Key Points

- $14.6B in Bitcoin and Ethereum options set to expire today.

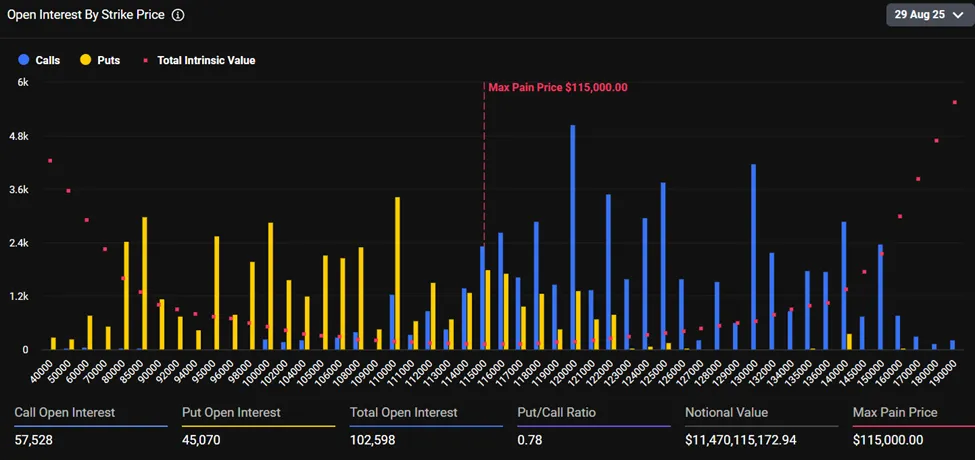

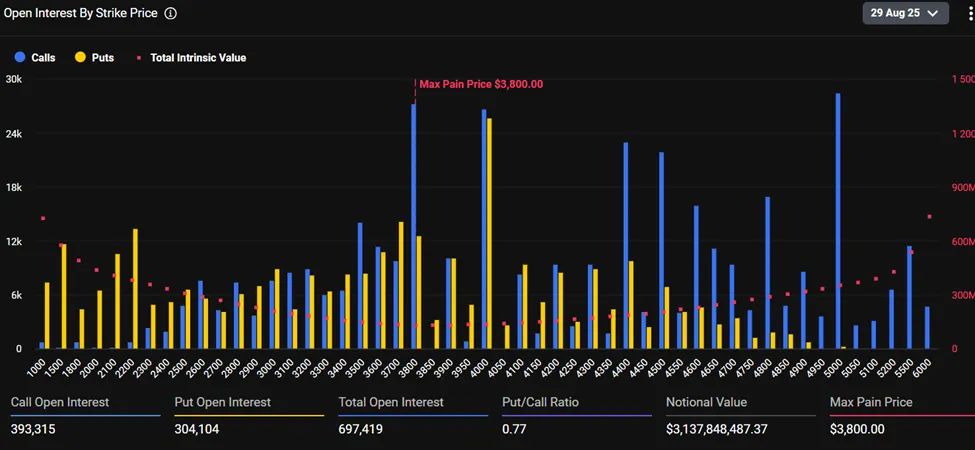

- Bitcoin options dominate with $11.47 in value; Ethereum at $3.13B.

- Max pain levels sit at $115K for BTC, $3,800 for ETH.

- Nvidia’s earnings stir debate on crypto’s next move.

Bitcoin and Ethereum Options worth nearly $14.6 billion are set to expire today, Friday, August 29. This end-of-month expiry is one of the largest in recent weeks, and markets are on alert for short-term volatility and sudden price swings.

According to Deribit, Bitcoin dominates the expiry event with a notional value of $11.47 billion, while Ethereum follows with $3.13 billion. These contracts represent open bets on future prices and tend to impact spot price movements as expiration approaches.

Bitcoin Expiring Options. Source: Deribit – Techtoken

Bitcoin’s max pain level is $115,000, the strike price where most traders stand to lose the most money. Bitcoin is currently trading around $111,428, meaning upward pressure may build to align with the max pain point.

Ethereum’s situation is reversed. Its max pain level is at $3,800, while the current market price is significantly higher at $4,468, which could result in downward pressure on ETH.

Expiring Ethereum Options. Source: Deribit – Techtoken

Market analysts are also watching the Put-to-Call Ratio (PCR) closely. Bitcoin’s PCR is at 0.78, while Ethereum’s is 0.77, both below 1, indicating more bullish bets (calls) than bearish ones (puts). This means traders are cautiously optimistic about the short-term price action for both assets.

In comparison, last week’s options expiry was significantly lower, at around $5 billion. This week’s total is nearly three times higher because it’s a monthly expiry, always a heavier event for the crypto market.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, ~$15B in crypto options are set to expire on Deribit.$BTC: $11.7B notional | Put/Call 0.79 | Max Pain $116K$ETH: $3.2B notional | Put/Call 0.76 | Max Pain $3.8KBTC OI clusters around $110K–115K, ETH shows balanced flows with… pic.twitter.com/iY3AkbIs5F

— Deribit (@DeribitOfficial) August 28, 2025

Analysts at Deribit highlighted that Bitcoin and Ethereum options have created a cluster of open interest near these pain points, which may increase volatility as expiration approaches.

In the midst of this, some traders are also tracking broader market sentiment shifts, like the sharp drop in Solana DEX traders, which hints at caution even in other parts of the crypto ecosystem.

Nvidia Earnings May Influence Crypto Direction

While the expiry of Bitcoin and Ethereum options is the headline, a wildcard has entered the mix: Nvidia’s recent earnings report.

Released on Wednesday, August 27, Nvidia’s blockbuster Q2 earnings have sparked debate among crypto traders. The question: Will crypto follow equities or carve its own path?

The analytics platform Greeks. live reported that “debate centered around BTC implied volatility being too low ahead of NVDA earnings.” Nvidia had an implied volatility (IV) of 100% and an expected 7% move, leading some traders to believe Bitcoin could be influenced by similar forces, as it was earlier in 2024.

https://t.co/n0OcjSHcin Community Daily Digest

Published: 2025-08-28

Overall Market Sentiment

The group shows mixed sentiment with traders closely watching key levels around BTC 112K resistance and discussing NVDA earnings impact on crypto volatility. Some traders expressed…

— Greeks.live (@GreeksLive) August 28, 2025

After Nvidia’s February earnings, Bitcoin rallied alongside tech stocks, showing a strong correlation with equity markets. But today, that link is being questioned. Has crypto matured enough to resist traditional market influence?

Traders are split. Some believe Bitcoin could bounce up toward $115,000 thanks to strong call activity. Others warn that Ethereum’s relative weakness may cap broader bullish momentum.

Despite differing opinions, the sentiment leans slightly bullish, largely due to lower PCR ratios and heavy interest in calls. Still, as prices drift from their respective pain levels, sharp moves are likely during the hours leading to expiry.

Bitcoin currently trades near $111,428, just shy of its pain point, while Ethereum stands at $4,468, significantly above its max pain, a clear setup for opposing price movements.

Similarly, we’ve seen surprising price crashes like Dolo and WLFI shake altcoin investors recently, showing that volatility isn’t limited to just BTC and ETH.

What This Means for Traders in the Coming Days

With the expiry of Bitcoin and Ethereum options just hours away, traders need to prepare for a quick shift in market momentum. Historically, options expiry leads to increased volatility in the hours before expiration, followed by a cooling-off period.

On Deribit, the official expiry for both Bitcoin and Ethereum options is set at 8:00 UTC, and until then, the market is expected to see erratic swings as large positions settle. After that, price action typically calms down as traders adjust their positions and await the next cycle.

For Bitcoin, a move toward $115,000 is possible if bullish pressure continues, particularly if legacy market momentum carries over.

Ethereum, however, could see a short-term correction toward its max pain level of $3,800, especially if traders choose to lock in profits.

For traders and investors, understanding the behavior of Bitcoin and Ethereum options is crucial, not just for predicting short-term volatility, but also for identifying longer-term market sentiment.

With over $14.6 billion in contracts coming off the board today, this event is a major moment for the crypto market. Whether it results in a breakout or a sharp reversal will depend on how aligned price action becomes with the max pain levels and how much influence Nvidia’s earnings truly have.

Going forward, the market will likely shift focus to September’s options contracts and whether traders are positioning for a continued rally or a period of consolidation.

One thing is certain: today’s expiry is a major inflection point for both Bitcoin and Ethereum, and it could shape market direction heading into September.