $773M by July. Over $1B USDT was issued, the fastest in Tether’s history.”

These numbers show that Toncoin isn’t just gaining hype; it’s delivering real adoption and use.

INCUBATION: Toncoin just listed on Robinhood.

And it comes as no surprise.

36.2 million new users onboarded.

Monthly active wallets on @ton_blockchain have soared to 12.4 million, an impressive 110× growth.

TVL rose from $537,000 in early January to a record $773 million by… pic.twitter.com/25U2DNjpqq

— Mario Nawfal (@MarioNawfal) August 28, 2025

Why Exchange Reserves Matter Right Now

Tracking Chainlink exchange reserves, as well as those of other key tokens like NMR and TON, is now more important than ever.

In a market where price alone doesn’t tell the full story, understanding the movement of assets in and out of exchanges can offer early signals of major accumulation.

Whether it’s due to institutional buy-ins, token utility, or new exchange listings, these shifts reflect growing confidence in these projects.

As Q4 approaches, keep an eye on exchange reserve trends, especially for tokens like LINK, which are increasingly connected to traditional financial systems and government agencies.