Key Points

- DOLO sinks 30% after major exchange listings

- WLFI connection sparks fresh wave of speculation

- Whale activity signals potential bounce ahead

- Market unsure if WLFI is DOLO’s turning point

The DOLO price is sending shockwaves through the crypto market.

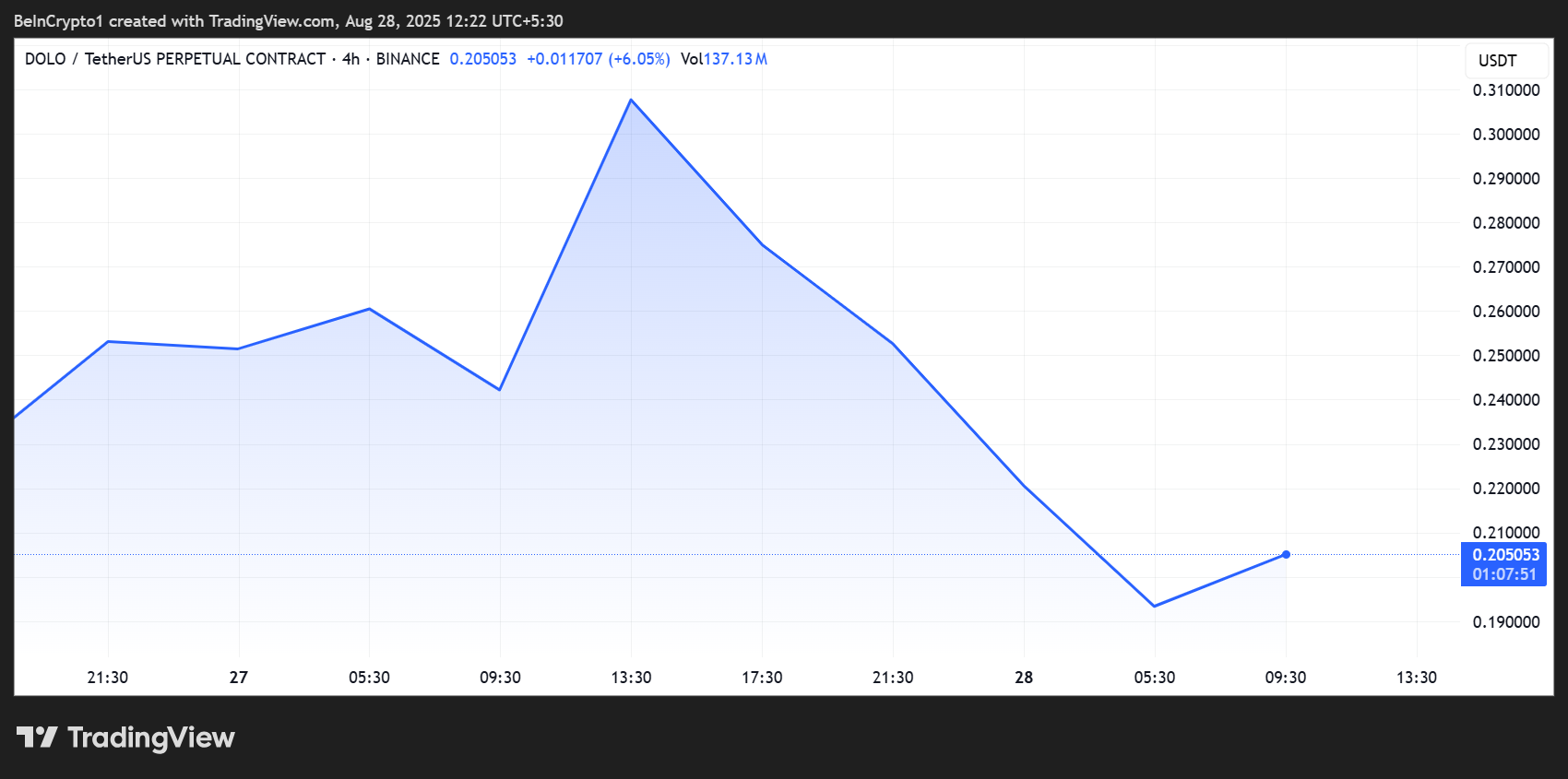

Despite landing listings on two of the world’s biggest crypto exchanges, Coinbase and Binance, Dolomite’s native token dropped by 30% in a single day, trading at just $0.20 at the time of writing.

On paper, this makes no sense.

Dolomite (DOLO) Price Performance. Source: TradingView – Techtoken

Most tokens surge after getting listed on top-tier exchanges. It brings more visibility, more liquidity, and usually, a boost in investor confidence. But for DOLO, the opposite happened.

Assets added to the roadmap today: AWE Network (AWE), Dolomite (DOLO), Flock (FLOCK), Solayer (LAYER), and SPX6900 (SPX)https://t.co/rRB9d3hSr2

— Coinbase Assets 🛡️ (@CoinbaseAssets) August 20, 2025

The trouble started right after Coinbase added DOLO to its official listing roadmap, which usually hints at a full listing.

#Binance is excited to announce the Dolomite (DOLO) HODLer Airdrop – @Dolomite_io $DOLO.

BNB Holders, get ready! The Airdrop page will be available on the Binance Airdrop Portal in 24 hours. Plus, this token will be listed on Binance soon!

👉 https://t.co/AMeTSZbJkd pic.twitter.com/nGqdUDUsOd

— Binance Africa (@BinanceAfrica) August 27, 2025

This was followed by Binance Africa launching a “HODLer Airdrop” campaign, which typically precedes a major listing announcement.

Instead of rising, the DOLO price took a nosedive.

Some investors called it a classic “sell the news” event, where early holders cashed out once the exchange hype reached a peak. But others believe something deeper is at play, especially when you factor in Dolomite’s growing relationship with World Liberty Financial (WLFI).

Meet Corey Caplan – Co-founder and creator of Dolomite! 🚀

An early Ethereum builder since 2017, cryptopunk enthusiast, and one of the most innovative minds in DeFi, Corey has joined World Liberty Financial’s advisory team and is the first of many incredible people we are… pic.twitter.com/rdOwjrbOiN

— WLFI (@worldlibertyfi) August 30, 2024

WLFI Connection Raises Hope and Doubt

To understand the situation, we need to look at what’s happening behind the scenes.

Dolomite started as a decentralized money market on Arbitrum in 2022, later expanding to Polygon zkEVM, Mantle, and X Layer. It aims to build a new type of DeFi platform that supports advanced financial use cases, including margin trading and lending.

Then came a plot twist.

All I can say is now that the AAVE and WLFI partnership has been shutdown by someone working at WLFI and if $DOLO is going to be in direct partnership with WLFI over AAVE…

It’s going to go straight into the stratosphere. Easily doing multiples from here

– $80m mcap

– CTO of…— Gold (@Gold_Cryptoz) August 23, 2025

In September 2024, Dolomite co-founder Corey Caplan joined World Liberty Financial (WLFI) as an advisor. WLFI, known for its ties to the Trump crypto movement, has ambitions to build a politically-backed financial ecosystem.

The announcement called Caplan the “first of many” major additions, suggesting that more integration between DOLO and WLFI could be coming.

Since then, crypto analysts and traders have speculated that DOLO may become a key player in WLFI’s platform, possibly replacing or competing with established protocols like AAVE or MakerDAO.

One trader on X (formerly Twitter) wrote:

“If WLFI adopts DOLO instead of AAVE, this thing’s going to the moon. It’s got 5x upside minimum.”

$WLFI just use @Dolomite_io to collateralize $ETH and borrow USD1: https://t.co/KAQtUYmAgx$DOLO is prob one of the most undervalued projects at the moment. The token price is still around private sale pricing and has recovered after a 50% dip

Here’s the thing, their founder… pic.twitter.com/TVMJyMztaH

— Sell When Over 9000 (@sell9000) July 16, 2025

Other users pointed to on-chain evidence showing that WLFI had already used Dolomite to collateralize Ethereum (ETH) and mint their own USD1 stablecoin.

In simple terms, WLFI is already putting Dolomite’s tools to work.

This paints a picture of a much deeper relationship, one that could dramatically shape DOLO’s price in the future.

But not everyone’s convinced. Some say the current DOLO hype is based on speculation, not hard facts. They worry that traders are jumping the gun before any real partnership is confirmed.

The WLFI narrative is starting to gain momentum, and $DOLO is the #1 beta play for it.

I’ll repeat what I’ve said before: @CoreyCaplan3 the CEO of @Dolomite_io is also the CTO at @worldlibertyfi $DOLO is the 🗝️ https://t.co/nGEBjqceEq pic.twitter.com/vWLplVsu0K

— Kornik 🐻⛓️ (@kornik_crypto) August 9, 2025

Whales Are Quietly Accumulating DOLO

While public opinion is divided, whale wallets have been quietly loading up on DOLO during the dip.

Blockchain data shows that several wallets have purchased between $100,000 and $500,000 worth of DOLO over the last seven days.

This level of accumulation during a downturn often signals long-term confidence. These investors may believe the current price is a temporary mispricing caused by short-term market fear.

Whales typically don’t chase hype, they follow narratives, utility, and connections. And in this case, they seem to be betting that DOLO’s ties to WLFI will eventually lead to a strong comeback.

What could trigger that comeback?

It could be a formal announcement from WLFI. It could be a joint partnership deal. Or it could simply be DOLO getting integrated into WLFI’s broader DeFi ecosystem.

Until that clarity comes, DOLO price remains extremely volatile, pushed and pulled by exchange hype, political narratives, and social media speculation.

Some see it as a high-risk bet with big upside. Others see it as a falling knife waiting for more bad news.

Either way, Dolomite is no longer just another DeFi project. Its fate is now tied to one of the most controversial movements in crypto. And that could make all the difference, for better or worse.